Charities are typically non-profit organizations that operate with a social or public benefit objective, relying on donation policy and grant project proposal from individuals, corporations, and governments to fund their activity schedule. As such, they are often subject to greater scrutiny and local control and accountability than for-profit companies, particularly when it comes to how they use the funds they receive.

Charity Remuneration Policies are designed to ensure that charitable organizations use their resources responsibly and transparently, and that the salary proposal they pay are commensurate with the organization’s size, scope, and objectives. The policies aim to strike a balance between attracting and retaining talented staff and directors, while ensuring that the organization’s resources are used effectively to fulfill its charity mission statement.

FREE 8+ Charity Remuneration Policy Samples & Templates in PDF

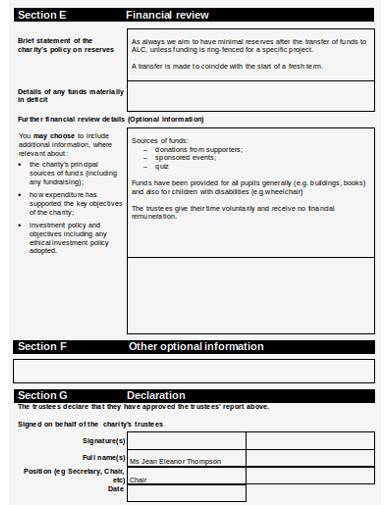

1.Charity Remuneration Policy Template

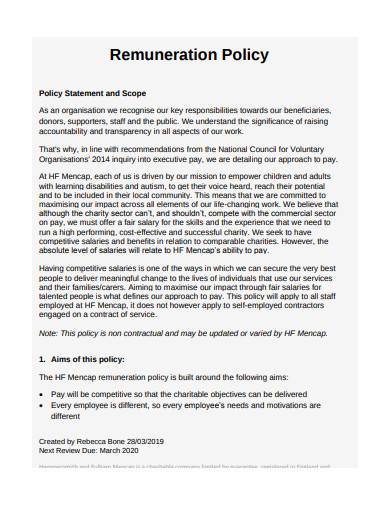

2. Trustees Remuneration Policy Template

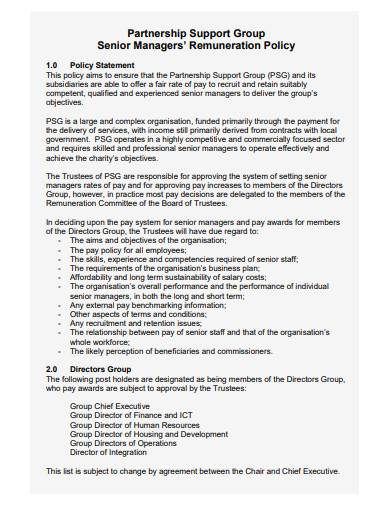

3. Charity Remuneration Policy & Procedure

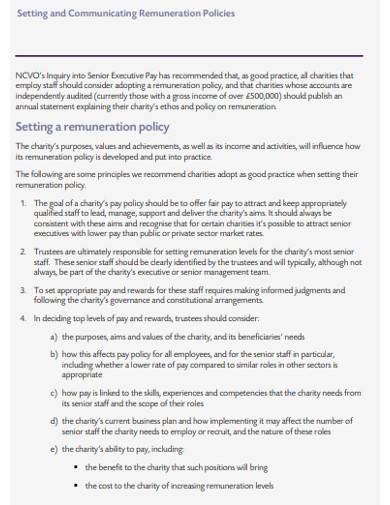

4. Charity Pay and Remuneration Policy

5. Basic Charity Remuneration Policy

6. Charity Remuneration Policy

7. Formal Charity Remuneration Policy

8. Trust Manager Remuneration Policy

9. Standard Charity Remuneration Policy

What is Charity Remuneration Policy?

Charity organizations play a critical role in society by addressing various social, environmental, and public health project proposal challenges. These organizations rely on donations and charity grant proposal from the public, corporations, and governments to fund their activities. To ensure that these funds are used effectively, transparently, and in line with the organization’s objectives, it is crucial to have a well-defined Charity Remuneration Policy.

How To Make Charity Remuneration Policy?

One of the critical aspects of a Charity Remuneration Policy is transparency. Charitable organizations rely on the trust and confidence of their donors and the public. To maintain this trust, it is essential to have a planning policy that outlines how salaries are set and the factors considered when determining executive compensation. Developing a Charity Remuneration Policy involves several steps, including:

Step 1- Define the policy’s purpose

Before developing the policy, it is essential to define its purpose. The policy should align with the organization’s values, objectives, and mission. Gather data about the organization’s financial position, operations agreement, and staff structure. This will help you determine what factors to consider when developing the policy.

Step 2-Determine the decision-making process

Define the process for setting salaries and benefits. This process should be transparent and take into account factors such as the organization’s financial position, the complexity of its operations, and the level of responsibility of its staff and executives.

Step 3- Set salary and benefit guidelines

Define salary and benefit guidelines that are in line with the organization’s objectives, financial position, and size. The guidelines should be competitive with other organizations in the same sector. Link compensation to performance by developing a performance evaluation process. The process should be objective and transparent, and the criteria should be clearly defined.

Step 4- Review and revise the policy

Regularly review and revise the policy to ensure it is still aligned with the organization’s objectives, mission, and values. Obtain approval from the organization’s governing body before implementing the policy. Communicate the policy to staff, donors, and the public to ensure transparency and build trust.

What factors should be considered when developing a Charity Remuneration Policy?

Factors that should be considered when developing a Charity Remuneration Policy include the organization’s financial position, operations, and staff structure. The policy should take into account factors such as the complexity of its operations, the level of responsibility of its staff and executives, and the organization’s objectives, mission, and values.

How often should a Charity Remuneration Policy be reviewed?

A Charity Remuneration Policy should be reviewed regularly to ensure that it remains relevant and effective. The frequency of review will depend on the organization’s needs and circumstances.

Should a Charity Remuneration Policy be made public?

Yes, a Charity Remuneration Policy should be made public to promote transparency and build trust. The policy should be communicated to staff, donors, and the public to ensure that everyone understands how the organization’s resources are being used.

In conclusion, a Charity Remuneration Policy is a critical tool for charitable organizations. It provides guidelines and principles that ensure that the organization’s resources are used effectively, transparently, and in line with its objectives. The policy should promote transparency, fairness, and accountability and should be made available to the public.

Related Posts

FREE 10+ Charity Standing Order Form Samples & Templates in MS Word | PDF | MS Excel

FREE 10+ Charity Risk Management Policy Samples & Templates in PDF

FREE 3+ Charity Investment Strategy Samples & Templates in PDF | MS Word

FREE 5+ Charity Marketing Policy Samples & Templates in PDF

FREE 5+ Charity Recruitment Policy Samples & Templates in MS Word | PDF

FREE 3+ Charity Management Accounts Samples & Templates in PDF

FREE 10+ Charity Gift Aid Form Samples & Templates in MS Word | PDF

FREE 10+ Charity Strategy Samples & Templates in MS Word | PDF

FREE 6+ Charity Marketing Strategy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policies and Procedures Samples & Templates in MS Word | PDF

FREE 10+ Charity Expenses Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Donation Letter Samples & Templates in MS Word | PDF

FREE 4+ Charity Request Letter Samples & Templates in MS Word | PDF

FREE 5+ Charity Impact Report Samples in PDF