Most contractors in any specialized field, like research and construction, work independently and are generally not employed by their clients who hire them for their work. For this reason, contractors need to issue invoices for their work when they’re done to ensure processing of payment for their services.You may also see construction invoice samples

- 110+ Invoice Templates

- 20+ Sample Contractor Invoices

Contractor Invoice Sample

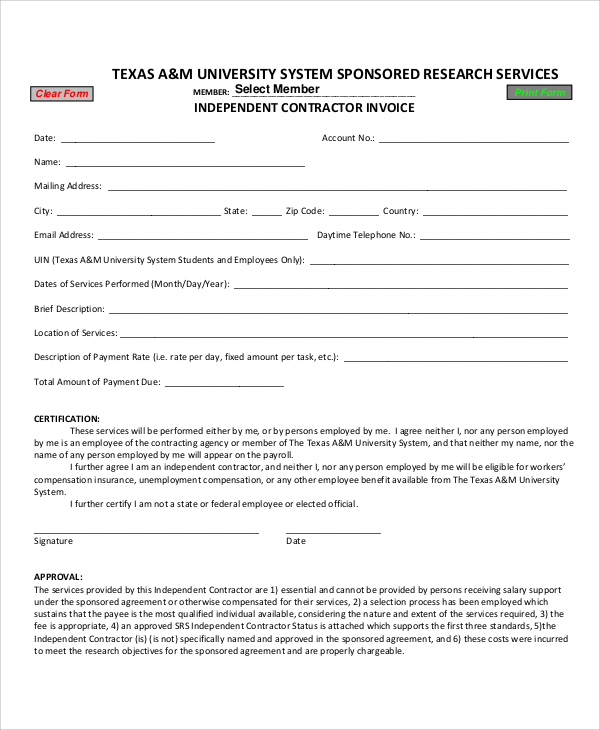

Independent Contractor Invoice Template

Electrical Contractor Invoice Template

Self Employment Contractor Invoice Template

Our website’s invoice samples for contractors offer different examples that users who do contracting jobs may find helpful. These come with different examples that they can use with modification for their own specifications.

