The principal sources of shareholders’ equity, often known as the business’s book value, are as follows. The first source of funding is the cash that was initially and later invested in the business through share issuance. The company’s retained profits (RE), which are a byproduct of its ongoing operational processes, make up the second source. Retained earnings are typically the greatest component, important when working with businesses that have been in operation for a long time. Equity held by shareholders may be favourable or unfavourable. If the answer is yes, the company’s assets exceed its obligations. If it’s negative, the company has more liabilities than assets. This is regarded as balance sheet insolvency if it persists. Because of this, many investors consider investments in businesses with declining shareholder equity to be dangerous or unhealthy. Equity held by shareholders by itself cannot accurately predict a company’s financial situation. The investor can appropriately assess the state of a business when combined with other technology and analytics.

10+ Statement of Stockholders Equity Samples

A statement of stockholders’ equity is part of a company’s balance sheet. This report shows investors how the company’s value to shareholders varied during accounting periods. This sheet shows investors how a company’s operations affect shareholder value. If the statement of stockholders’ equity increases, it demonstrates that the company’s actions are paying off for investors. If it declines, the company may wish to rethink its activities.

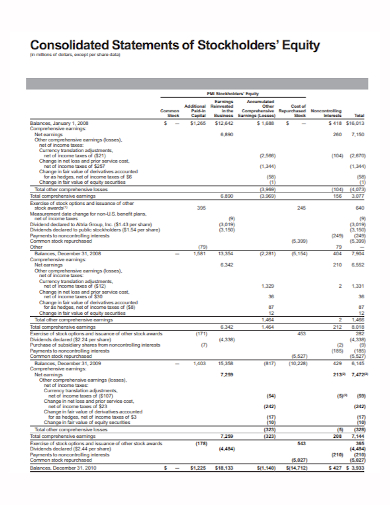

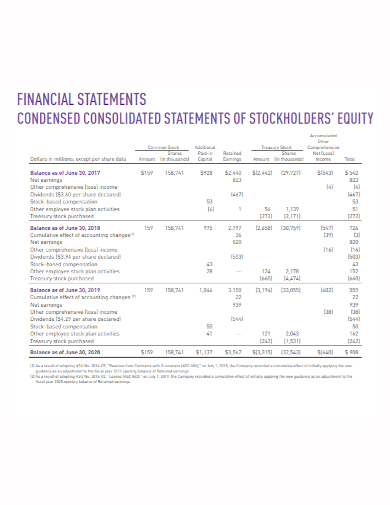

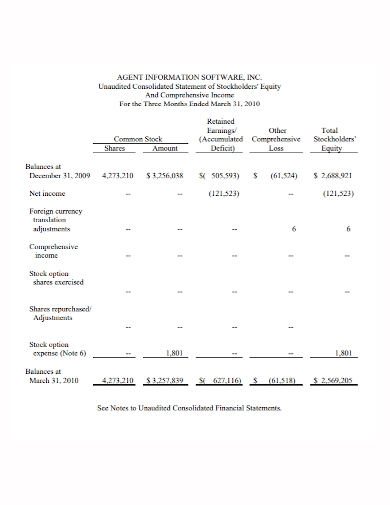

1. Consolidated Statement of Stockholders Equity

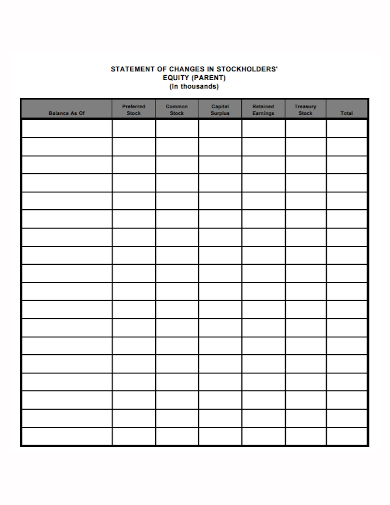

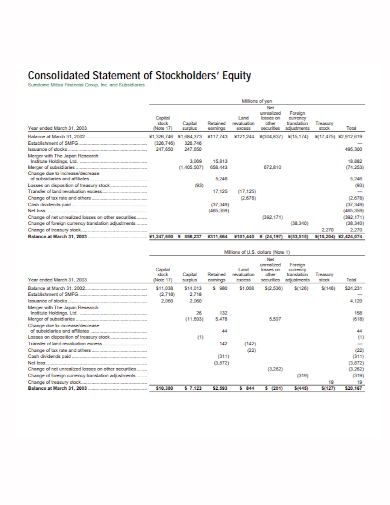

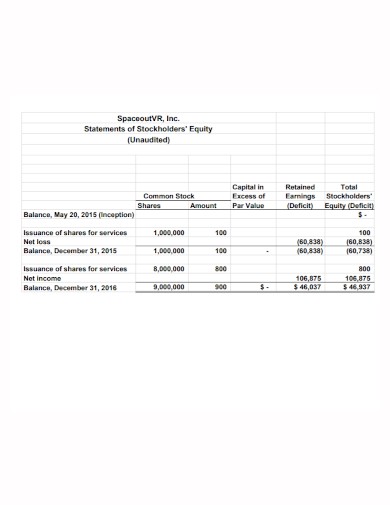

2. Statement of Changes in Stockholders Equity

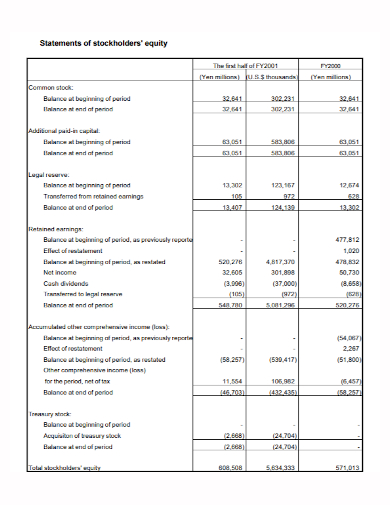

3. Statement of Stockholders Equity

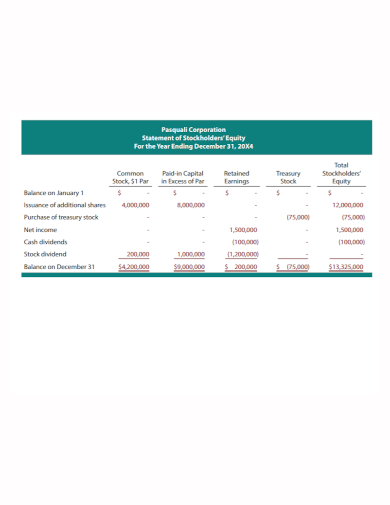

4. Corporation Statement of Stockholder Equity

5. Financial Statement of Stockholder Equity

6. Sample Statement of Stockholders Equity

7. Company Statement of Stockholders Equity

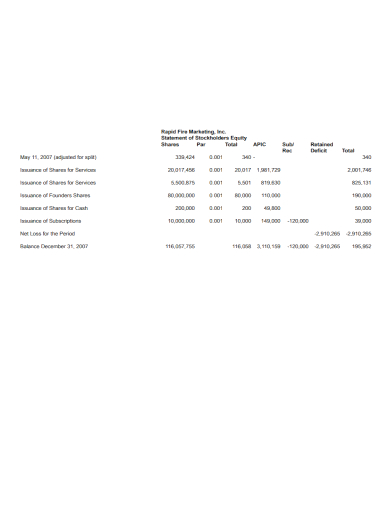

8. Marketing Statement of Stockholders Equity

9. Income Statement of Stockholders Equity

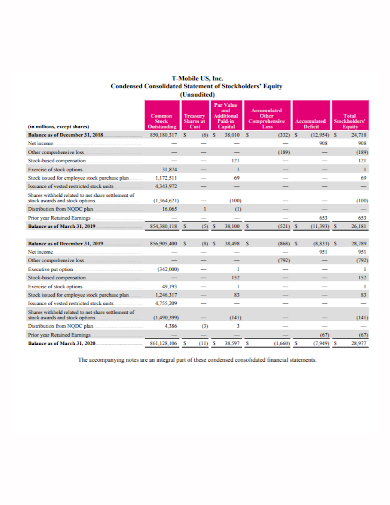

10. Unaudited Statement of Stockholders Equity

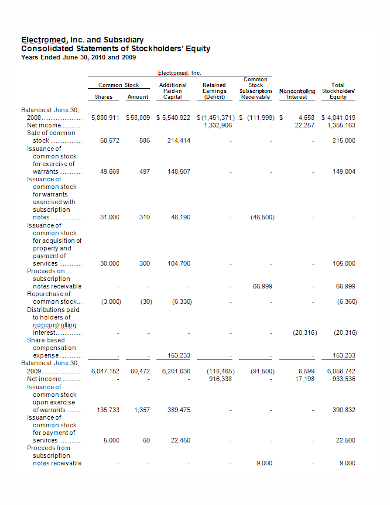

11. Subsidiary Statement of Stockholders Equity

All About Statement of Stockholders Equity

