Did you know that the Organisation for Economic Cooperation and Development(OECD) study advises that corporate taxes inflict the most negative effect on economic growth? However, if you are running a smaller and startup company, this type of tax should not greatly affect your business. Thus, you can use the money for other important investments, such as market research. Nonetheless, you may feel its effects as your company grows. On the other hand, sales tax inflicts the least harm to economic growth because it’s calculation does not base on a person’s wealth or income.

What is a Sales Tax?

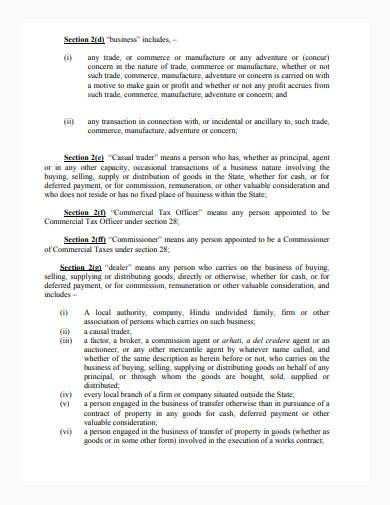

A sales tax is a consumption tax that the government places for the sales of specific goods and services. Usually, businesses collect these taxes from the customers through point of sale (POS). The government, then, collects these taxes and provide the companies with sales tax receipts. In some cases, the government directly receives the charge from the consumer. We call this tax as use tax. Aside from the regular sales tax, the government may also impose a value-added tax (VAT) on the goods and services that the customers buy.

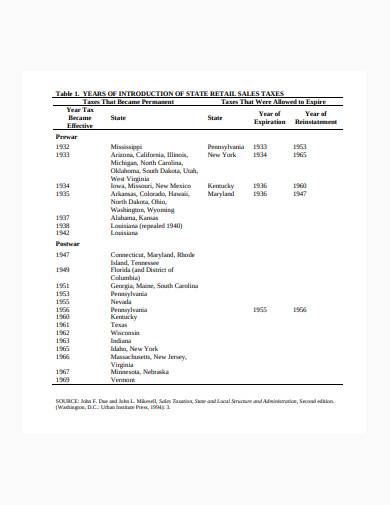

Retail Sales Tax

Another thing that you should know is the final end-users are the ones who pay the retail sales tax. If you are buying products for retail purposes, you should get a resale certificate from the taxing authority. You will need this certificate in purchasing items from the wholesalers and state that the products are for retail. Additionally, you should know that retail sales tax law may vary by state or country. For example, Texas, United States applies a 6.25% tax rate on retail sales, but it does not stop there. This tax extends to other revenue-producing businesses such as leases and rentals of most assets. If you operate a business in California, you will collect a 7.25% sales tax from the customers.

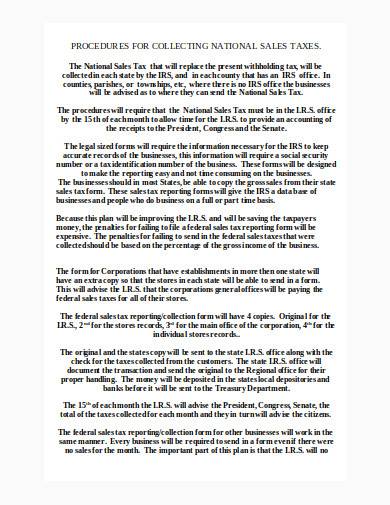

10+ Sales Tax Samples in PDF | DOC

Know more about sales tax by checking out the following samples. You can download these zipped files in PDF and MS Word format.

1. Sales Tax Sample

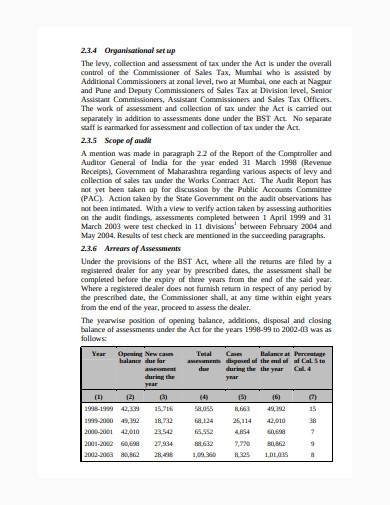

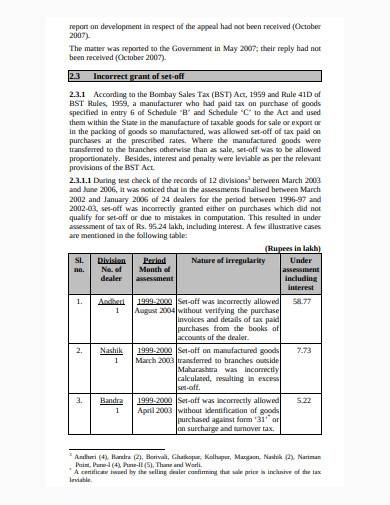

2. Sales Tax Template

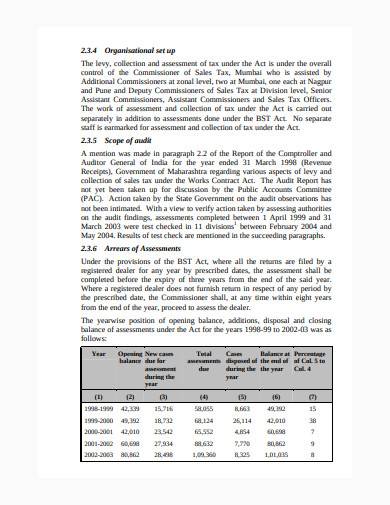

3. Sales Tax in PDF

4. Sales Tax in Example

5. Formal Sales Tax Sample

6. Sales Tax Law in Kerala Template

7. Basic Sales Tax Template

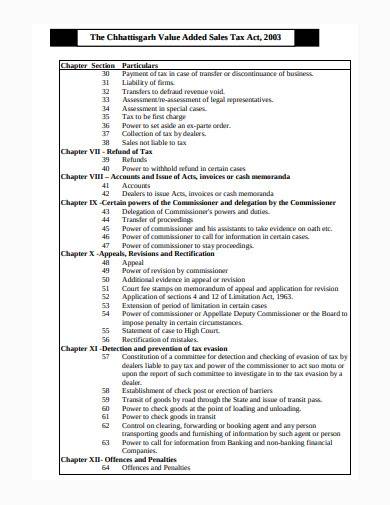

8. State Sales Tax Act Sample

9. Simple Sales Tax Template

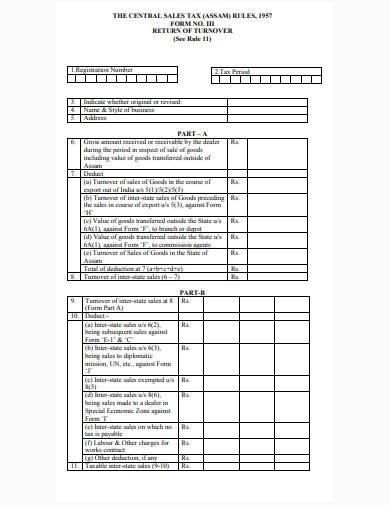

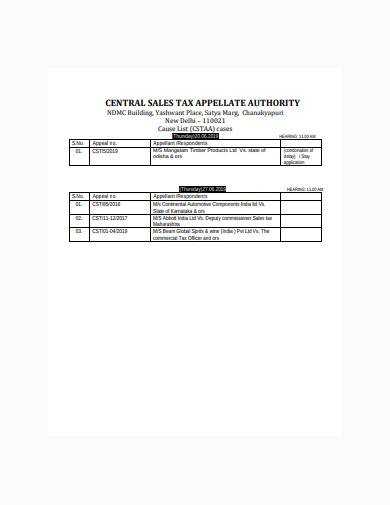

10. Central Sales Tax Sample

11. Sales Tax in DOC

How to Ensure that Your Company Complies with the Sales and Use Tax Rules

In every state or country, there are specific taxing rules that every business has to follow. That includes your company. Follow these best practices to avoid any issues with the law.

1. Determine Sales Tax Nexus

The first thing that you need to consider when starting a business is the sales tax nexus of a particular state to determine when you need to file tax returns. The nexus rules will base the tax that you need to pay on the activities that you conduct. The government penalizes the companies that fail to follow these rules. Additionally, a state may also apply tax rules to online retailers. Currently, Amazon and eBay are imposing the required state sales tax.

2. Analyze the Taxability of the Products

Not all services and products are subject to sales tax. Tax rules may also differ in some products. Thus, you need to determine which products you need to impose taxes. We recommend that you use a chart to map the products to its proper tax code accurately.

3. Monitor the Changes

Just like construction law and areas of the law, the clauses of sales tax law can change from time to time due to various factors, such as economic activities. Therefore, you have to monitor these changes and review the system that you are using to avoid any conflict. Also, other bills may indirectly affect your business. Thus, you have to extend your monitoring to other affecting areas.

4. Create Audit Processes and Procedures

Inaccurate sales tax to products can lead to penalties. To avoid it, you should develop a standard internal procedure to monitor the sales tax. It will lessen the possibility of inaccuracy and promote a good relationship with the auditors. You can read our article about tax audit reports samples and templates to know more about tax audit reports development.

Sales tax is the least harmful tax to economic growth. However, if you don’t know enough about this type of tax, the authorities may come after your business, which can lead to more problems. It may also destroy the reputation of your company, which is the best branding strategy of a business.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]