Due to the daily interest added to your loan balance, the payoff statement is an important document. The exact amount due varies depending on the terms of your loan, so you can’t just guess how much you owe. If you try, you’ll almost certainly fail to pay everything you owe, resulting in frustration, long wait times, and difficult communication. A payoff statement can usually be obtained by visiting your lender’s website or calling them to request one. It’s also a good idea to save a copy of your payoff statement in case you need to double-check anything later.

10+ Payoff Statement Samples

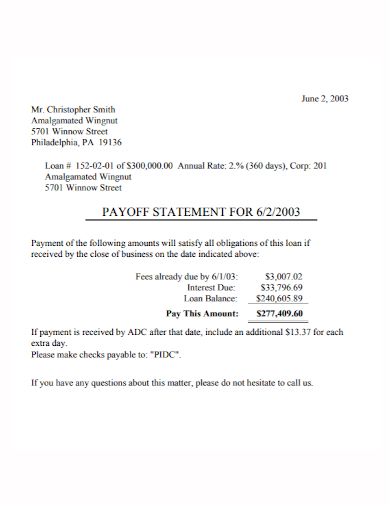

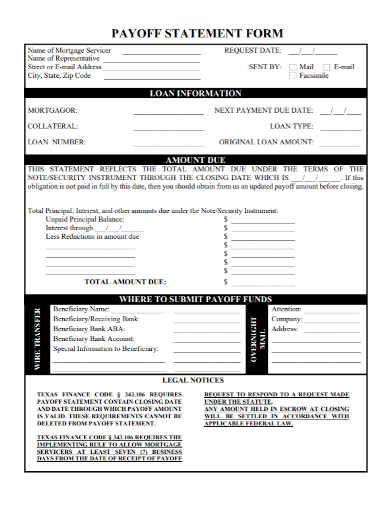

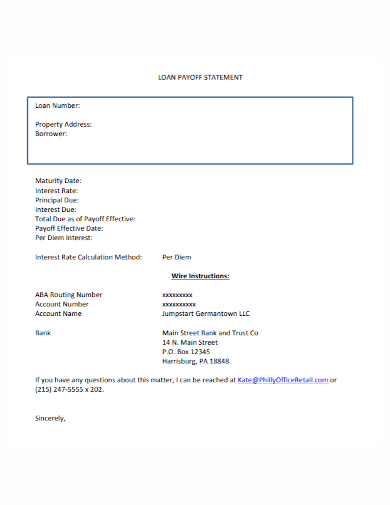

A payoff statement is a document prepared by a lender that shows the payoff amount for a mortgage or other loan prepayment. A payoff statement or a mortgage payoff letter will usually show you the amount you need to pay to close your loan. It may also include additional information such as the amount of interest that will be refunded as a result of early payment, the remaining payment schedule, interest rate, and money saved. Finally, it will have a “good-through” date, which is required because additional interest will be due after that date, changing your payoff amount and requiring you to apply for a new payoff statement. On any type of loan, you can request a payoff statement.

