Keep in mind that if you aren’t attentive enough with the subcontractor statement requirements, you may find yourself in a situation where your liability is enhanced. Subcontractors declare that they have already paid their insurance, payroll tax, and remuneration duties in their subcontractor declarations. If the principal contractor does not get a subcontractor statement, they will be held liable for a variety of issues.

10+ Independent Subcontractor Statement Samples

Subcontractors give their major contractors with “subcontractor statements,” which are written contracts. They apply to specific subcontracted work periods. Subcontractors affirm that they have paid their insurance premiums, payroll taxes, and remuneration responsibilities through their subcontractor statements. If a major contractor fails to obtain a subcontractor statement, they may be held liable for the commitments of the subcontractor.

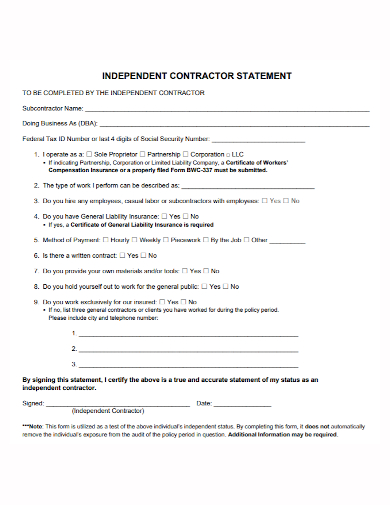

1. Independent Subcontractor Statement Template

2. Independent Subcontractor Statement

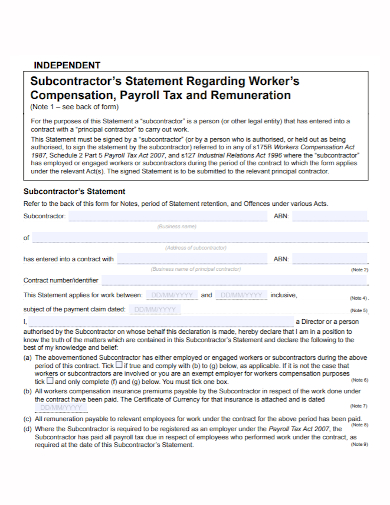

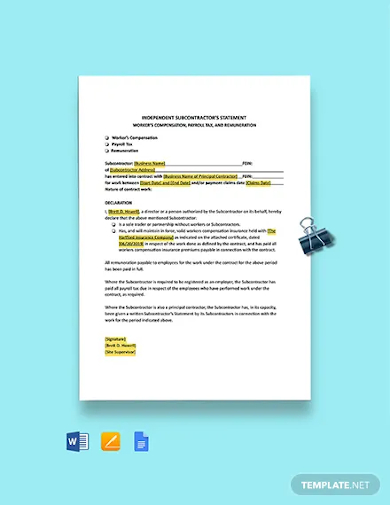

3. Independent Subcontractor Remuneration Statement

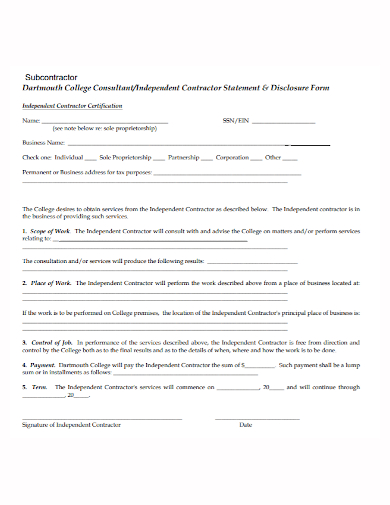

4. Independent Subcontractor Disclosure Statement

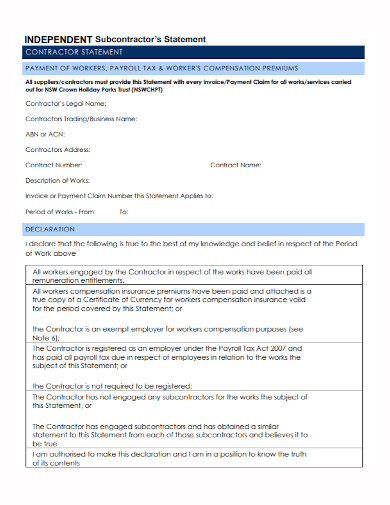

5. Independent Subcontractor Declaration Statement

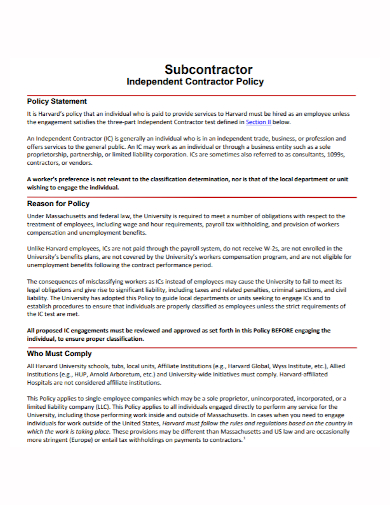

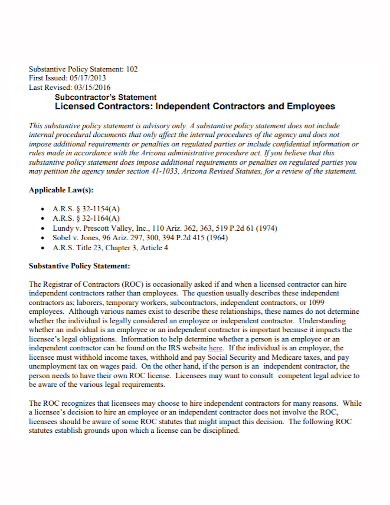

6. Independent Subcontractor Policy Statement

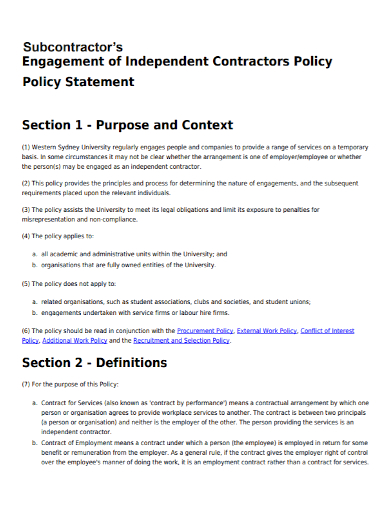

7. Independent Engagement Subcontractor Statement

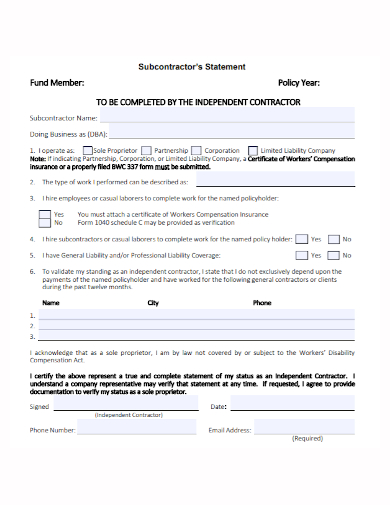

8. Independent Subcontractor Fund Statement

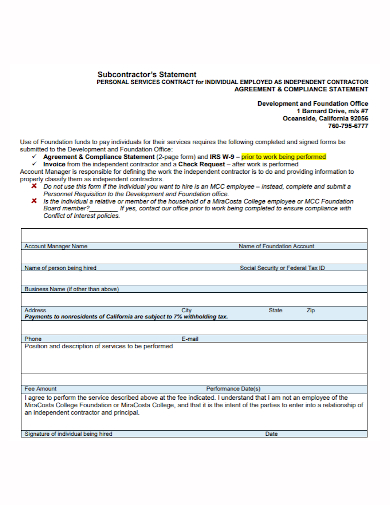

9. Independent Subcontractor Compliance Statement

10. Independent Subcontractor Employee Statement

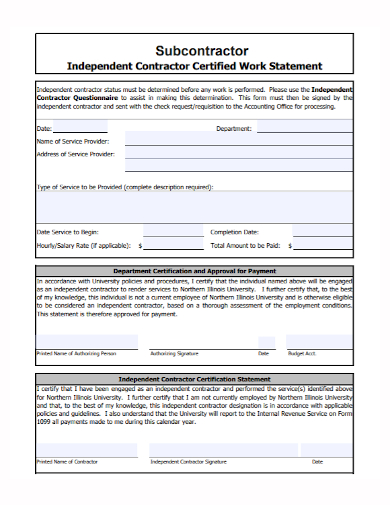

11. Independent Subcontractor Work Statement

Purpose

A subcontract statement is an agreement between a principal contractor (often a builder) and a subcontractor. The Workers Compensation Act of 1987, the Payroll Tax Act of 2007, and the Industrial Relations Act of 1996 all require that this be done.

As a subcontractor, the subcontractor statement empowers you with the authority to:

- Work on a construction project for the main contractor;

- Be fairly compensated for your contributions to the project;

- If you break the law, you must accept full responsibility.

If you sign into this type of agreement but fail to send this agreement form to your principal contractor, the principle contractor will reclaim these rights and responsibilities. However, if the major contractor gets the form and states that the information you provided on the form is fraudulent, you may be charged with an offense under the Industrial Relations Act 1996, which might result in a fine of up to 100 penalty units.

