As it turns out, success doesn’t need a fancy place to grow. Sometimes, all you need is a bare garage. Some of the prominent businesses that laid their foundation behind their homes include industry giants such as Disney, Amazon, Apple, Google, and Mattel. It is the same as the humble beginnings of small businesses. Their daily operations are often composed of a decent space and few workforces, but they have a high potential for success. A small business investment agreement will help you lay your terms on investing in these local names.

FREE 10+ Small Business Investment Agreement Samples

1. Business Investment Agreement

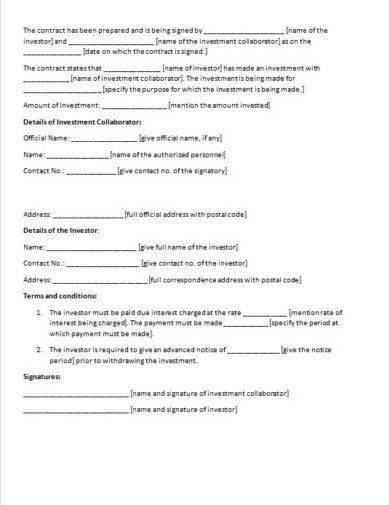

2. Investment Agreement Template

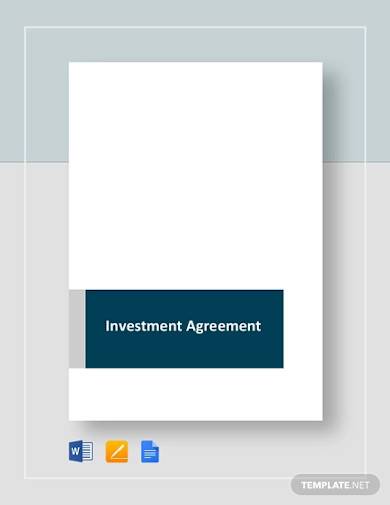

3. Small Business Investment Agreement

4. Small Business Investor Agreement

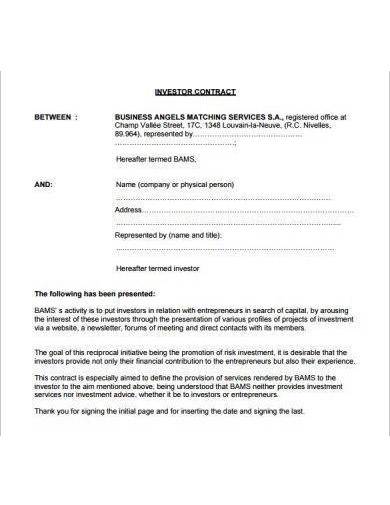

5. Small Investor Contract Sample

6. Sample Small Business Investment Agreement

7. Simple Business Investment Agreement

8. Small Business Investor Contract

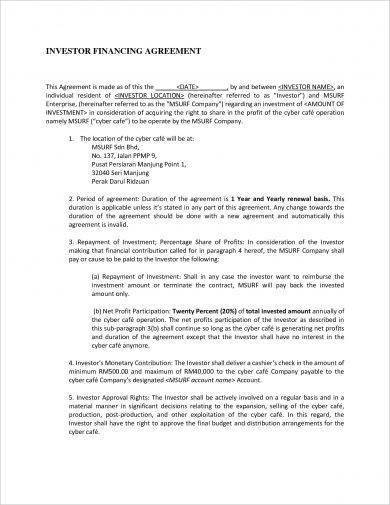

9. Small Business Investor Financing Agreement

10. Small Business Investment Agreement Sample

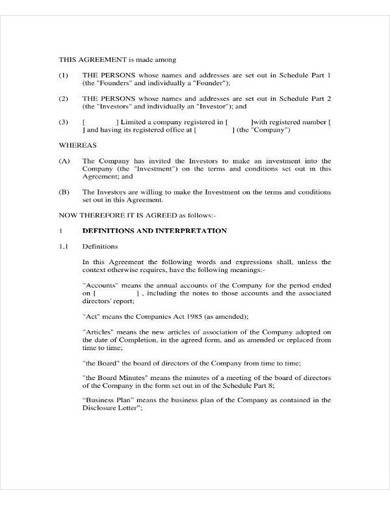

11. Small Partnership Investment Agreement

What Is a Small Business Investment Agreement?

