Purchasing a piece of property or real estate can be costly for many people since the prices of real estates and properties have increased. With this, people often borrow or loan money from a particular organization or bank to help them raise funds for the property or real estate agreement that they want to purchase.

A mortgage deed is one of the most important documents tht is used when buying a property through a loan. You can also see mortgage agreement contracts. The purpose of a mortgage deed is to protect both the lender and the borrower during these transactions. You can also see amortization mortgage samples.

For example, if an individual loans money from a lender to purchase a property or house , a mortgage deed serves as a proof that the borrower has transferred ownership of the property to the lender. This gives the lender a lien or a security interest to ensure that the borrower pays for the mortgage loan. We have provided some samples of mortgage deeds below to help you create your own document.

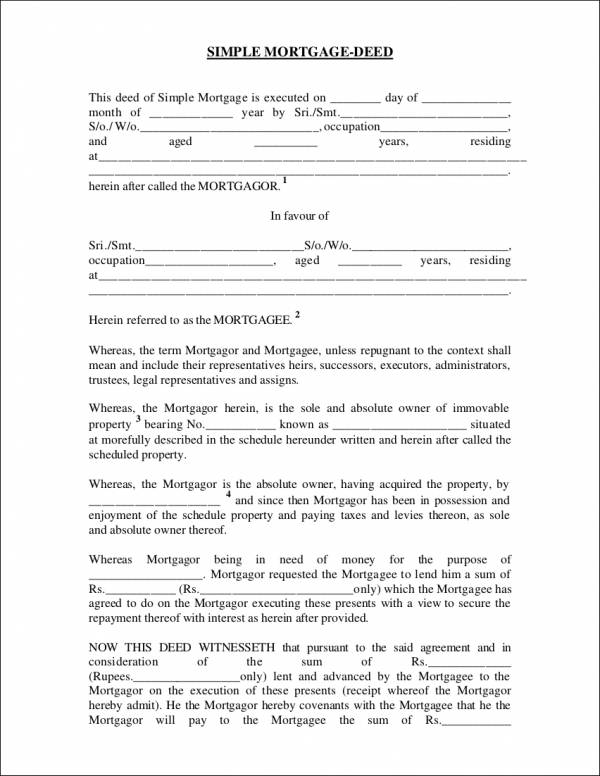

Mortgage Deed Sample

Sample Mortgage Deed in PDF

What is a Mortgage Deed?

A mortgage deed is a legal document that is used as a lien for a mortgage loan that a particular individual has used to buy or purchase a property, whether it is a house, a building, or a piece of land.

In a mortgage deed, the property title is given and transferred to the lender of the loan as a guarantee until the borrower has repaid the loan in full. You can also see excel mortgage calculators.

Although the lender has the title for that particular property, the lender does not have any right to the property or the title as long as the borrower pays the loan on time. Should a borrower fail to pay the mortgage loan contract, the lender has the right to foreclose the property. You can also see mortgage note samples.

