In the business industry, we know that money keeps the ball rolling. Business owners do not just wake up one day and decide to put up the business they like. It takes more than their gut feelings. Before establishing a business, considering the resources and where to get it are essential. Once these are ready, the business can now take place. In the middle of the fast-pace business operations, how will a business maintain its financial balance? Overseeing income and cash flow is an important obligation for business owners because it gives them an insight into their business’s financial position. To do it, general ledgers and balance sheets must be on hand.

What are the General Ledger and Balance Sheet?

The pressure to come up with a transparent financial statement does not root from troubled business operations. In fact, a statement like this represents the financial strategies that worked and did not. Comprehensive financial statements make a picture of a business’s future. Thus, a business owner will have ideas on what to do to make his or her business successful. But before that, recording business deals and accounts in the balance sheet and general ledger should come first.

Investors and stakeholders play a big role in your business. Hence, they should understand how to analyze and read a balance sheet. Why? A balance sheet will help them to decide whether to continue their investment, lessen it, or even cut it off. A balance sheet is a clear statement of the financial position, which means it entails your business’s accounts—asset, liabilities, and the owner’s net worth.

On the other hand, before these accounts land on the balance sheet, their entry point to the accounting book is a general ledger. It will record every transaction made and all financial information for your firm. That said, it contains all that are required to analyze asset, liabilities, and equity. The balance sheet, together with the general ledger, is the foundation of any company’s income statement.

The main difference between a balance sheet and a general ledger is their purpose. A balance sheet keeps a record of all business deals so that the firm can easily track every financial transaction. More so, it compiles financial documents to help your company trace the errors and inconsistencies. And the balance sheet explains the ownership versus the debt of the business.

A Strong Balance Sheet

A strong balance sheet has more assets than debt. However, if you want loan providers and potential investors to trust your company’s ability to maintain a healthy financial position, you will need more than your assets. A balance sheet is not just about numbers, but ratios. According to Forbes, some factors make a business’s assets: these are the working capital, cash flow, capital structure, and income-generating assets. Though certain circumstances can affect the real value of these factors, they are enough to make up the financial assets.

FREE 10+ Ledger and Balance Sheet Samples & Templates in MS Word | MS Excel | PDF