A small business investment agreement is a document stating the details of an entity’s investment on a small-scale establishment or operations. It provides both parties with a comprehensive understanding of how the agreement works, including the rights the investors are entitled to perform and how they’ll expect to receive the return.

Reasons to Invest In a Small Business

If you think corporations and large companies make a country’s economy go around, you should think again. According to the US Small Business Administration, there are over 31.7 million small businesses in the country. It comprises 99.9% of the country’s number of businesses. It supplies jobs to 60 million people, which is 47% of the US total employment rate. It’s apparent that more than the big names that take the spotlight in the industry, small businesses’ everyday operations significantly impact a country’s economy.

According to The Balance, there are several ways by which small business investments can earn. It includes earning as a self-employed individual, gaining from profit share, and selling the establishment. Commonly, these enterprises stay in a single location and flourish under the same management that founded it or stay within the family.

Among the reasons why small businesses are investment-worthy is because it helps support local employment. The small businesses around New York alone employs four million employees. It also helps build a community. Often in a small town, operating small businesses such as diners, convenience stores, coffee shops, and other establishments becomes a rendezvous of conversations and connections that lead to lasting bonds. There’s also the possibility that you might be supporting the next big thing. Most successful entrepreneurs started as a local name. Think of the pride and the return that it will bring you when a tiny shop you’ve placed your trust in becomes a renowned business chain in the country.

How to Make a Small Business Investment Agreement

Drafting an investment agreement can get complicated. There are myriad points to consider, and there are a lot of important elements to include. To help you get started, here are some basic steps when making this document:

1. Know the Basic Agreement Terms

When you begin to draft your agreement, identify its basic terms. It includes a clear definition of each party, so it’s easy to establish roles and accountability. You also need to include the addresses of the parties and the date of the agreement. It’s also important to stress out the agreement’s purpose by providing a clear description of the investment’s structure. This information will introduce the participating parties and the goal of the investment agreement. Be sure to incorporate all the right details.

2. Provide Details on the Investment

It’s imperative that your agreement should focus on the investment’s details. This part of your document should present how much the investor is pitching in, when the investment will be made, and the investment transfer method. It can be a capital investment or a loan that an entity gives to the business in exchange for a return with interest. Aside from monetary support, investments can also come as materials or tangible assets that can help the business’s operations. It’s better to address this in a thorough discussion so both parties can agree to whatever is written in this section. They must understand this part of their deal to avoid future misunderstandings.

3. Discuss the ROI

Every investor’s main concern is the return of the investment or ROI. If you’re a small business owner and are looking for ways to invite an investor to support you, a part of your presentation should be to assure that they will get something in return by presenting your business plan’s profitability. Your investment agreement should have a description of how the investor can reap their share. Discuss if you’re offering a flat interest rate, or it depends on the business’ gains. Including this helps them know what to expect. However, your agreement should contain not only the guarantee but also a caution. Spell out the risks or under what circumstances can affect their share negatively.

4. Specify the Investor’s Rights

Dealing with investors also means giving them access to your business’ management and information. They have rights and responsibilities to fulfill. In large corporations, investors often have the right to make a vote on significant company decisions. Because it’s a small business, explain what roles an investor can take and what details she’s entitled to know. An investor can get themselves involved in daily operational plan and help make sure that it goes smoothly. They can also review sales reports and financial reports to check on the business’ performance. When there’s a need for resolutions, they can help the owners decide on an action plan to straighten out problems.

FAQs

What are the different types of investments for small businesses?

According to The Balance, the different types of investments for small businesses are equity investment and debt investment.

Which small business industries are good for investments?

The following are some of the best industries to choose from when investing in a small business:

- Training and fitness

- Writing services

- Cleaning services

- Storage facilities

- Party and event planning

- Accounting

Who is considered an angel investor?

Angel investors are those who provide support for business start-ups when they’ve just taken their first step in the field.

Entrepreneurial initiatives often need support, whether in resources or in establishing the operations. Investments don’t only provide that much-needed backing by these local enterprises, but they also help investors earn their money back plus more. Our small business investment agreement template can help layout the terms of the process for a more manageable transaction. Download now!

Related Posts

Sample Business Agreement between Two Parties

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF