Erin Duffin of Statista.com published a statistical study and estimation about the US excise tax revenue wherein it’s stated that in the next years, there’d be an increase of up to 137 billion dollars in the US alone. But, what would a revenue growth do if the taxpayers themselves don’t know anything about excise taxes, payment procedures, and how to file them? That’s why we are here to help you as we present to you our downloadable, editable, and different varieties of excise tax forms that you can use.

What Is an Excise Tax?

Excise taxes began way back in the 1700s aimed for supporting the country, and for paying the government’s debts accrued from war and security needs. This type of tax is an indirect tax that manufacturers and suppliers of specific goods are required to provide. On the one hand, consumers won’t be able to see the actual value of the excise tax when they buy the product. Why? Because it’s only the value-added tax or sales tax that’s indicated in their purchase receipts.

Importance of Excise Tax Forms

Excise tax forms are important, due to the following reasons and purposes:

1. Document details

There are several types of excise tax forms and each one’s intended for varying purposes. But, one common objective of these forms is, it must document every necessary information to use for tax transactions, claims, and other related procedures.

2. Record updates

Mistakes and errors in a tax form can cause a lot of problems. That’s why a taxpayer should update all his tax details using the right tax document, including his excise taxes.

3. Inform eligible taxpayers

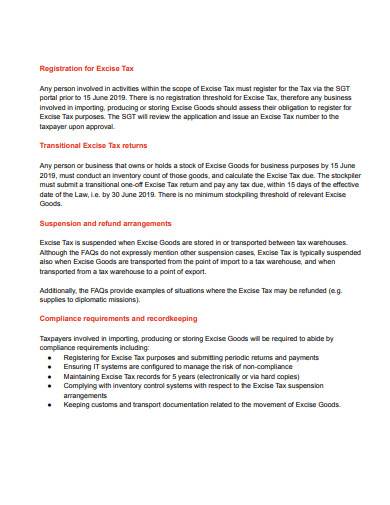

Some excise tax forms are not for collecting data and information since they’re for informational purposes. Nevertheless, they’re all essential, specifically when it comes to informing taxpayers about new tax policies and laws.

10+ Excise Tax Samples

Reading tax audits, statements, reports, and other tax documents can be a daunting task. More so, in determining which and what form you have to use! Well, you’re lucky, for we have here our varieties of excise tax forms. And the best part is, each of it is downloadable to any type of device, editable, and printable to any sort of printer. Aside from that, it’s also available in two different file formats; PDF and DOC. Now, you have better options about which excise tax form you can utilize for this tax period. Discover them below:

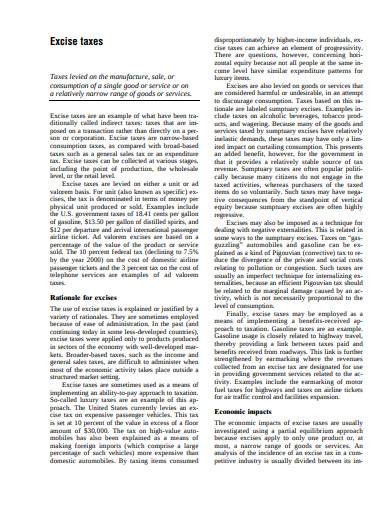

1. Exercise Taxes Sample

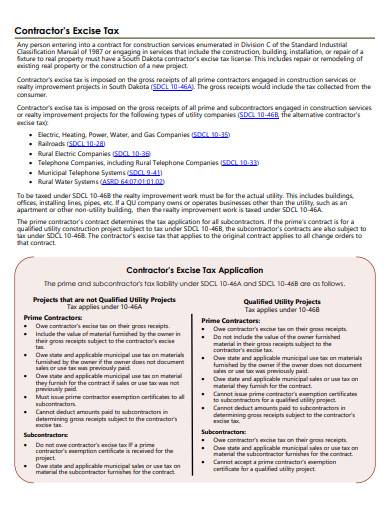

2. Contractor’s Exercise Tax Template

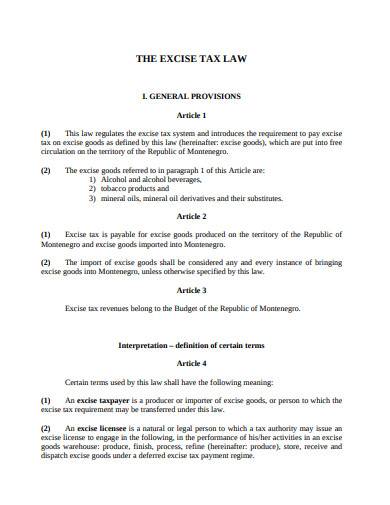

3. Exercise Tax Law Sample

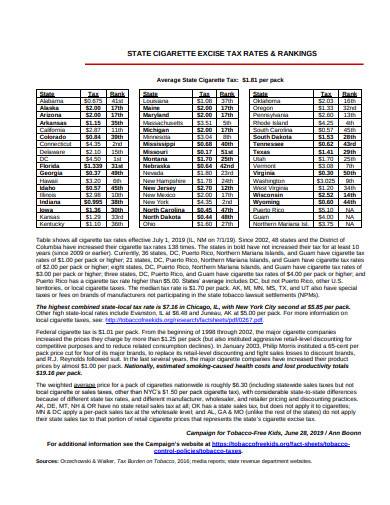

4. Cigarette Exercise Tax Rates Sample

5. Exercise Tax Implementation Template

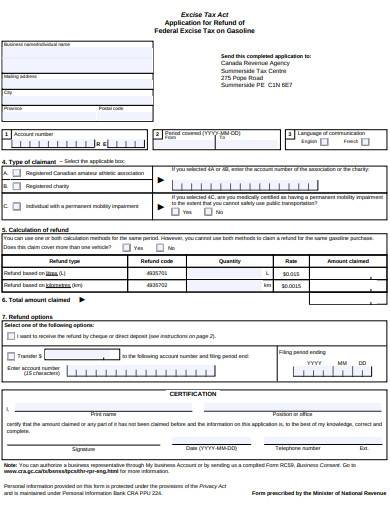

6. Federal Excise Tax on Gasoline Sample

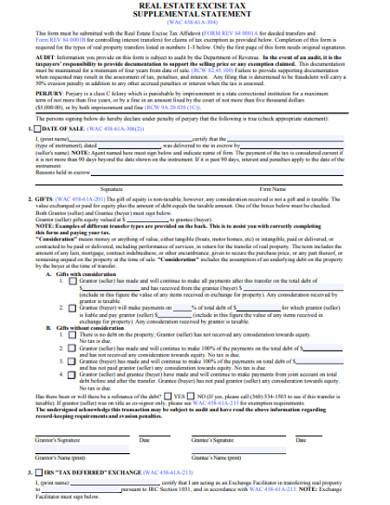

7. Real Estate Exercise Tax Sample

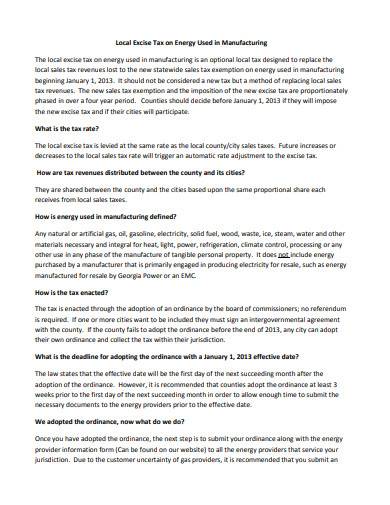

8. Local Excise Tax on Energy used in Manufacturing Sample

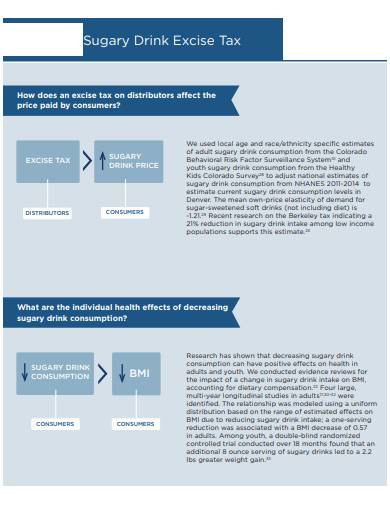

9. Sugary Drink Exercise Tax Template

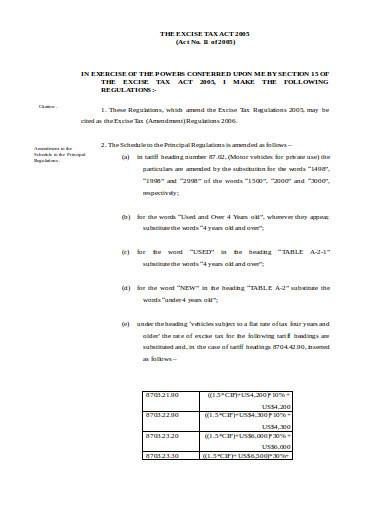

10. Exercise Tax Act in DOC

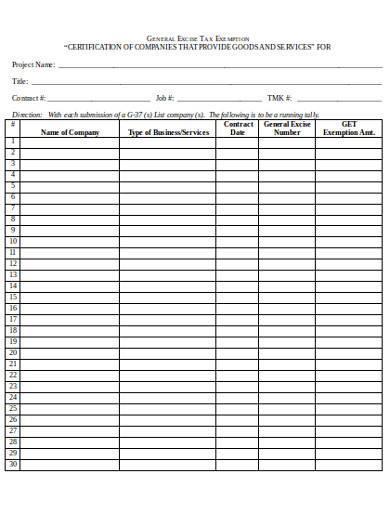

11. General Exercise Tax Exemption in DOC

Varieties of Excise Tax Forms

If you’re wondering what sort of document you must use to file, claim, or support your excise tax information, then we’ve listed a variety below that you can consider:

1. Federal Excise Tax Refund Application Form

Who doesn’t want tax refunds, right? And according to The Washington Post, more than 73% of Americans get their tax refunds, and the number grows each year. But, how can one get an excise tax refund in his business? Well, by filling and submitting a completed federal excise tax refund application form. In it, the taxpayer will be able to indicate the amount that he overpaid, as well as his expected refund eligibility.

2. Excise Tax Supplementary Statement Form

Along with a tax affidavit and other documents, this form will serve as a supporting proof for claiming and paying excise taxes. Since this is a statement form, its contents are mainly sentences or paragraphs with entry fields for the information of the taxpayer. And if a duplicate of the form is one of the requirement, then it’s essential to note that the taxpayer will only have to affix his original signature in the first form, and no longer necessary to sign the second one. Of course, different states and counties have varying rules about providing supplementary statement forms. Therefore, taxpayers should inquire to their nearest IRS offices to know what specific document to use.

3. Excise Tax Exemption Form

When one knows about what items are tax-deductible, that person will be able to benefit a lot. For instance, vehicle manufacturers and owners can claim tax exemptions when installing idling reduction devices to tractors and large vehicles. But, for them to claim the exemption, they must inform and connect with the state agencies who handle such deductions, exemptions, and tax-related concerns. Other than that, they should also complete an excise tax exemption form to file their claims and eligibility.

Excise Tax FAQs

What goods or items have federal excise taxes?

Some of the most common include health-related goods, tobacco, and alcohol, as well as fuel. The amount of excise tax for each item mentioned above vary state by state, so be sure to research or ask your state agency about it.

How are excise taxes calculated?

There are excise tax calculators available online, but these are just estimations of the actual taxable amount. However, the basic calculation involves the multiplication of the item’s value to the tax rate.

Knowing your taxes allows you to be a better citizen of your state and country, especially in the area of filing excise taxes. Furthermore, you should also be knowledgeable about the different forms and documents you have to use. So, what are you waiting for? Use our excise tax and other sample form templates that we offer here on our site now!

Related Posts

FREE 10+ Pest Control Scope of Work Samples in PDF | DOC

FREE 10+ Affidavit of Acknowledgement Samples [ Paternity, Marriage, Voluntary ]

FREE 10+ Affidavit of Business Closure Samples [ Temporary, Permit, Owner ]

FREE 10+ Affidavit of Guardianship Samples [ School, Legal, Temporary ]

FREE 10+ Affidavit of Financial Support Samples [ Notarized, Immigration, Student ]

FREE 10+ Affidavit of Execution Samples in PDF

FREE 10+ Affidavit of Consent Samples [ Parental, Marital, Support ]

FREE 10+ Affidavit of Discrepancy Samples [ Joint, Name, Address ]

FREE 10+ Affidavit of Declaration Samples [ Income, Ownership, Citizenship ]

FREE 4+ Small Business Balance Sheet Samples in PDF

FREE 4+ Notary Acknowledgement Samples in PDF

FREE 10+ Damage Estimate Samples in PDF

FREE 50+ Packing Slip Samples in PDF | MS Word

FREE 50+ Data Analyst Samples in MS Word | Google Docs | Pages | PDF

FREE 29+ Recruitment Samples in MS Word | Google Docs | Pages | PDF