To attract and retain investors, a company must do all they can to keep their business clean and trustworthy. What better way to ensure this is by conducting regular business audits. These are documented assessment of a company’s financial statements to verify if they are accurate. The details may be broad in this matter so it is essential to have a financial audit checklist on hand to guide you through the auditing process. Learn more about this in our article and and don’t forget to check our free financial audit checklist samples:

10+ Financial Audit Checklist Samples

1. Financial Audit Preparation Checklist

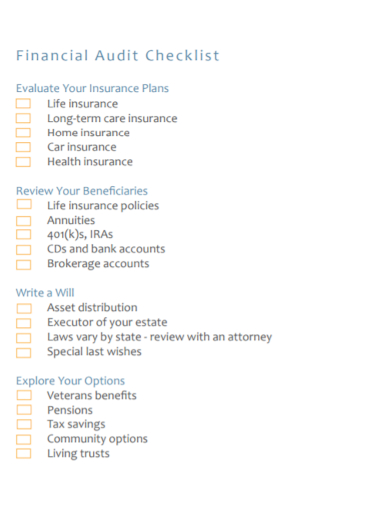

2. Financial Audit Checklist

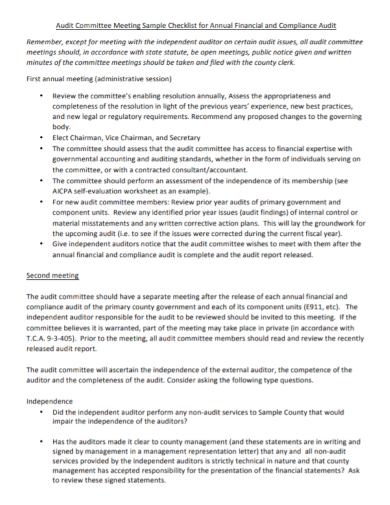

3. Annual Financial Audit Committee Checklist

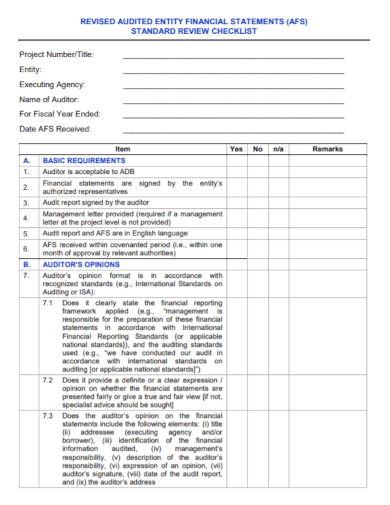

4. Audited Financial Statement Review Checklist

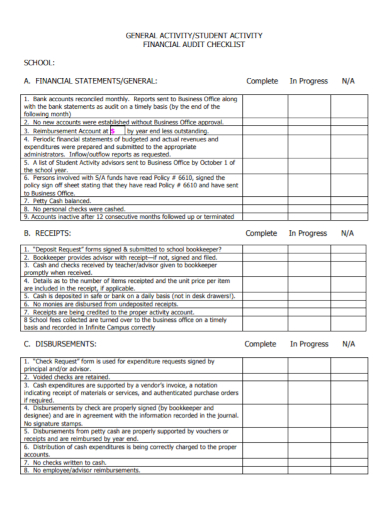

5. Student Activity Financial Audit Checklist

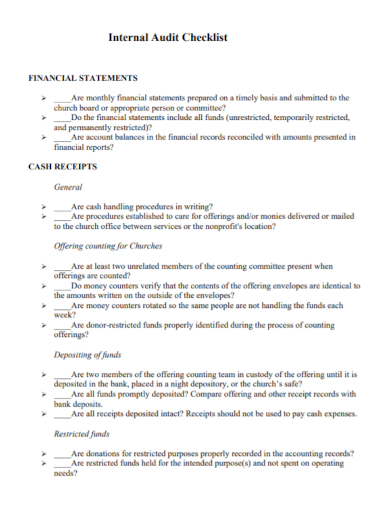

6. Financial Internal Audit Checklist

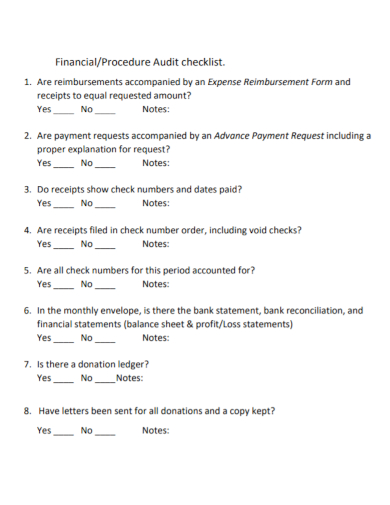

7. Financial Procedure Audit Checklist

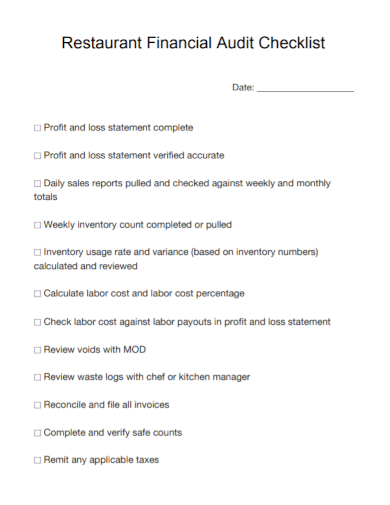

8. Restaurant Financial Audit Checklist

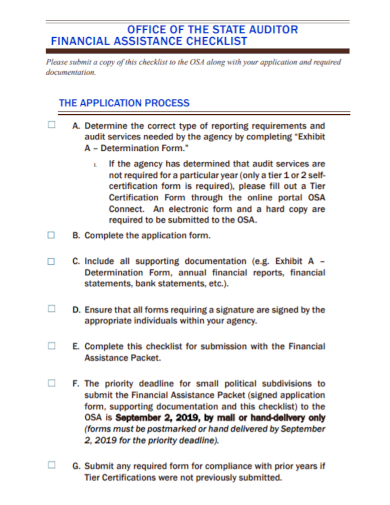

9. Financial Auditor Assistance Checklist

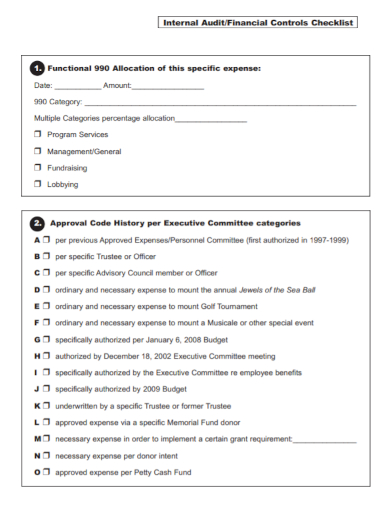

10. Financial Internal Audit Control Checklist

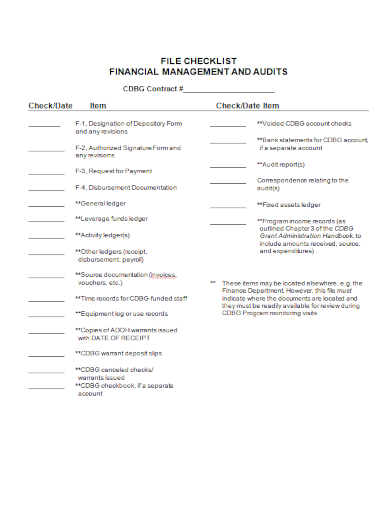

11. Financial Management Audit Checklist

What Is a Financial Audit Checklist?

The benefits of conducting a financial audit can be identified in a number of ways. This could verify compliance with all applicable regulatory agencies, improve credit standing and reliability and it protects business stakeholders from risk of fraudulent practices. Thus, regular financial auditing plays a vital role in the improvement and the success of a business. Helping you get through this is a financial audit checklist is a tool which is a acts as an internal guide, to aid you through the financial auditing process.