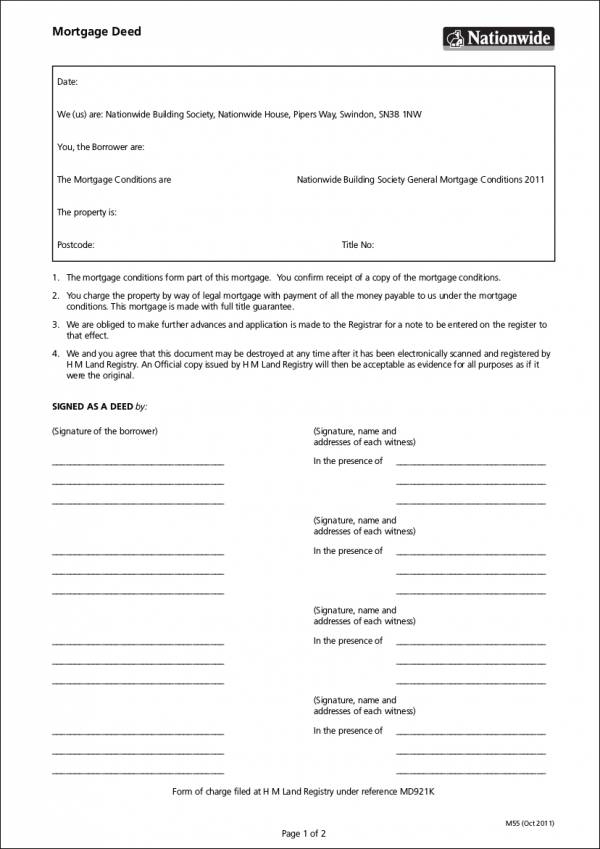

Standard Mortgage Deed Sample

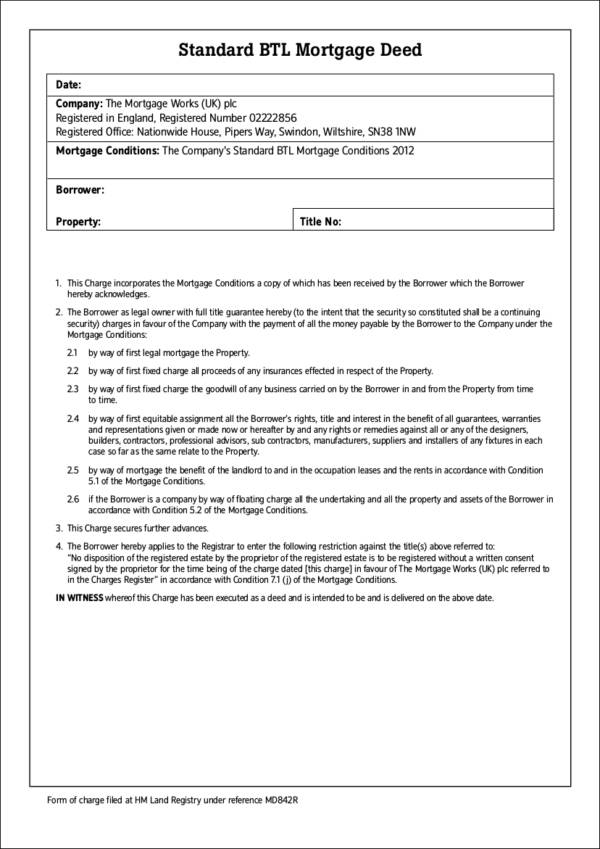

Blank Mortgage Deed Template

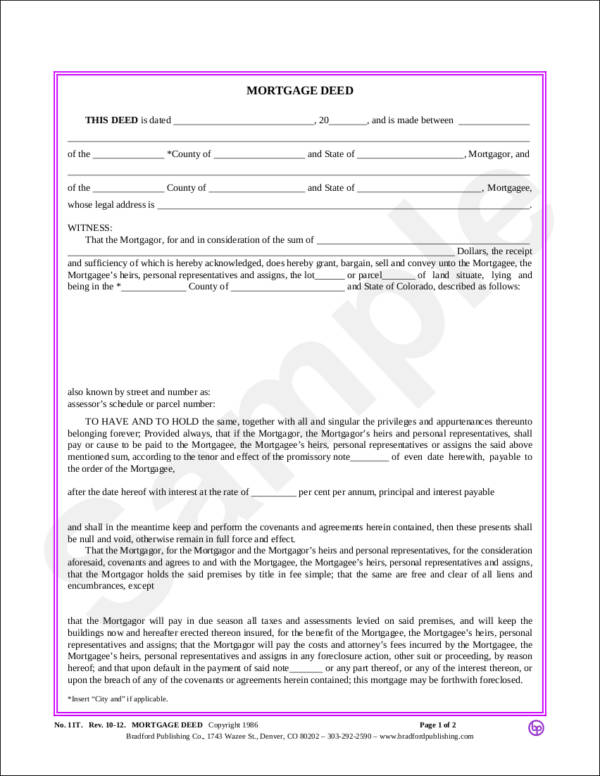

Printable Mortgage Deed Sample

Items to Include in a Mortgage Deed

When creating a mortgage deed, understanding all the elements that go into an effective mortgage agreement is important. This will ensure that you will have a highly usable and organized document. In this article, we have listed the important elements that should be present in your mortgage deed. You can also see home mortgage calculators.

- The title of the document. As with any formal and legal document that you create, a mortgage deed should always include a title. Indicating the title of the document that you will be creating will ensure that both the lender and the borrower clearly understand the type of agreement they are going into. You can also see quick claim deed forms.

- The day and year when the document is created. Aside from the title, the date when the document is created should also be specified in the mortgage deed.

- The name, address, and contact information of both the lender and the borrower.

- The address and a detailed description of the property.

- The title number of the property.

- The terms and conditions of the deed.

- The signature of both parties involved in the transaction.

Related Posts

FREE 5+ Lease Power of Attorney Samples in PDF

FREE 10+ Property Power of Attorney Samples in PDF | MS Word | Google Docs

FREE 6+ Special Power of Attorney Samples in PDF

FREE 5+ Business Power of Attorney Samples in PDF

FREE 10+ Health Care Power of Attorney Samples in PDF | MS Word | Google Docs

FREE 6+ Company Power of Attorney Samples in PDF

FREE 5+ Affidavit of Desistance Samples [ Case, Settlement, Claim ]

FREE 10+ Affidavit of Funeral Expenses Samples [ Claim, Cost, Benefits ]

FREE 6+ Affidavit of Translation Samples in PDF

FREE 2+ Supporting Deposition Samples in PDF | MS Word

FREE 9+ Sample Orders to Appear in PDF

FREE 13+ General Power of Attorney Templates in PDF | MS Word

FREE 19+ General Affidavit Samples and Templates in PDF

FREE 9+ Patent Assignment Samples and Templates in PDF

FREE Basics to Get Permission to Use Quote or Personal Statement