How to Fill Out the Subcontractor Agreement Form?

This declaration is a one-page document in which you agree to the following as a subcontractor:

- During the contract’s duration, you engaged workers;

- You’ve paid and compensated them with the necessary insurance premiums.

- You have paid remuneration—that is, the sum due to the project’s staff;

- You’ve compensated your employees for their efforts by deducting their respective payroll taxes, and;

- If you are also a principal contractor on the project, you have been issued a formal statement releasing the principal contractor from liability.

Because the statements you’ll need to agree to in the form will vary depending on your contract with your major contractor, simply check the boxes that apply and fill in the blanks.

If you’re still unsure about how to protect your legal and contractual right to be paid as a subcontractor under the Security of Payment Act, consult the notes provided in the form or contact our construction lawyers for more experienced legal guidance.

FAQs

What is Workers Compensation Act 1987?

“The principal contractor is liable for the payment of any workers compensation insurance premiums payable by the subcontractor in respect of the work done in connection with the contract during any period of the contract unless the principal contractor has a written statement given by the subcontractor under this section for that period of the contract,” according to section 175B(2) of the Workers Compensation Act 1987. Subcontractors that provide false statements on purpose are breaking the law. This statement must be kept by the principal contractor for at least 7 years after it is received.

What is Payroll Tax Act 2007?

If the principal contractors believe or assume that the claims were fraudulent, they are accountable for the payments. Subcontractors who supply incorrect information are then found guilty. Under this law, the major contractors have the right to withhold payment. A principal contractor who has paid the payroll tax can also reduce their losses.

What is Industrial Relations Act 1996?

“A principal contractor is liable for any remuneration of the relevant employees that has not been paid for work done in connection with the contract during any period of the contract unless the principal contractor has a written statement given by the subcontractor under this section for that period of the contract,” says section 127.

If you want to see more samples and formats, check out some independent subcontractor statement samples and templates provided in the article for your reference.

Related Posts

FREE 6+ Research Contribution Statement Samples in PDF | DOC

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word