Most people equate the word “trade” with products such as silk, spices, and past civilizations such as ancient Egypt or old American Navaho Tribes. However, the concept of trading still exists today—but has taken on a new form. Now, the stock market is the mecca of trade and commerce with various entrepreneurs imploring multiple marketing strategies to gain the upper hand and obtain high revenue. However, with continuous fluctuations in the stock market, understanding volatility trading strategies becomes a defining factor to success.

What are Volatility Trading Strategies?

Contrary to popular belief, trading is more than just exchanging spices and goods for silk and ivory trinkets. Over the past decades, the evolution of commerce has gone through quite a journey. From the introduction of currencies to the power of today’s dollar, the word “selling” has—through time—become more frequent in use. However, with the rise of the stock market and the commerce behind the buying of franchises, trading is once again used as the gentleman’s fancy way of saying “I want to buy your brand.” As such, the business strategy of purchasing and selling businesses has risen from this new trend.

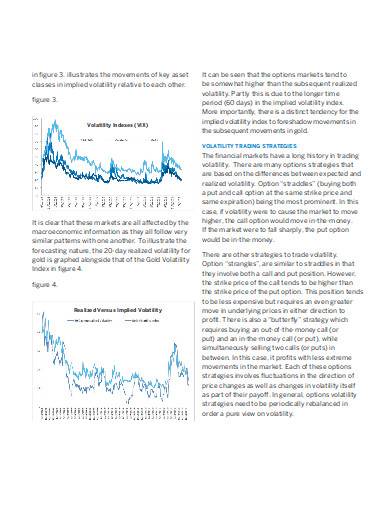

With that said, a new enterprise and source of revenue come new challenges. One such threat to your financial investments is that of what’s known as a stock-price plummet. The stock market is never consistently stable as prices often rise and fall according to circumstance. This volatile, unstable market requires the investigative prowess of a sleuth and the financial skills of a shrewd businessman. This, in essence, is what volatility trading strategies are; the ability of modern-day businessmen to find revenue within the stock market despite the rise or fall of prices.

By Horn or Claw

The bear and the bull: the yin and yang of stock marketing. For those who are unfamiliar with these animal totems of finance, they depict the status quo of the stock market. Like a religious cult connecting animalistic behavior to an entity beyond the realms of realistic comprehension, people in business have associated these creatures with the stock market’s conditions. Through their innate defense mechanisms, you can deduce that a bull swinging its horns up projects an increasing rate of marketability, while the bear’s heavy-pawed swipe to the ground shows an opposite reaction. With that said, as financial entrepreneurs, it’s best that you understand the stock market either by horn or by claw.

10+ Volatility Trading Strategies Samples in PDF | DOC

1. Volatility Trading Strategies Sample

2. Volatility Trading Strategies Template

3. Volatility Trading Strategies in PDF

4. Volatility Trading Strategies Example

5. Basic Volatility Trading Strategies Sample

6. Formal Volatility Trading Strategies Template

7. General Volatility Trading Strategies in PDF

8. Simple Volatility Trading Strategies Template

9. Volatility Index Trading Strategies in PDF

10. Volatility Swap Trading Strategies Template

11. Volatility Trading Strategies in DOC

How to Apply Profitable Volatility Strategies

The Stock market is easily one of the most challenging aspects in finance and business. Few people understand the complexity of budget metrics, and even few utilize it in negotiations and stock trading. However, with a few basic steps and pointers, you’ll learn to grasp and eventually create your own volatility trading strategies.

1. Analyze the Financial Status Quo

Like how a business project has an evaluation method and period, a successful stock trader doesn’t put his assets up for sale willy-nilly. He analyzes the situation of the market and checks if it’s being pushed up on a bull’s horns or struck down by a bear’s claw. As such, make it a prerequisite to study the layout of the stock market before moving forward.

2. Manage Your Resources

Whether it’s budget, product, or time management, having firm control over your resources reduces wastage. While resource management is impactful in all business endeavors, it’s even more so when it comes to profiting off of volatility strategies. When dealing with an unstable market condition, a defining factor for success isn’t just the strategies you utilize, but also how you make sure your resources are uncompromised.

3. Cut Your Losses

As barbaric as it sounds, the practical option of any business when things are consistently on the downside is to cut their losses. Now, this might seem like such a horrible mistake on your part should things go south, but cutting losses isn’t a direct equivelent to loss of profit. As a matter of fact, letting go before an endeavor becomes a disaster means you still have the resources and start over successfully.

4. Have a Strategic Plan

Not the worst thing you can do as an entrepreneur is to be caught unprepared: do not let this happen! What are various “effective” volatility trading strategies if you plan out your actions? Having a strategy plan that assists in executing your trading patterns makes them more proffitable in the long run.

With the vast amount of knowledge required in profitable stock marketing and trading, it’s no wonder that not many people are into it. However, for those who want to be part of the elite who profitably trade stocks, it’s a requirement to understand the market, its situation, and the bull and bear that keep it volatile. But, most importantly, you need to learn to manage your resources, cut your losses when needed, and understand that volatility trading strategies are only lucrative if you put in the time and effort in the right process.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]