There are a number of business transactions when one party is unable to pay for the full amount of the item they have purchased or a service they have availed of. So, instead, companies often offer their clients an installment or monthly payment plan. This is quite common when purchasing a vehicle, a laptop, or a mobile phone where payments are made over a short period, roughly around 6-18 months, and usually with interest. When offering this plan, a monthly payment contract is executed to ensure that both parties are in agreement with the terms and conditions of the payment plan. To know more about this payment contract, let us discuss this further below. And if you need to prepare this document, check out our free monthly payment contract samples that are available for download below.

+ Monthly Payment Contract Samples

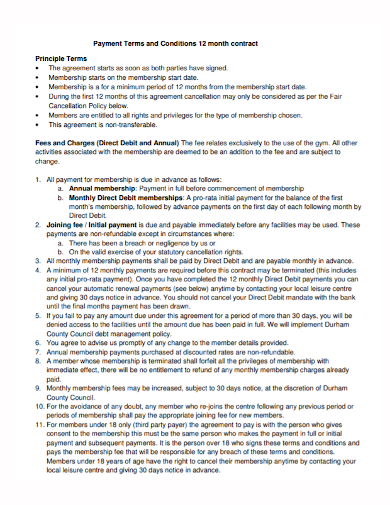

1. Monthly Payment Contract

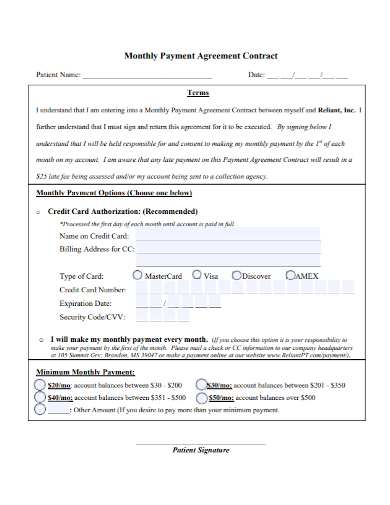

2. Monthly Payment Agreement Contract

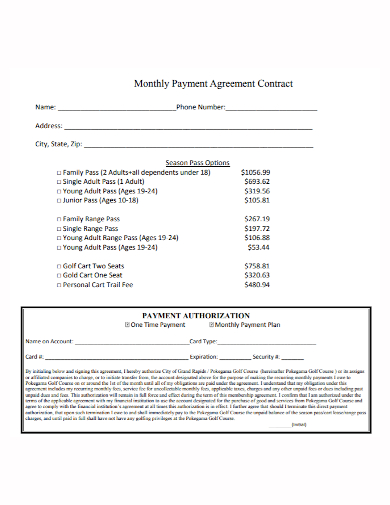

3. Monthly Payment Authorization Contract

4. Monthly Payment Plan Contract

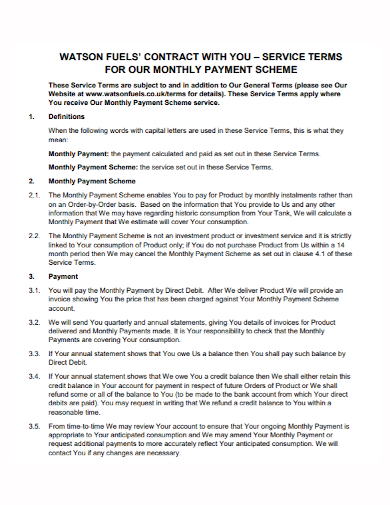

5. Monthly Payment Scheme Contract

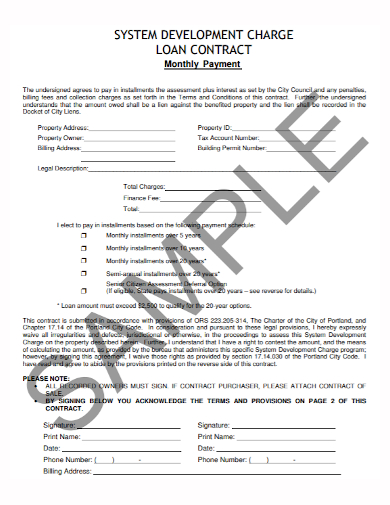

6. Monthly Payment Loan Contract

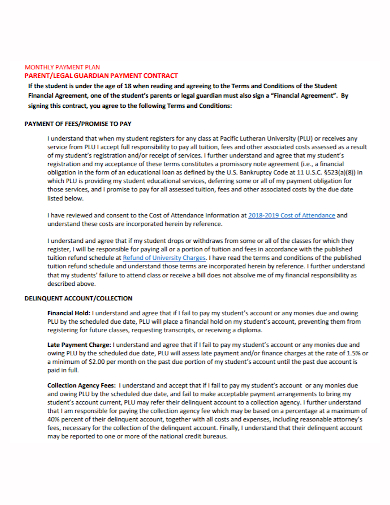

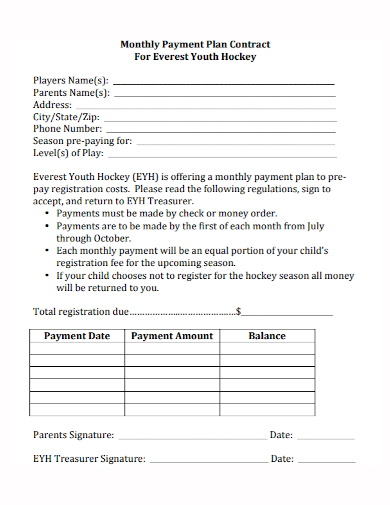

7. Parents Monthly Payment Contract

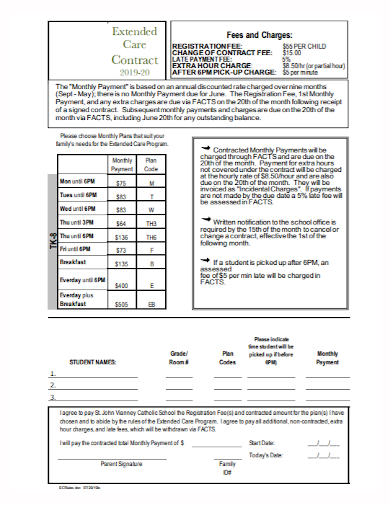

8. Monthly Fees Payment Contract

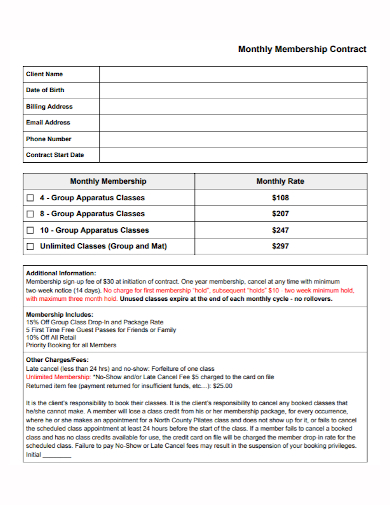

9. Monthly Membership Payment Contract

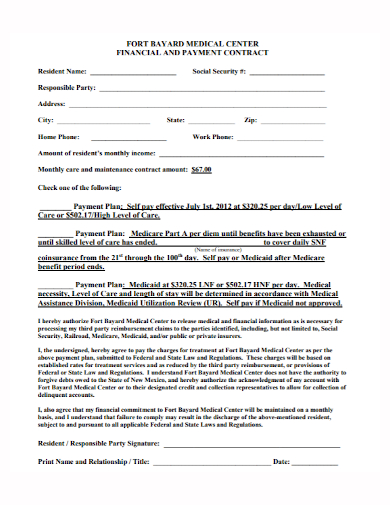

10. Monthly Medical Care Payment Contract

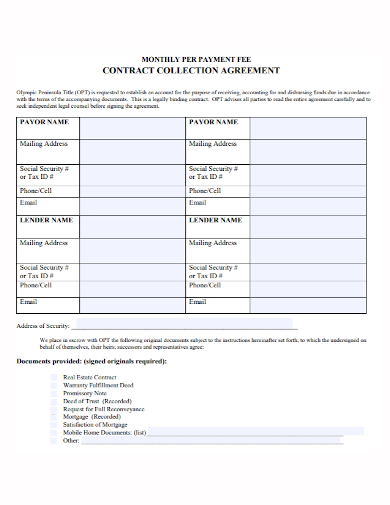

11. Monthly Collection Payment Contract

What Is a Monthly Payment Contract?

A lot of clients prefer paying on a certain scheduled date rather than paying everything in full amount. This gives them time to save and still acquire the item in the process. This is why a lot of businesses are offering monthly payments or installments. Clients are more attracted to purchasing something that they can acquire readily and pay for it later. And there are different ways to settle your payment, the most common is by paying on a monthly basis. A monthly payment contract will set the terms of allowing multiple recurring payments, in this case on a monthly basis, instead of one lump sum payment. Such contracts are used between a debtor, client, customer to another party that is owed money.

How To Create a Monthly Payment Contract?

