Part of running a business is paying for company-related expenses. You need to shell out money in order to make money, but of course, it is important that your revenue outweighs the costs. Employees play a part in these expenses, as they may need it for office-related activities such as for transportation, meals, materials, and many others. If they are unable to cash advance, they end up paying from their own pockets. Since these expenses are incurred on behalf of the firm, employees will request reimbursement for any amount they paid by submitting an employee expense report. This is needed because management will be able to keep track and manage their finances accordingly. To learn more about this, let us discuss this further below. And if you need to start working on this report, check out our free employee expense report samples that are available for download on this page.

10+ Employee Expense Report Samples

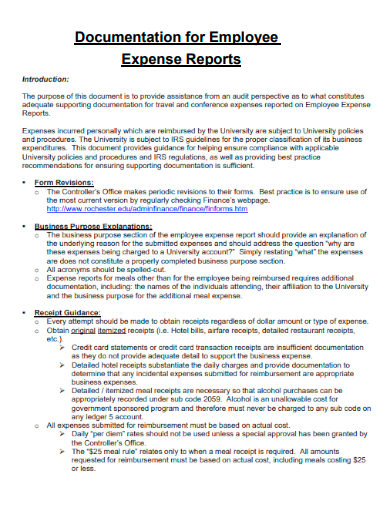

1. Documentation for Employee Expense Reports

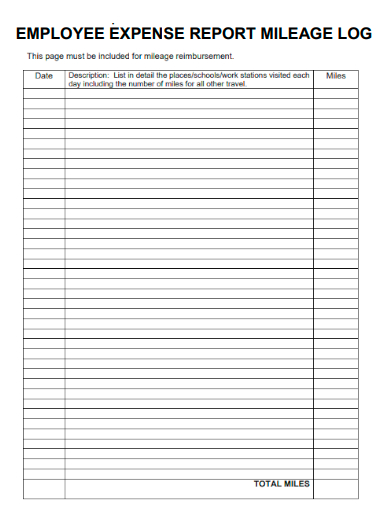

2. Employee Expense Report Mileage Log

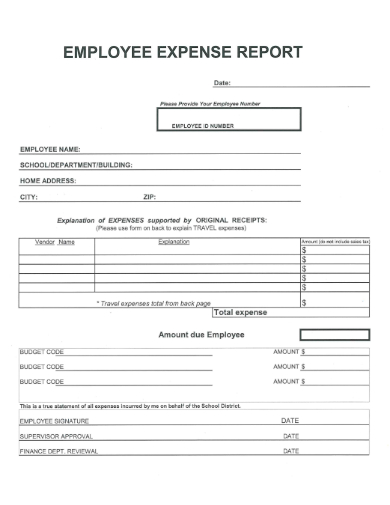

3. Sample Employee Expense Report

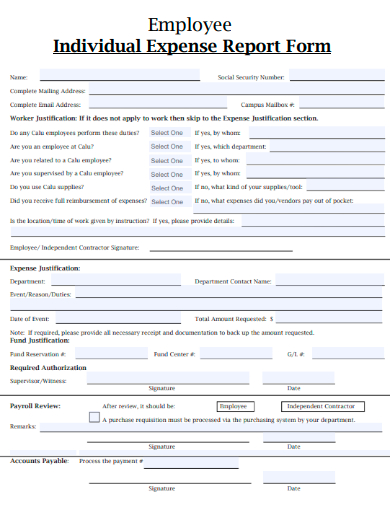

4. Employee Individual Expense Report Form

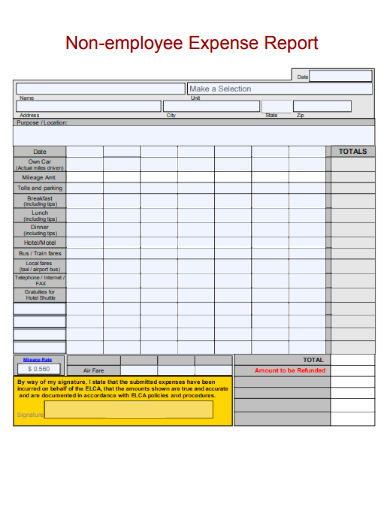

5. Non Employee Expense Report

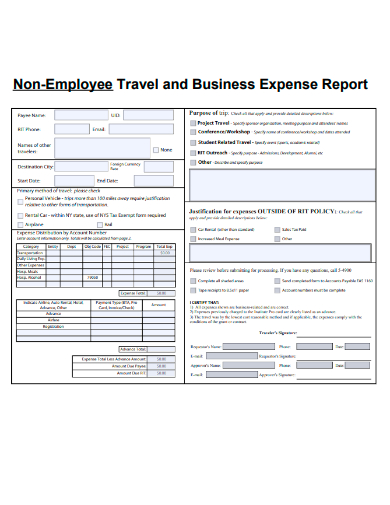

6. Non Employee Travel and Business Expense Report

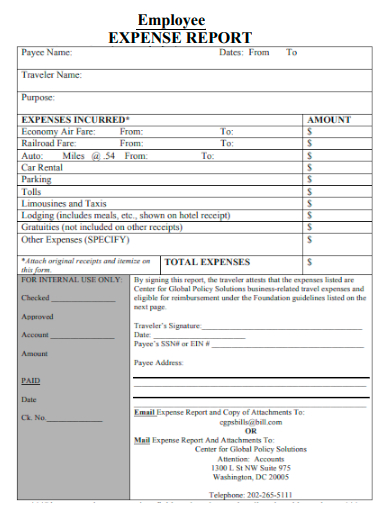

7. Basic Employee Expense Report

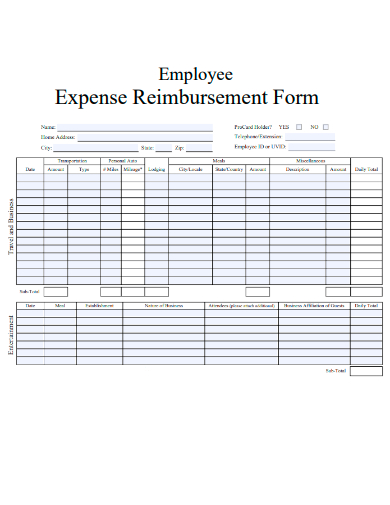

8. Employee Expense Reimbursement Form

9. Expense Report Net Card or Employee Paid

10. Employee Travel & Expense Report

11. Employee Expense Report Guidelines

What is an Employee Expense Report?

It is critical that reports be submitted when it comes to company-related expenses. With this document on hand, it would be eaiser for management to organize and make sure their finances are updated. An employee expense report in particular is used for reimbursement of business-related expenses. It is inevitable that employees need to spend money to go to clients or transact with suppliers or buy materials and supplies for the office. This report basically includes the details of what an employee has spent over a specific period with supporting documents such as receipts, invoices, and purchase orders.

This particular report can give you an accurate look at how much money is being spent within your business. To make sure you keep accurate records, it is important to understand what expense reports are, how they are used, what is included in them and why they are important. Without it, you may end up spending more than your budget on unnecessary expenses.

How To Create an Employee Expense Report

Every time an employee is given money to spend or has the need to shell out personal cash, it is important to take note of it. This is why accounting or the finance department would need a report to be submitted to either reimburse the employee or to tally their accounts from the cash given in advance versus the expenses made. So what should be included in this report? Here are several things you need to remember.

1. Where to Prepare the Report

The accounting department may have a ready format for you to fill in. Or you can always open up a Microsoft Excel application to create an expense report.

2. Employee Information

Details of the employee who has prepared the report should be included, which is their name, designation, department and contact details.

3. List of Expenses

The main content of this report is the list of expenses together with its details. Include the dates(must correspond to the dates in the receipt or invoice), the amount, a description of the expenses (meals, gas, materials) and the merchant or vendor from whom the item was purchased.

If applicable you may opt to include in the description if the expense is for a client or a project.

4. Total Cost

The total amount paid, including taxes, commissions, and fees.

5. For Reimbursement

You need to identify if the item is for reimbursement so that accounting will be able to pay you back.

6. Attachments

Remember to always keep your receipts and other important documents that are needed by the accounting department which are to be attached to the expense report. This will serve as proof of the transaction being made.

FAQs

How long does a company need to reimburse its employees?

After submitting a report, it is important that an employee be reimbursed not later than two months after the date of the expense.

What is an employee allowance?

An allowance is given to employees on top of their usual pay, for expenses such as transportation, the internet, accommodation, meals and etc. This is not mandatory and would depend on company policy.

Will the company reimburse without receipts?

Now, this will depend on what kind of expenses are made. Accounting may need other proof to prove that a transaction has been made.

After you have submitted this report, this will be checked and reviewed by the accounting department and other decision-makers in the company. This will enable management to determine where their money has been usually spent, if there is a need to cost-cut, and what other measures could be constructed to minimize the spending. Although as mentioned, it is a must to spend money for the sake of the company, then a employee expense report is a great tool that may help control expenses and budgeting.

Related Posts

Sample Chemistry Lab Reports

School Accomplishment Report Samples & Templates

Field Report Samples & Templates

Sample Science Project Reports

Business Report Samples & Templates

Survey Reports Samples & Templates

Sample Feasibility Reports

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

Report Format Samples & Templates

Acknowledgement for Internship Report Samples [ Hotel, Hospital, Teaching ]

Field Trip Report Samples [ Agriculture, Educational, Environmental ]

Student Counseling Report Samples

Narrative Accomplishment Report Samples [ Science, Teacher, Reading ]

Sample Acknowledgment Report Templates

Internship Narrative Report Samples