Buying a property, such as a house, is very expensive, and paying the total price of the property upfront seems impossible for a salaryman. But even with this fact, a lot of people still manage to buy and own a property. It may be impossible to pay for a huge sum upfront, but it doesn’t mean that it can’t be done. Thanks to loan amortization, your average working-class individual can afford to buy their dream house. And they can pay off their loans by following a loan amortization schedule.

What Is a Loan Amortization Schedule?

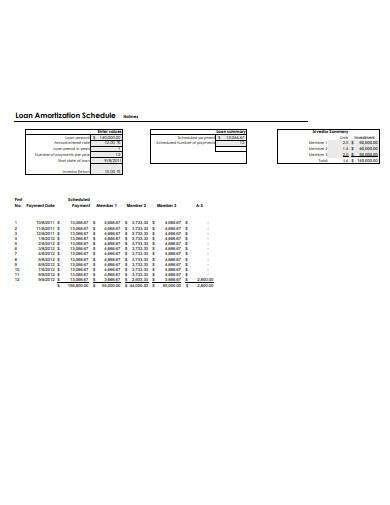

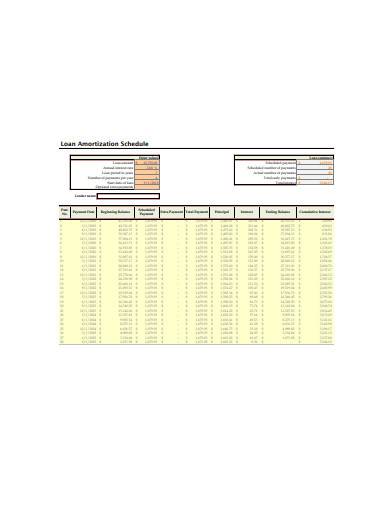

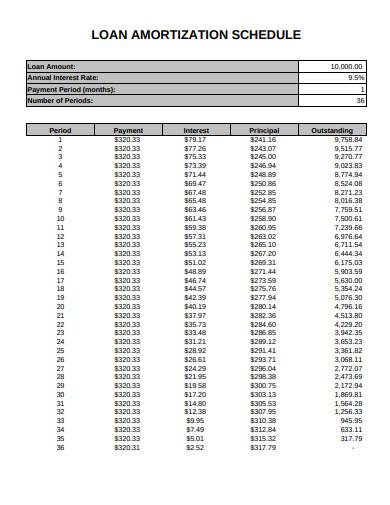

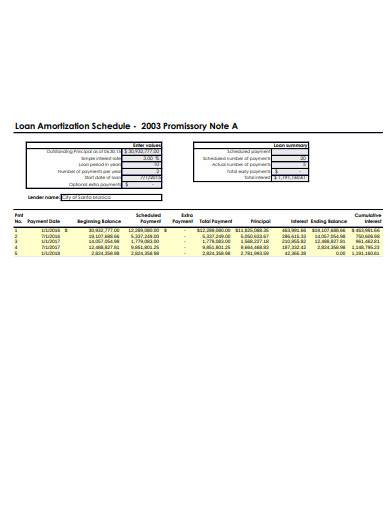

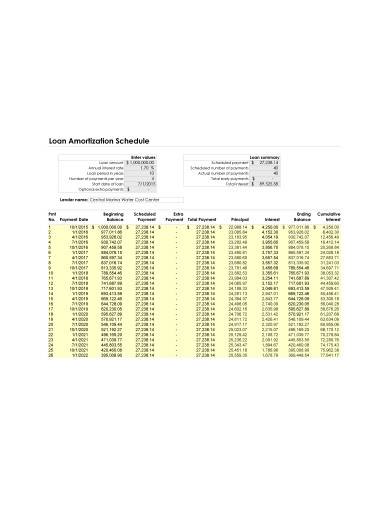

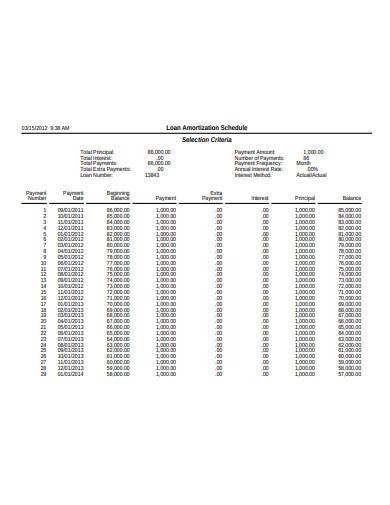

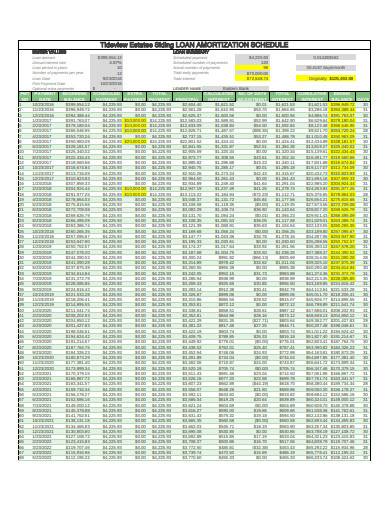

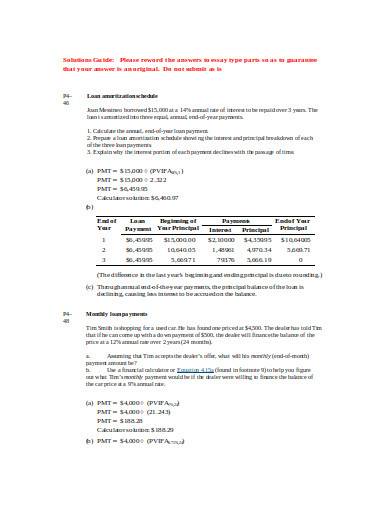

Amortization is the process of evenly spreading out costs over some time. This is done to lower the value of a loan or an intangible asset. The loan or debt is paid off by paying the loan interest and principal over time. The schedule of payment, as well as the payment amount, is provided in an amortization schedule. A loan amortization schedule is a table that provides details on how much the borrower needs to pay periodically until their loan is paid off at the end of its term. The amount of responsibility varies depending on the principal and the interest incurred. In a loan amortization spreadsheet, the same amount is shown early in the schedule. Later on, the payment amount changes to include the payment for the loan’s principal. The last line or the row at the bottom part of the table shows the total interest that the borrower owes and the total principal payments for the entire loan.

Instead of paying a lump sum upfront, a loan amortization allows you to breakdown the lump sum into smaller amounts that the borrower can afford to pay periodically. Through this process, a lot of people can buy a property, such as a house, a lot, or a car. Just make sure you read and understand the details before you sign a loan contract.

Types of Amortizing Loans

Loans are considered as a quick solution to financial problems, especially when you need a significant amount of money immediately. Ideally, you pay a loan on an installment basis, and they are amortized, where you pay the balance over time until it finally goes down to zero. Three types of loans can be depreciated. They are auto loans, home loans, and personal loans.

Auto Loans

Not everybody can afford a car, and some people don’t consider it a necessity. Cars are expensive, and they’re worth millions. For this reason, auto loans are offered so that people can afford to buy vehicles by making fixed monthly payments that usually lasts up to five years or shorter. Longer years are available for auto loans so that you can get a lower monthly payment, but doing so means that your loan will exceed the resale value of your car. You’ll also be paying more interest.

Home Loans

If you want to buy a house that you can call your own, then go for a home loan. It’s another type of amortized loan that lasts for 15 to 30 years on fixed-rate mortgages. It’s also the type that takes the most extended number of years. If you decide to keep the house for good, then that’s fine. Other people would sell the house or refinance the loan, which still works. Using a loan amortization schedule in Excel will help you keep track of your payment schedule, as well as the payments made.

Personal Loans

You can get personal loans from credit unions, banks, online lenders, and other lending institutions. If you need to work on small projects or have your debt consolidated, then you should get a personal loan. This loan has fixed payment and interest rates, and banks or loaners often offer them in three-year terms.

FREE 9+ Loan Amortization Schedule Samples in PDF | DOC

1. Loan Amortization Schedule Sample

2. Loan Amortization Schedule Template

3. Loan Amortization Schedule in PDF

4. Loan Amortization Schedule Sample

5. Printable Loan Amortization Schedule Sample

6. Formal Loan Amortization Schedule Template

7. Sample Loan Amortization Schedule in PDF

8. General Loan Amortization Schedule Template

9. Basic Loan Amortization Schedule Sample

10. Loan Amortization Schedule in DOC

How to Create a Loan Amortization Schedule

Step 1: Record the Details of Your Loan

It’s important to know every detail of your loan so that you’ll know what payment options are available to you. It also helps you make payments on schedule. The details of your loan are information used to calculate your monthly amortization.

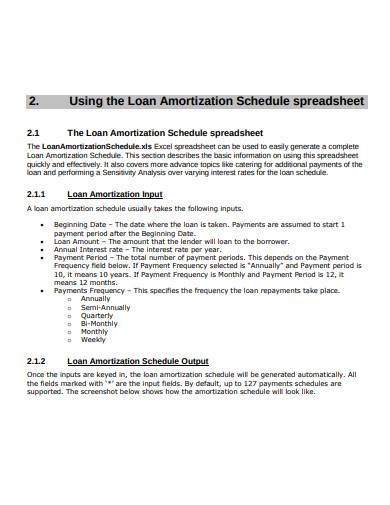

Step 2: Download a Loan Amortization Template

There are a lot of available loan amortization schedule templates that you can find online. Most of them already have links to amortization schedule calculators and are available in Excel spreadsheets.

Step 3: Enter Your Loan Details

If you have downloaded a template that exactly has everything that you need, then you’ll only need to enter numeric data in the spreadsheet. The loan amortization calculator will automatically make the calculations while you’re entering the numbers. The accuracy of the estimate depends on how accurate you enter data, so you should be careful with what you put in each cell.

Step 4: Rename the Template

When you have completed the template and are satisfied with the outcome of your loan amortization schedule, then the final step would be to rename the template and save the changes you’ve made. You may also save it as a new file so that you can still use the template for other purposes.

Loan amortization is not free of the interest that you need to pay on top of the principal amount you borrowed. It makes the principal amount bigger by a satisfied percent. The good thing is that the required periodical payments are more manageable compared to paying a lump sum.

Related Posts

FREE 10+ Employees Schedule Samples in PDF

FREE 10+ On Call Schedule Samples in PDF

FREE 10+ Time Block Schedule Samples in PDF

FREE 10+ Gym Schedule Samples in PDF | MS Word | Apple Pages | Google Docs | Keynote |

FREE 10+ Daily Hourly Schedule Samples in PDF

FREE 10+ Weekly Schedule Template with Hours Samples in PDF

FREE 10+ 7 Day Weekly Schedule Samples in PDF

FREE 10+ Working Schedule Template Samples in PDF

FREE 6+ Preschool Schedule Template Samples in PDF

FREE 10+ Daily School Schedule Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Day Schedule Samples in PDF

FREE 10+ Daily Work Schedule Samples in PDF

FREE 10+ 24 Hours Schedule Samples in PDF | Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Baseball Schedule Samples in PDF

FREE 10+ Availability Schedule Samples in PDF