Looking for a credible reference on sample purchase and sale for business agreements? Unlike any business agreement, entering into a purchase and sale of a business truly imposes greater risks as it involves the acquisition of a company’s assets and liabilities.

It’s always essential to come to terms with a mutually agreed contract to avoid problems in the future. Yet, it is much more critical to secure an agreement without missing out on any important items when entering into a purchase and sale agreement of a business.

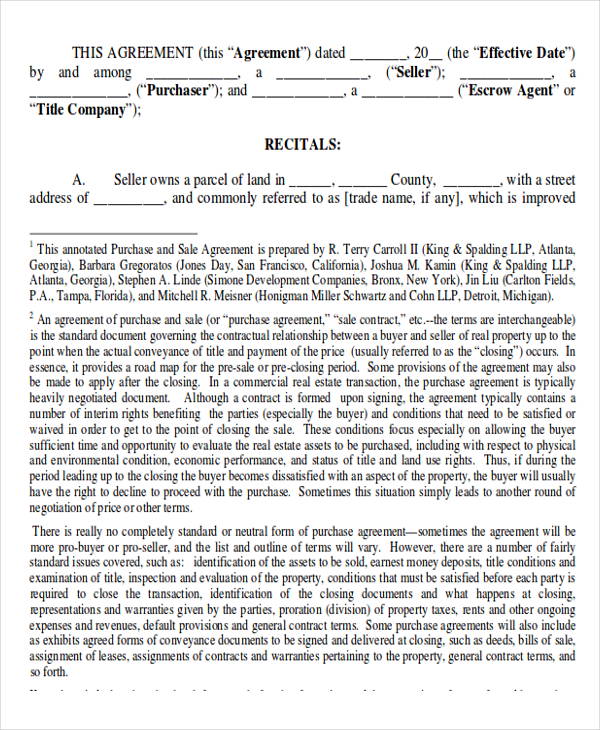

Sample Purchase and Sale Agreement Template

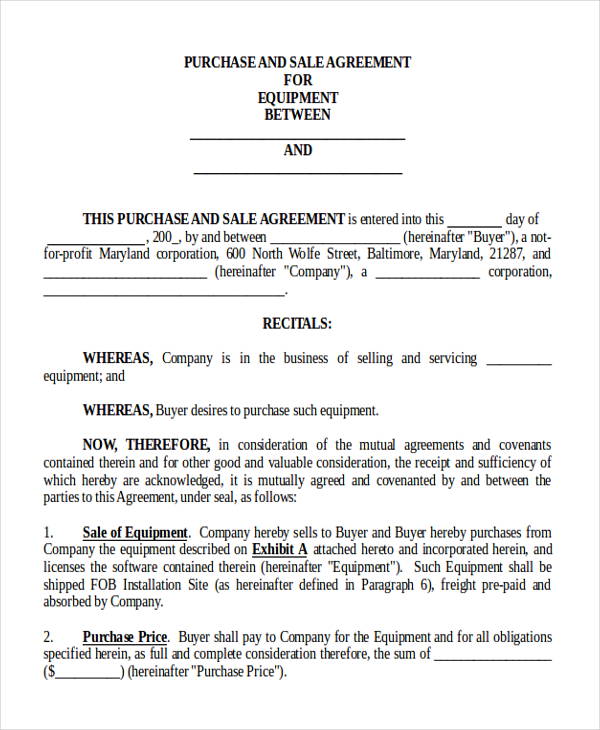

Sample Agreement of Purchase and Sale of Business Assets Template

Sample Purchase and Sale of Business Asset Agreement

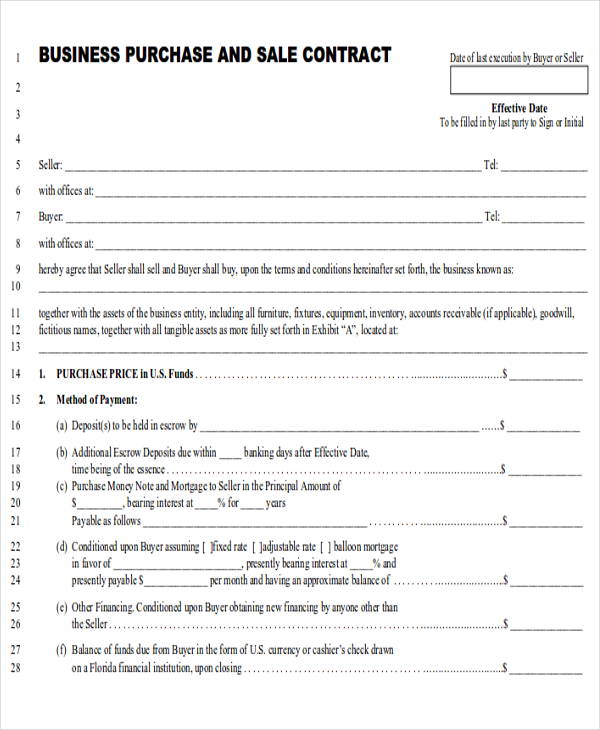

Purchase and Sale of Business Contract Sample

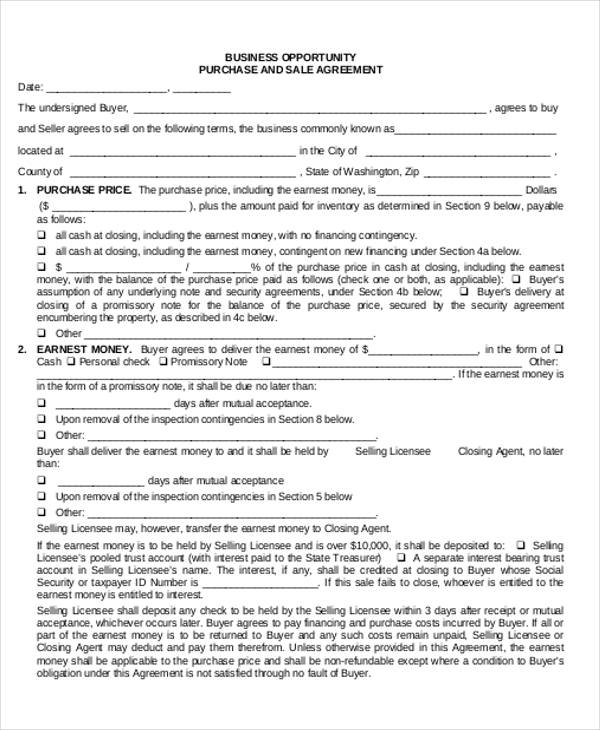

Business Opportunity Purchase and Sale Agreement

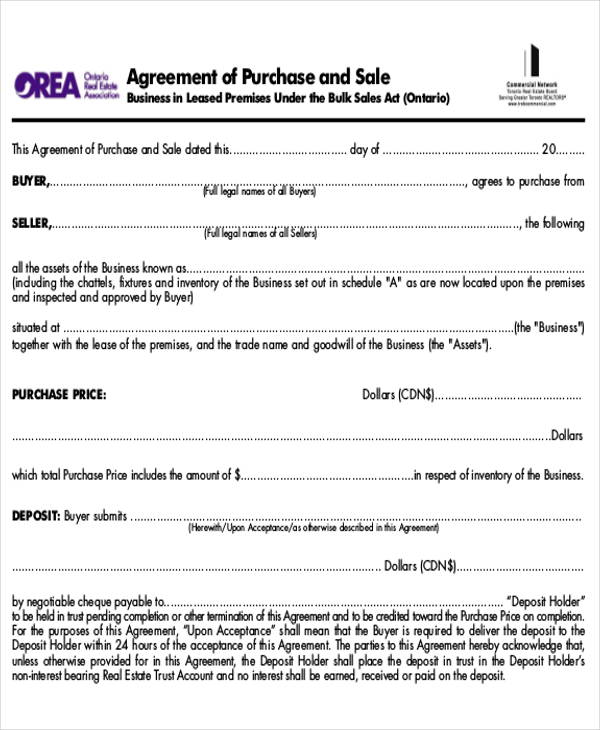

Purchase and Sale of Business Agreement Form in PDF

How to Draft an Agreement for the Purchase and Sale of a Business

- Indicate all parties involved, with complete names and addresses of all individuals and business affiliations along with any partners that may directly or indirectly hold interest in the business.

- Indicate the sale items in full details.

- Include the complete terms of sales with corresponding dates, mode of payments, amounts paid, interest rate and required deposits if paid in installments, complete names of any brokers and companies facilitating in the sales transaction.