Printable Contractor Invoice Template in Word

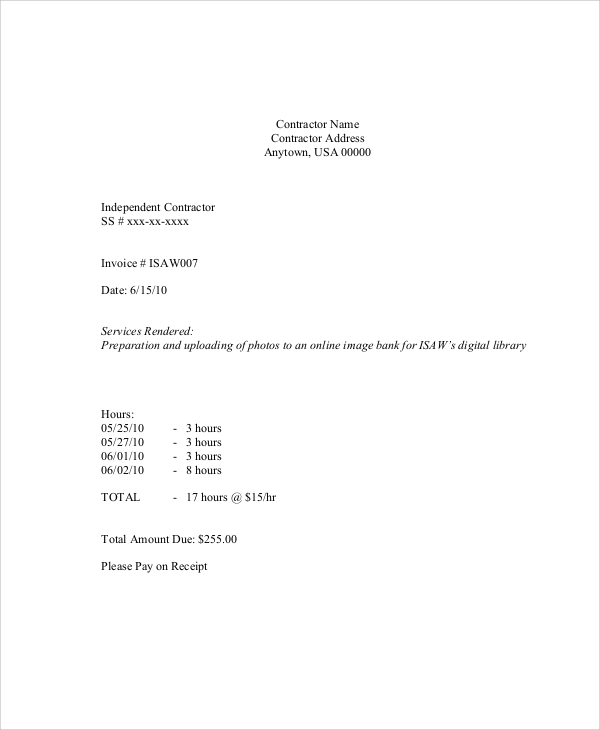

Independent Contractor Invoice

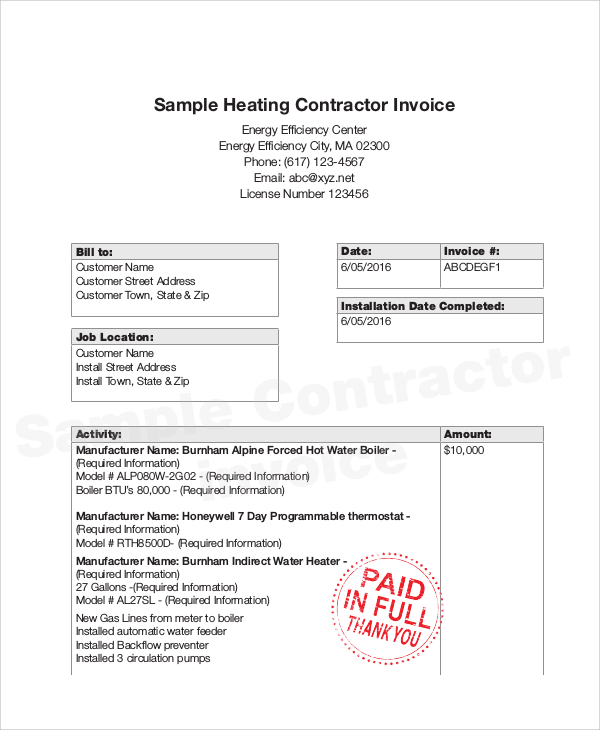

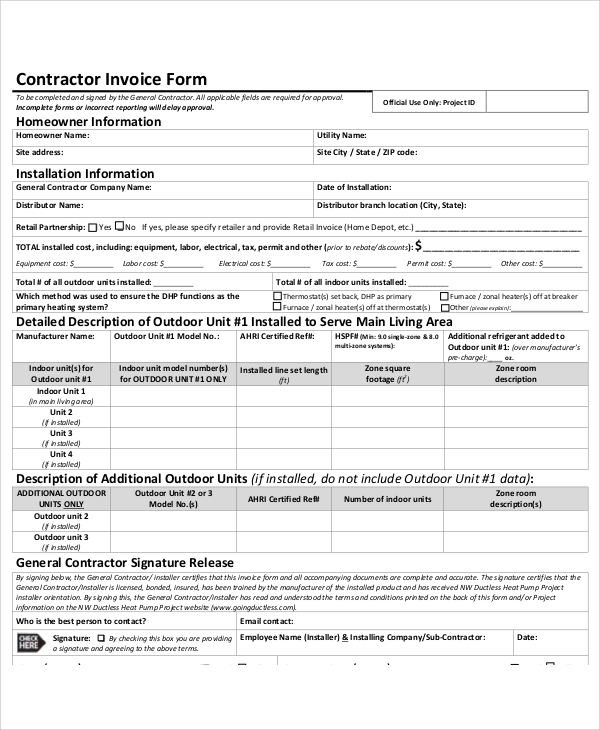

Sample Heating Contractor Invoice

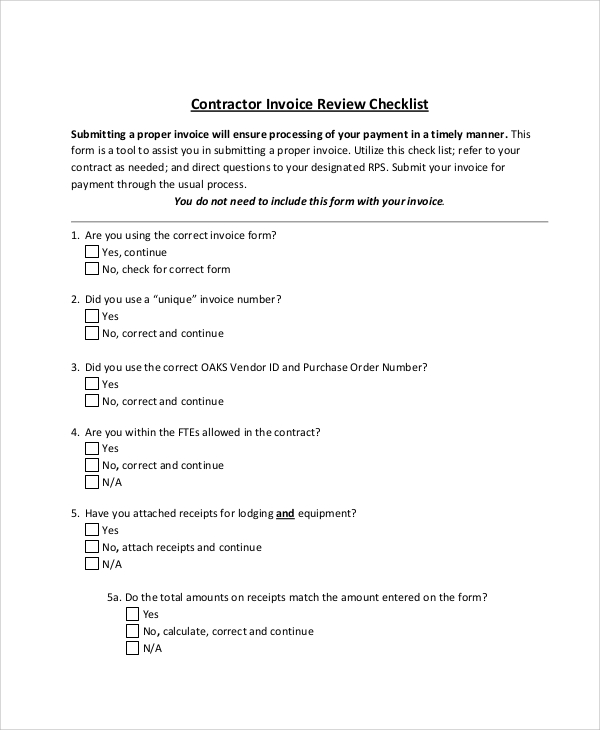

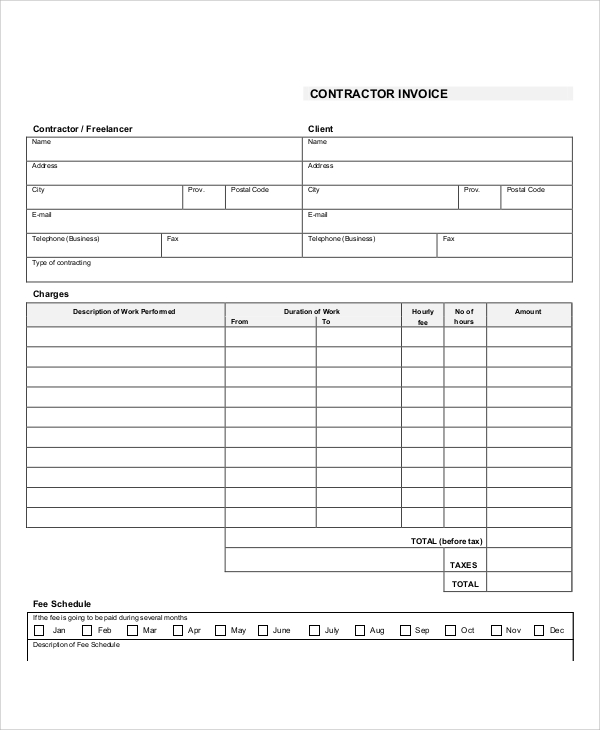

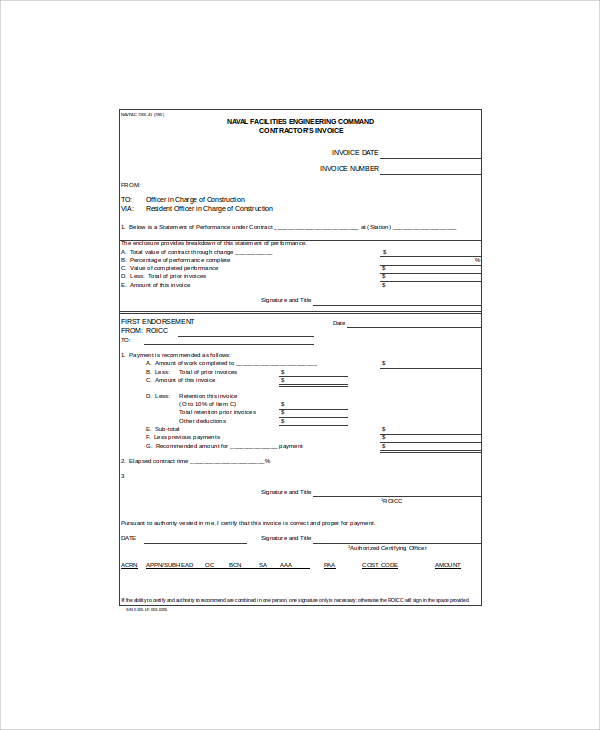

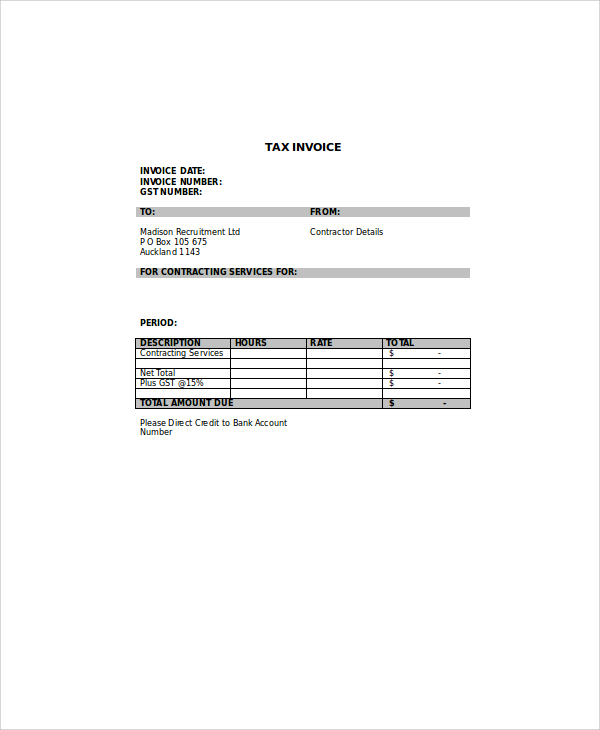

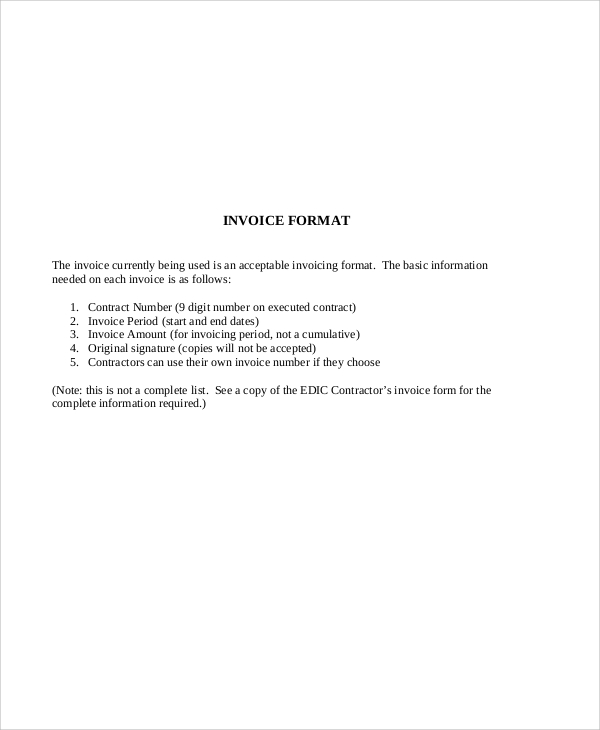

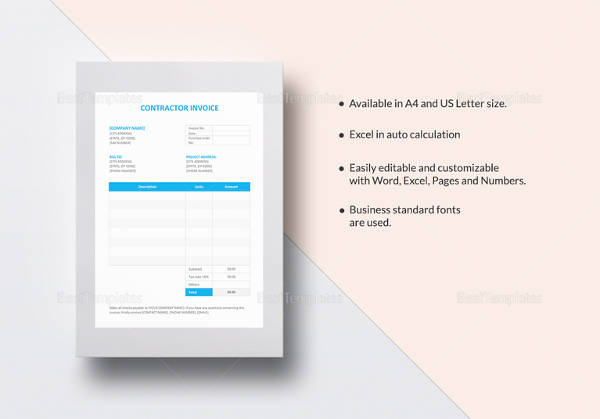

Generally, invoices are tools of business that are used to list down services or purchases of goods. They are basically documents that detail the purchase or the services being provided and the payment terms with which the contractor issues to the client. Our website’s contractor invoice samples provide spaces to list down or detail the kind of services being provided together with sample checklists that some clients provide to contractors.

These checklists are standard for companies who hire contractors for large-scale work being done and are mandatory to be completed before contractors can submit their invoices for billing. For users who do independent contracting work, please refer to our examples that will act as guides to making your own invoices and printing them to be used whenever you complete your services. As seen in our samples, when drafting or making contractor invoices, the following components must be included:

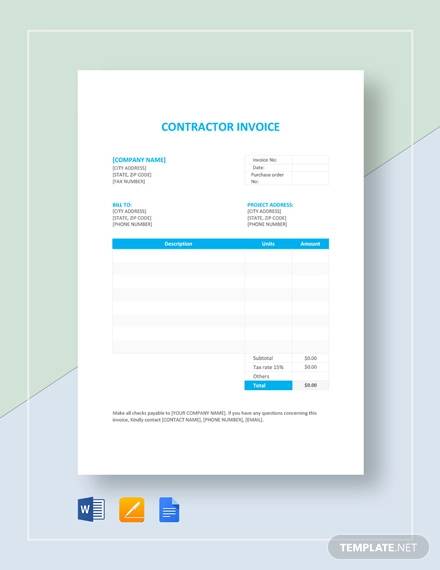

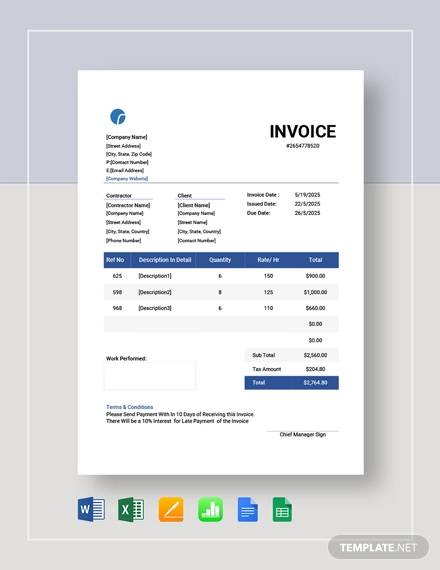

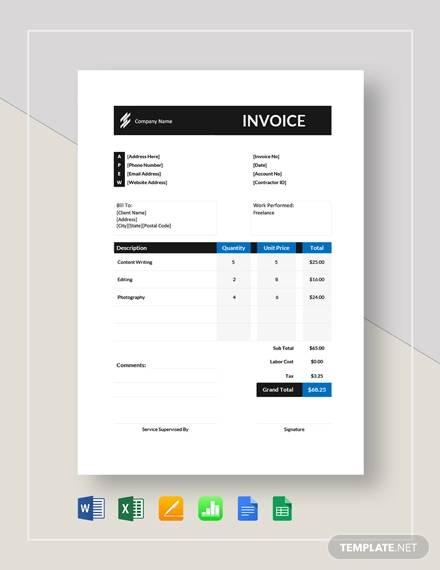

1. Invoice Number

Usually found on the top left of the invoice. Depending on how many times the contractor has issued an invoice to clients, the number should correspond with the quantity of the invoices being issued. Usually starts with 001 for most invoices. You may also see billing invoices.

2. Client Information

Includes client name, name of business establishment (not applicable for private homes), site address, city, zip code

General Contractor Invoice

Contractor Invoice Form Example

Contractor Invoice Example

Contractor Invoice in Excel

3. Contractor Information

Contractor name and company or business name

4. Work/Installation Information

Description of work detail and/or installations including cost, labor, equipment, tax, and total amount of work done

5. Contractor Signature

Contractor affixes his or signature to signify all information, accompanying documents, and details provided on the invoice are correct and accurate. You may also see free contractor invoices.

For other invoice samples, please check more on our website or click on the links for Free Invoice Samples and Generic Invoice Samples that are all free for downloading and can be modified or edited to user specifications.

Contractor Tax Invoice in Doc

Simple Contractor Invoice in PDF

Contractor Invoice Format

Keep in mind that being a contractor is not just all about collecting payments and issuing invoices. A contractor must be able to manage all site-based activities, ensuring that all contracts must be finished on time. With this aspect, it’s very important to collate the work done and make careful supervision on the different aspects of the project being worked on, otherwise miscommunication will result in the work not being made according to specifications. You may also see blank invoices.

Budgetary considerations also need to be included due to the fact that some clients are not willing to put in more money than what is being estimated or specified in the contract. To maintain client satisfaction, the contractor must make sure that the work is within budgetary limits.You may also see it invoice templates.

For more simplified, basic invoices, please check on our Simple Invoice Samples that you can use for all types of transactions. These are all free for downloading and can be modified for user specifications.

Related Posts

FREE 3+ Cake Invoice Samples [Wedding, Birthday, Order]

FREE 5+ Accounting Service Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Payment Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Agriculture Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Work Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Professional Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Cleaning Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 6+ Massage Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Work Order Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 5+ Legal Service Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Hourly Invoice Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 5+ Architecture Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Customer Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 14+ Construction Invoice Templates in MS Word | PDF

FREE 10+ Delivery Invoice Samples in MS Word | MS Excel | Pages | Numbers | Google Docs | Google Sheets | PDF