Most payment plans, depending on the other party would have corresponding interest rates, or no interest as long as the payments are made on time. This is to ensure that the debtor does not default on their payment schedule. In some cases, a deposit is made by the debtor, after which terms are then set to settle the remaining balance through a monthly payment contract. Each payment contract may be slightly different from the other since you have to consider the particulars about the item or service but overall, you must be able to include the following details in the contract:

I. Contact Information

The client/debtor and the creditor’s name and address should be included in the first section of the contract.

II. Acknowledgement

A statement that defines the acknowledgment of the balance owed must be written in the contract.

III. Amount Owed

Write down how much is owed or the remaining balance in the contract.

IV. Interest Rate

If you wish to impose an interest rate, then make sure to include this together with the terms. For example, an interest rate will only take into effect if there are late payments or overdue.

V. Payment Schedule

Indicate what date of the month should the payment be paid by the client/debtor.

VI. Payment Instructions

Include the payment method you or your company is willing to accept (cash, check, credit card) and where the should payment be made or deposited.

VI. Late Payment

Late payments can be charged through interest rates or a specific amount. Make sure to write this down in the document.

VIII. Other Terms and Instructions

Include other terms or instructions in the contract that is applicable between both parties. You may want to include the terms on how to terminate or cancel the contract.

FAQs

What Is an Installment Plan?

An installment plan is a type of payment method where payments are made in fixed amounts at specific intervals.

Can Payment Plans be Used in Real Estate?

Yes, in fact, one of the most popular and widely used payment plans is the flexible-payment plan. This payment scheme is a right blend of two payment modes: Down Payment Plan and Construction-Linked Plan.

Is Debtor Legally Justified to Refuse to Pay Creditor?

No, the debtor is not entitled to demand from the creditor without an agreement or contract. Payment must be made in lawful money, frequently referred to as legal tender.

A monthly payment contract will help set the terms on the amount due by one party to another. A contract such as this will help ensure the payment process is properly carried out.

Related Posts

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 14+ Sample Music Concert Proposal Templates in MS Word | Google Docs | Pages | PDF

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Assurance Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF