It’s a thing for most people in the world to not talk openly about their pay. Most if us don’t think that it’s a public matter where you just tell people you meet how much you make in your job. Yet, it’s still the most important reason people take and leave jobs. Companies need to make sure that whatever they’re paying their employees, is right on time for the pay period and is in compliance with employment laws and payroll regulations. If the payroll isn’t in order, then your company might just cease to exist not even after a few months. Payroll is usually a matter that is left to human resources, and they must ensure that the payroll is accurate. A payroll audit is a great way to make sure that it is so.

Everyone wants accurate pay. Every employee wants taxes to be done properly, health insurance and other payments calculated correctly, and that all wage deductions are legal and accurate. The overall purpose of a payroll audit is to determine if the employer is in compliance with the terms set by the local or national government with regards to the employer’s contributions to the benefit funds. A payroll audit checklist analyzes the company’s payroll processes to ensure accuracy. The document examines things such as the active employees of the business or company, the company’s pay rates, wages, and total tax withholdings. A payroll audit is usually conducted at least once a year to verify if the overall process is up to date. Basically anyone who’s ever run payroll knows that it’s not an easy task, and sometimes a largely arduous process. It’s a largely overwhelming process, because there’s so many details to keep track of and it’s relatively easy to mess up. That is why checklists are here to help ease things up. To get to know what a payroll audit checklist is and see how it works, check out these payroll audit checklist samples that we have listed down below. Once you’ve gotten yourself acquainted with the document, feel free to use these samples as guides or sometimes even as a template for your own payroll audit checklist.

5+ Payroll Audit Checklist Samples

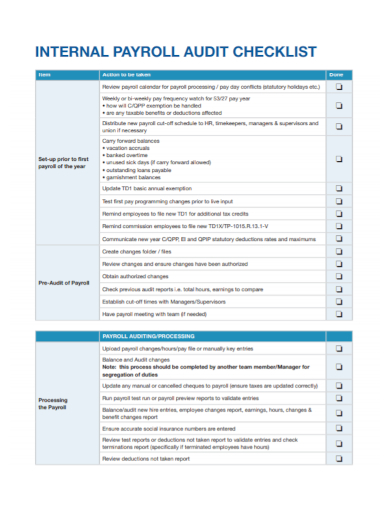

1. Internal Payroll Audit Checklist

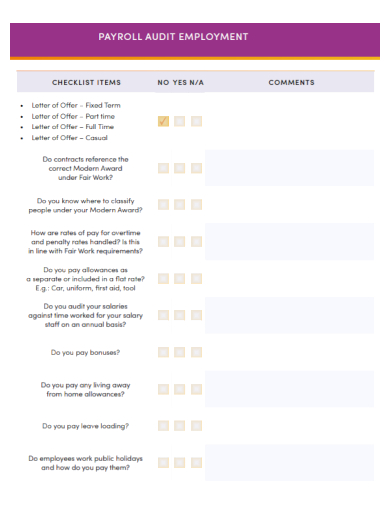

2. Payroll Audit Employment Checklist

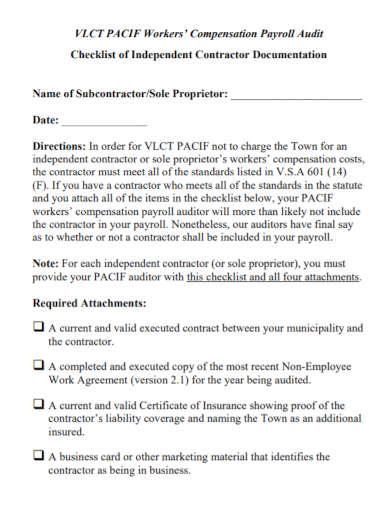

3. Workers Compensation Payroll Audit Checklist

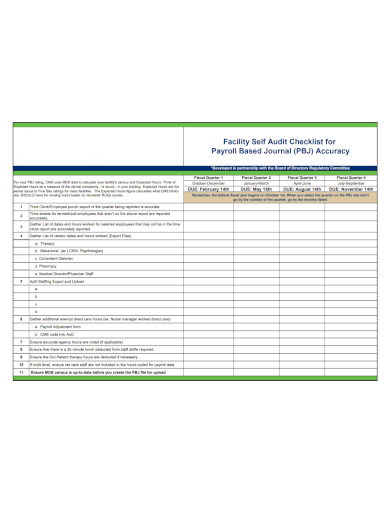

4. Payroll Facility Self Audit Checklist

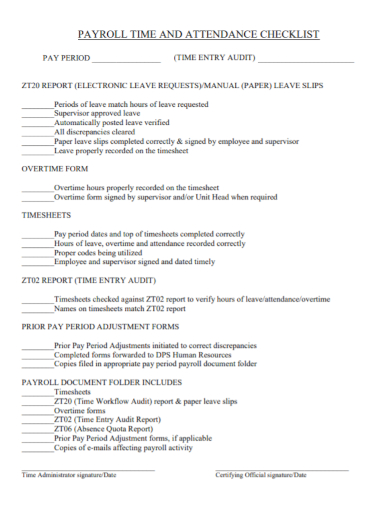

5. Payroll Time Attendance Audit Checklist

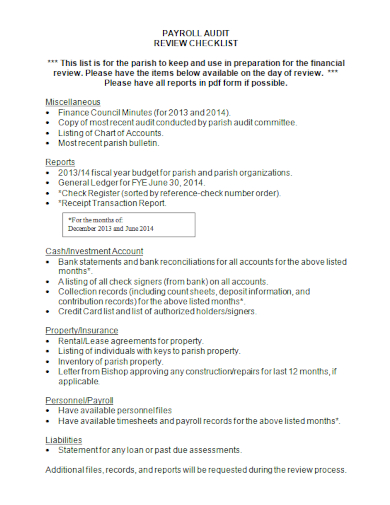

6. Payroll Audit Review Checklist

What Is a Payroll Audit Checklist?

A payroll audit checklist is a document that further supplements the effectiveness of a payroll audit. A payroll audit helps companies make sure that everybody’s pay is correct and that all reports of all deductions such as benefits and taxes are accurate. While some employees immediately notice a discrepancy in their payrolls, some really don’t. Payroll audits help you catch these mistakes which are an indispensable part of your compensation and benefits strategy. It’s essentially a systematic examination of the payroll aspect of a company or business to assess conformance with a well established set of local or national labor standards. The inspection is usually conducted by an appointed auditor or a set of auditors. Payroll audit procedures can take from a few minutes to a few weeks, depending on the size of your organization and the extent and coverage of the audit itself. Some payroll or HR departments automate this entire process for faster and more efficient responses.

What Should be Included in a Payroll Audit Checklist

Keep in mind that most of the more specific details of your payroll audit checklist depends on your company, the entire payroll process, or the overall nature of your business. You may have additional items to consider when it comes to paying your employees. Regardless of the document’s shape or form, it should be able to cover most, if not all of these components.

- Review any changes to your employees

Take note of changes in these details of your employees;- Employee address

- New hires

- Terminations

- Status changes

- Rate changes

- Complete, approve, and submit timecards or timesheets

Review your employees’ hours and determine its accuracy and whether it reasonable enough or not. State your established pay period. Weekly, fortnightly, semi-monthly? The key here is to make sure you’re doing these three things in your time sheets.- They’re accurate

- They’re approved

- They’re submitted

- Enter and review any needed additional payments

A lot of hours are tallied into payroll. Anything that stands out should be check and double-checked. Make sure that you have backup copies of every documentation that you are using. Additional types of payments may include some of the following:- Retro pay

- Bonuses

- Commissions

- Review taxes and deductions

After you’ve calculated payroll, move on next to taxes and deductions. Review your taxes and deductions if it is accurate and reasonable. - Before you print checks, do a final review of all the changes

After making sure that everything is correct, you are now ready to print the payroll checks or process direct bank deposits. - Make sure everyone who needs payroll information has access to it

After the entire payroll process, you’ll have department leaders, managers, vendors, and other shareholders who rely on the data you’re about to present them. Once you’ve done a final overview of the completed payroll process, make sure that these appropriate people get the information they need. Payroll may be the largest budget for your company, and it’s important that you’re handling this budget right and that everything is according to the required payment schedule.

FAQs

What are payroll procedures?

Payroll procedures involve calculating total wage earnings, withholding deductions, filing payroll taxes, and delivering payment. Most of these steps can be accomplished manually, but a lot of payroll departments nowadays just automate the whole process.

What is payroll?

Payroll refers to the amount of money that the employer pays its workers.

Is payroll accounting or HR?

Payroll is largely and employee-facing function. That is why most people agree that it belongs with HR. Pay changes, termination dates and start dates of an employee, and benefits information falls under the scope of human resources.

Once HR professionals or appointed individuals have a fundamental understanding of a payroll audit and a payroll audit checklist, it allows them to identify opportunities for improvement and ensure compliance and accuracy to boost overall employee experience. Of course, your employees deserve to have that as well.

Related Posts

FREE 12+ Audit Checklist Samples

FREE 10+ HR Assessment Checklist Samples

FREE 10+ HR Assessment Checklist Samples

FREE 10+ Medication Checklist Samples

Checklists to Boost Efficiency and Reduce Mistakes

FREE 44+ Sample Checklist Samples

FREE 37+ Checklist Samples

FREE 28+ Checklist Templates

FREE 18+ Inventory Checklist Samples

FREE 15+ Sample Funeral Checklist

FREE 15+ School Checklist Samples

FREE 13+ Compliance Checklist Samples

FREE 13+ Standard Operating Procedure Samples

FREE 10+ Plumbing Maintenance Checklist Samples

FREE 10+ Retail Cleaning Checklist Samples