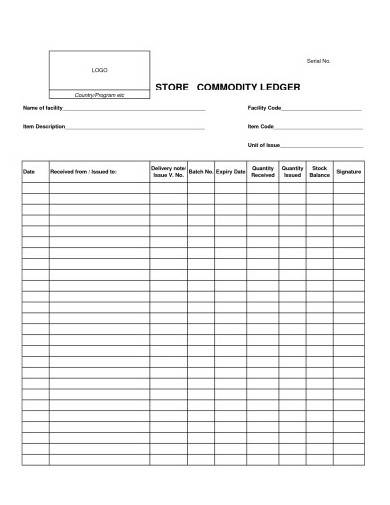

1. Store Commodity Ledger Template

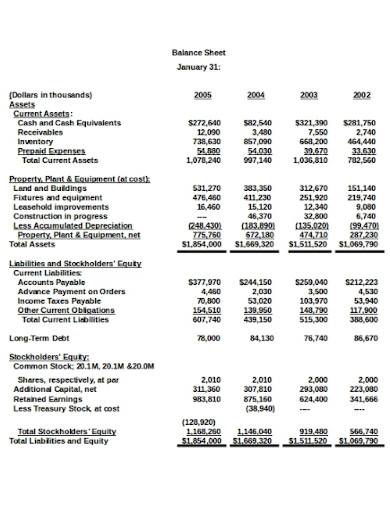

2. Balance Sheet Template

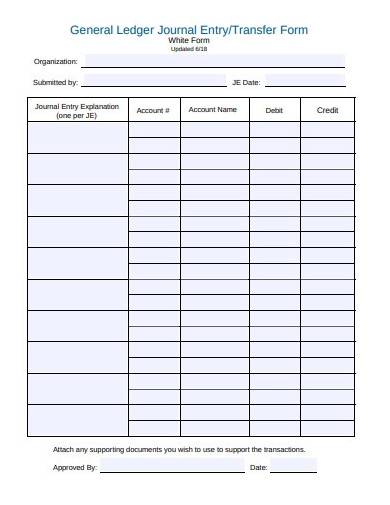

3. Transfer Ledger Form Template

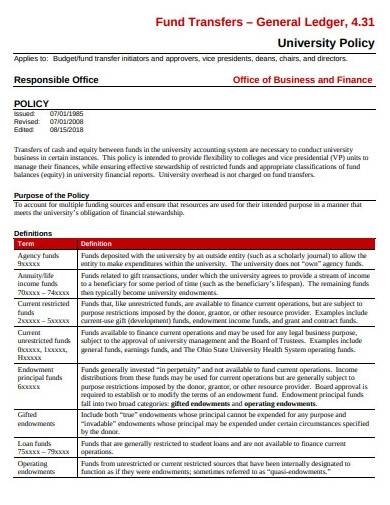

4. General Ledger Template

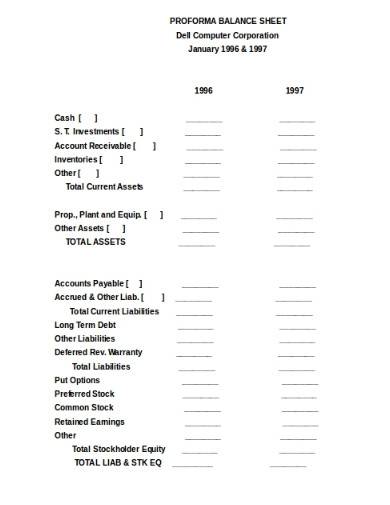

5. Proforma Balance Sheet Template

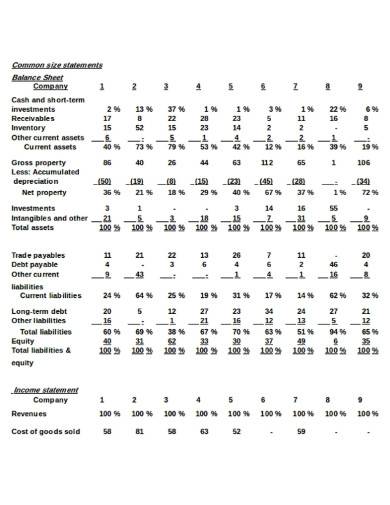

6. Company Balancesheet Template

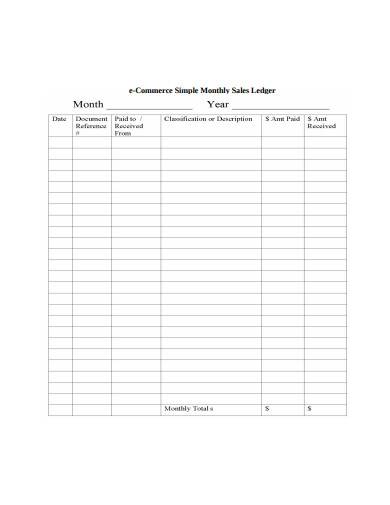

7. Monthly Sales Ledger Template

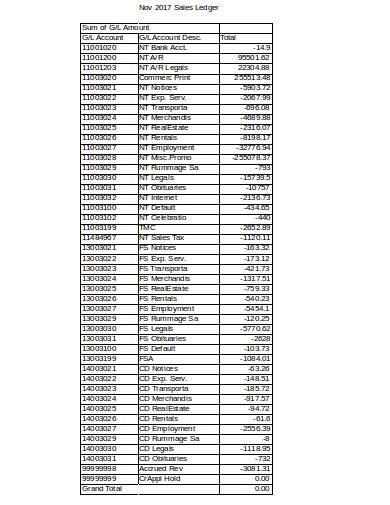

8. Formal Sales Ledger Template

9. Financial Year Balance Sheet

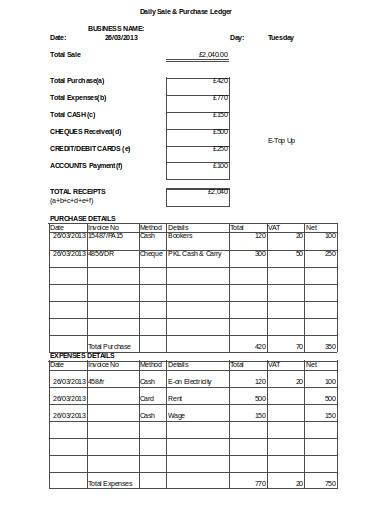

10. Daily Sales and Purchase Ledger

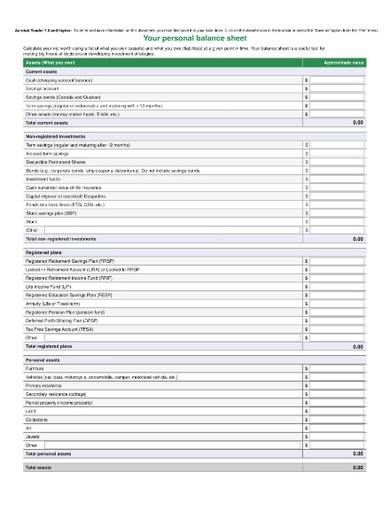

11. Format of Personal Balance Sheet

How to Work on Your Ledger and Balance Sheet

Making a reliable and honest financial statement can attract interest from potential business partners. Since it outlines the assets and liabilities of your business, your financial statement will provide insights into the business’s financial status. However, a great financial statement cannot come through without the documents from a ledger and the accounts in the balance sheet. Before you can start working on a report about money, secure your ledger and balance sheet first and here’s how:

1. Get Familiar with Accounting

Documenting business transactions and accounts do not take so much time if you are familiar with the task. It is also easier if you know the way around it. Many accountants know this task like the back of their hands. But, if you are new on working with balance sheets and ledgers, the best thing to do is to get familiar with it first. Getting started with the task could be the most difficult part. There is no shortcut to this other than studying through short accounting courses. You can look for the materials online. There are simplified discussions to help you learn about accounting as quickly as you can. Experience can also be an effective head start.

2. Set the Goals and Prepare Everything You Need

Setting your goals is important before working on the ledger and the balance sheet. Your goals should guide you through your task. Remember that the reason why you need to come up with a useful ledger and balance sheet is to generate great business returns. That should be enough to keep you going. With your goals in mind, prepare the things that you need. These are essential for your ledger and balance sheet. Your ledger must remain as the book that records documents from business transactions. Knowing that, keep all the entries that involve cash payments, receipts, and cash disbursement. You need the entries from the ledger because it makes up the accounts in the balance sheet.

3. Accuracy Makes a Big Difference

To get rid of inconsistencies and errors in your financial statement, you should prevent faulty transactions and documents as early as it enters the ledger. Use the ledger to trace the uncategorized entries before it lands on the balance sheet. From there, you can fix the loopholes brought by unmonitored business deals. With this, your business can avoid miscalculations of the assets and liabilities. You would not want to present an erroneous balance sheet to potential investors because it would discourage them from partnering with your business.

4. Presentation Matters Too

An organized accounting book is easy to look at. That said, arrange the transactions in the general ledger and the accounts in the balance sheet according to the standard format. There are different types of accounting journal standards, depending on the business, and despite that, making the ledger and balance sheet orderly will make a big difference. Remember that the person who is looking at one of these accounting documents should easily analyze the content. As much as possible, use at least three font styles, similar spacing, and capitalization through the entire ledger and balance sheet to maintain cohesion.

FAQs

What is an accounting ledger?

Without an accounting ledger, there are bookkeeping entries for a balance sheet and income statement. Since an accounting ledger contains journal entries, including cash, accounts receivable, investments, inventory, accounts payable, accrued expenses, and customer deposits, it is an essential part of a balanced accounting book.

What are the different types of ledger accounts?

Mainly, there are three different types of ledgers, which are the Sales Ledger, Purchase Ledger, and General Ledger. These ledgers keep records of all the business accounts as well as business transactions.

Why is a balance sheet important?

If a company wants to acquire new investors or loan money, it has to provide a well-made income and cash flow statement. In that case, a balance sheet has to come along to include insights into the company and its transactions.

Having less or no grasp of your business’s financial health is a no-no. You should know what is happening to your monetary resources before it gets out of hand. In case your liabilities approach the number of your total assets, you can avoid it if you have fully monitored all transactions and deals made by your business. A ledger and a balance sheet are helpful for this circumstance. Having an effective accounting book ensures full transparency on your financial health. Knowing this, you can continue to thrive for a successful business ahead.

Related Posts

FREE 6+ Sample Trail Balance Sheet Templates in MS Word PDF

FREE 6+ Sample General Ledger in PDF

FREE 7+ Customer Ledger Samples in PDF MS Word | Excel

FREE 7+ Accounts Receivable Spreadsheet Samples and ...

FREE 9+ Sample Accountant Job Descriptions in PDF MS Word

FREE 28+ Printable Accounting Forms in PDF MS Word

FREE 7+ Double Entry Bookkeeping Samples in MS Word PDF

FREE 7+ Sample Accounting Balance Sheet Templates in MS Word ...

FREE 20+ Sample Balance Sheet Templates in MS Word PDF | Excel

FREE 10+ Balance Sheet Samples and Templates in MS Word MS ...

FREE 7+ Sample Account Ledger Templates in PDF

FREE 7+ Sample Ledger Paper Templates in MS Word Excel | PDF

FREE 14+ Sales Ledger Samples in PDF MS Word | Excel

Profit and Loss Template

FREE 10+ Rental Ledger Templates in PDF