How to Create a Financial Audit Checklist?

The main objective of using a financial audit checklist is to impose accuracy, precision and reliability in during the financial auditing procedure. To be able to achieve these objectives, you will need to know the exact details in your financial audit checklist. Also, be reminded that a fundamental audit checklist should be used and an audit administered by an unbiased committee from within the business. So, to get started here are the key components you should include in your audit checklist.

I. Auditor and Auditee Details

Include the auditor’s name and auditee’s complete information for documentation and reference.

II. Financial Statements and Budgets

Determine if the financial statements are prepared on a timely basis and submitted to the board or relevant committee involved. Check if all financial statements include all funds and if account balances in the financial records are reconciled with the actual amount presented in the reports. Budgets should be put together at the beginning of each year for targeted income and expenses, then monitored monthly. Balance sheet, income statement, statement of owners’ equity and cash flows statement, should be reviewed for accuracy, completeness and compliance with generally accepted accounting principles.

III. Cash Receipts

Cash receipts is a printed statement of the amount of cash received in a cash sale transaction. Ensure that all cash receipts are properly documented and check if the handling procedures are being followed.

IV. General Ledger

Ensure that transactions are all documented in a general ledger, whether this is done manually or electronically. It should be consistently recorded with enough information to identify who created it and for what purpose. Each should be stamped with the transaction date.

V. Revenue and Sales Cost

Revenue is reviewed in a variety of ways that are primarily dependent on the way revenue is generated and cash is collected. One testing method will be to develop a correlation between the revenue recorded and the cash collected on a monthly basis. Costs-of-sales entries should be properly timed with associated revenue entries and checked for accuracy.

VI. Liabilities

- Accruals : Identify and prepare a list of transactions for which supporting documentation was received in the subsequent year. This should include items such as funds due for earned employee wages awaiting payroll processing, vacation or sick-day earnings and bonus or commission agreements.

- Account Payable: Check the accounts payable registry by customer and invoice.

- Loans : Include any loans, financial and legal documents, as they will be inspected to support balances.

VII. Contracts

Add into your checklist a review of major contracts engaged by the company such as a review of major leases, purchase and sales agreements, insurance policies or any other written company obligation.

VIII. Regulatory Compliance

Verify if the financial documents are all in compliance with all regulatory agencies that govern the business. This should include the filing of local, state or federal taxes. It should also include compliance with agencies that require periodic reporting of statistics or other actions to reduce physical risks.

FAQs

What Are the Different Types of Audit?

These would be external audits, internal audits, and Internal Revenue Service (IRS) audits.

What Is Task of an Auditor?

An auditor’s job is to assess or evaluate the accounts of companies and organizations to ensure the validity and legality of their financial records.

What Is Meant by Audit Plan?

An audit plan is a guideline used when performing an audit. This would help the auditor obtain sufficient appropriate evidence for the circumstances, helps keep audit costs at a reasonable level, and helps avoid misunderstandings with the client.

A good business performance is not only limited to its high earning revenue but also how its financial components are taken care of. Finance is one of the major backbone of every company, to see it tainted and disorganize can lead to financial ruin. Make sure you conduct regular financial audit to keep your finance procedures in tact before its too late. The implications can be dire and quite costly.

Related Posts

FREE 28+ Printable Accounting Forms

FREE 20+ Sample Financial Report

FREE 16+ Sample Audit Reports

FREE 16+ HR Audit Report Templates

FREE 15+ Sample Financial Reports

FREE 11+ Financial Statement Samples

FREE 11+ Clinical Audit Report Templates

FREE 10+ Tool Inventory Samples

FREE 4+ Interruption Checklist Samples

Checklists to Boost Efficiency and Reduce Mistakes

FREE 43+ Sample Checklist

FREE 21+ Student Checklist Samples

FREE 11+ Risk Assessment Templates

FREE 10+ Finance Skills Samples

FREE 9+ Stock Audit Report Samples