The statement of stockholders’ equity shows shareholders and investors how a firm is functioning by showing how its activities affect stockholders’ equity. The difference between a company’s assets and liabilities is used to calculate stockholders’ equity. Usually monthly, quarterly, or annually. When a business obtains new capital from its owner or investors, or if its profits increase due to a higher profit margin or higher sales, the stockholders’ equity increases. Often disregarded in favor of the income statement. The statement of stockholders’ equity shows how operations affect a company’s worth. This doesn’t tell business owners and investors how the company’s value is changing. Statement of stockholders’ equity might be scary for small business owners. Once split down, it’s easier to understand as a company’s retained operations. Profit-and-loss accounts and cash flow show how money enters and leaves a business.

Components of Stockholders Equity

Stockholders’ equity includes:

Share capital: Cash a company raises through stock issuing. At an IPO, a corporation sells stock at a specified price. Investors can then sell their stock and keep any profits. In an IPO, the firm keeping the money as share capital.

Net income is computed by deducting sales cost from revenue. Gross income is calculated. Net income is gross income minus costs.

When someone buys a company’s stock, they own part of it. This gives them a profit share. Dividends are payments made to investors for each share of stock. The corporation need not pay all profits as dividends. Dividends can be paid from company profits. Probably in the stockholder agreement.

FAQs

Who is statement of stockholders’ equity useful for?

All businesses can utilize this statement. Large enterprises to small partnerships use it. Owner’s equity is stockholders’ equity if the company isn’t public. Any business save a sole proprietorship should have a stockholders’ equity statement. The Statement of Stockholders’ Equity illustrates equity fluctuations over time.

What is a common stock?

Common stock provides the owner a stake in a company. It’s riskier than debt or preferred stock since debt and preferred shareholders are paid before common stockholders.

What is a contributed capital?

This is the amount investors paid above the par value of a company’s stocks. This quantity increases when a corporation issues new shares and decreases when it buys back shares.

Stockholders’ equity measures a company’s retained funds. If this value is negative, a business may be headed for bankruptcy, especially if it has a substantial debt load. If you want to see more samples and formats, check out some statement of stockholders’ equity samples and templates provided in the article for your reference.

Related Posts

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 10+ Diversity Mission Statement Samples in MS Word | PDF

FREE 10+ Architecture Statement of Purpose Samples [ Sustainable, Graduate, Master ]

FREE 13+ Project Scope Statement Samples in PDF | MS Word