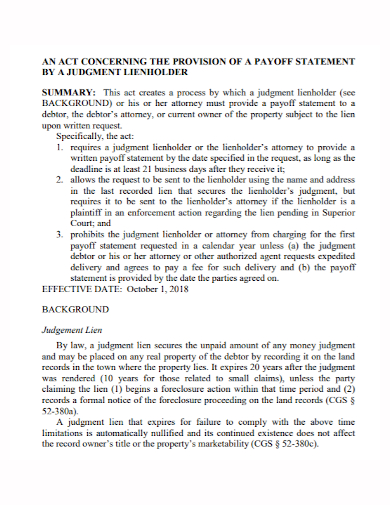

1. Payoff Statement

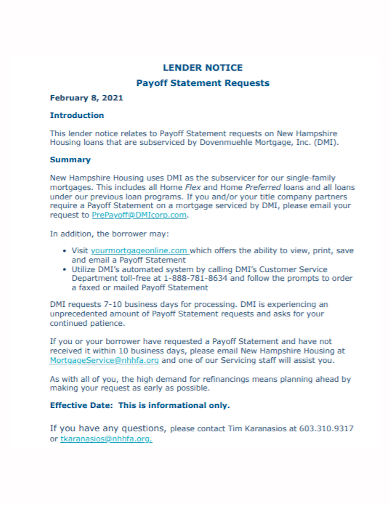

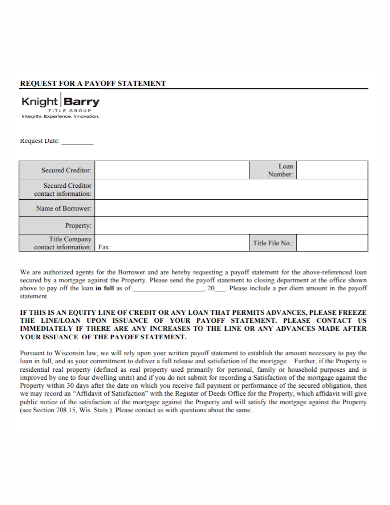

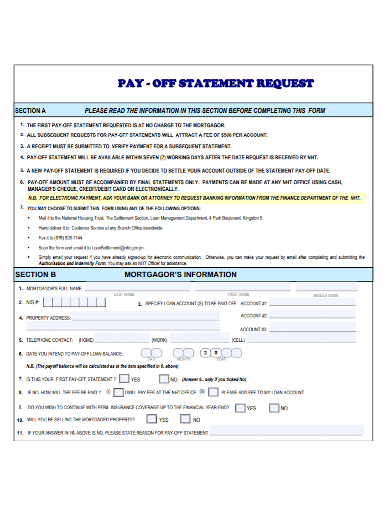

2. Payoff Statement Request

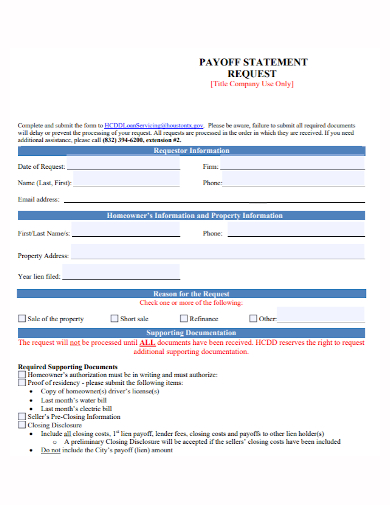

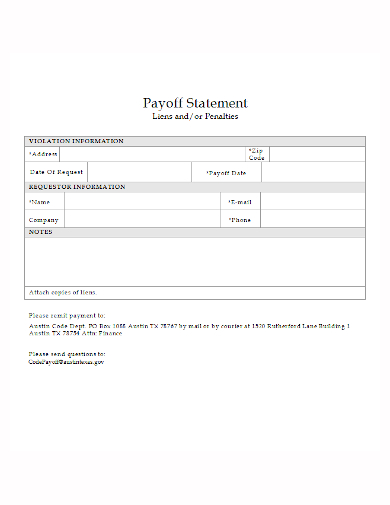

3. Payoff Statement Form

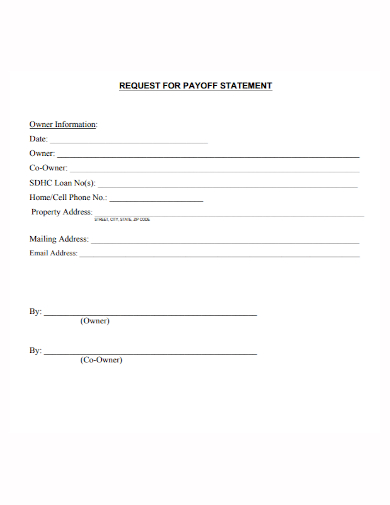

4. Request for Payoff Statement

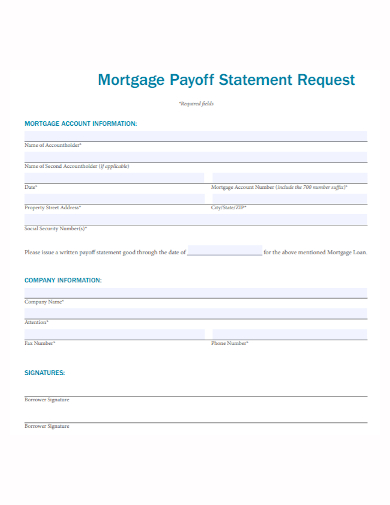

5. Mortgage Payoff Statement

6. Sample Payoff Statement

7. Company Payoff Statement

8. Judgment Payoff Statement

9. Loan Payoff Statement

10. Standard Payoff Statement

11. Editable Payoff Statement

How It Works

The first step in repaying a loan is to request a payoff statement. Payoff statements come in a variety of formats depending on the type of lender. In most cases, online lenders will give you a simple payoff amount that specifies the exact amount you’ll need to pay on a specific day to pay off the loan early. A more formal payoff statement, which provides a more comprehensive snapshot of information about a loan, is usually created by traditional financial institutions, and you may have to contact a customer service representative directly to request one. Payoff statements will usually calculate the prepayment amount based on the next forward payment date.

You can ask for payoff statements from your current creditors if you’re negotiating a debt consolidation loan with a new lender. You can also hire a debt relief company to handle the negotiations for you. A financial institution may choose to pay off each loan with the proceeds of the debt consolidation loan in a debt consolidation loan deal (according to the information provided in the payoff statements).

Payment Statement Fees

So, what does a payoff amount entail? It’s the exact amount of money you’ll need to pay off your loan, and it’s likely different from your current loan balance because it may include interest and fees you owe but haven’t paid yet. Furthermore, some lenders may charge you a fee or impose penalties for requesting a payoff statement. You should read your loan agreement before requesting one to ensure that you are aware of the terms.

FAQs

What is a mortgage payoff statement?

A mortgage payoff statement, also known as a payoff letter, is a document that specifies the exact amount of money required to fully repay your mortgage loan. The payoff amount includes not only your outstanding balance but also any interest you owe and any fees your lender may impose.

What is some information that you can find in a payoff statement?

- The principal balance is the total amount you owe minus any new interest. The principal is calculated using the amount borrowed plus any compounded interest.

- Interest that has accrued since your last payment must also be paid off — the exact amount will be shown on your payoff statement.

- Payoff Amount: Your total principal balance plus any accrued interest should equal your full payoff amount.

- Loan interest accrues on a regular basis, so a payoff statement won’t be completely accurate in the future. As a result, you’ll see a date that indicates how long the payoff amount is valid. Your payoff balances will change after this date.

Payoff statements are usually associated with serious collection action, which usually involves a lien. A lien is a legal document that allows a creditor to seize property from a debtor by obtaining it from the courts. If a debtor fails to make payments, the property of the debtor may be seized in order to repay certain debts. A lien will usually include a detailed payoff statement outlining the borrower’s payoff requirements, which, if met, will prevent further action and release the lien.

Related Posts

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 10+ Diversity Mission Statement Samples in MS Word | PDF

FREE 10+ Architecture Statement of Purpose Samples [ Sustainable, Graduate, Master ]

FREE 13+ Project Scope Statement Samples in PDF | MS Word

FREE 11+ Internship Statement of Purpose Samples in PDF | DOC