- A disclosure agreement that obligates both parties to state they have disclosed all legal obligations, liabilities, lawsuits, and other encumbrances must also transcribe in the contract.

- Ensure that all parties involved including witnesses sign and date the contract. Have all parties secure multiple copies with all documents notarized by a notary public.

Although a consulting arrangement would require entering Business Consulting Agreements, it would still be wise to seek expert advice from a trusted business consultancy firm before engaging into any business acquisition contract.

How to Cancel Agreement of Purchase and Sale for Business

Both the buying and selling parties can still retract and mutually cancel a purchase and sale agreement by completing and signing another type of Business Agreement Contracts—the Release and Cancellation of Contract for Purchase and Sale Form. By signing this form, both the buyer and the seller mutually agrees to cancel and release the buyer, seller, their agents, and everyone facilitating in the sales transaction from all known or unknown liabilities and claims arising from or relating to the cancelled agreement.

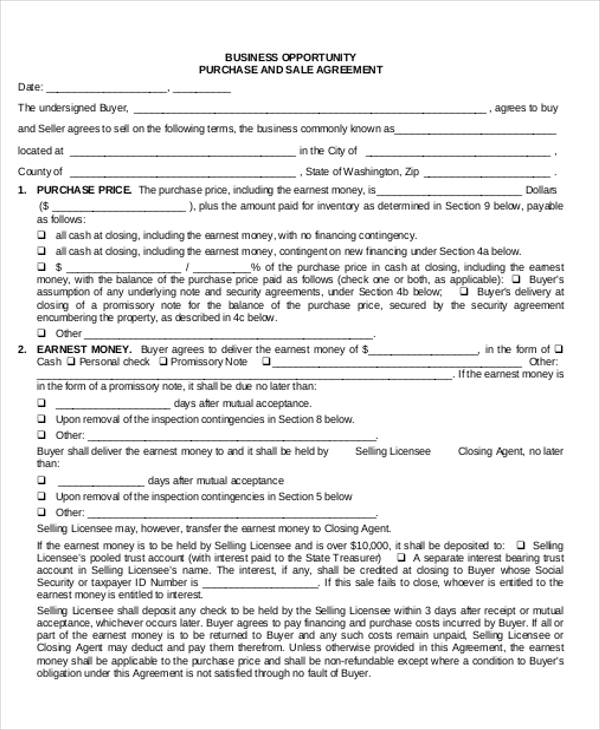

Standard Purchase and Sale of Business Opportunity Agreement

Legal Purchase and Sale of Business Agreement

Purchase and Sale of Small Business Agreement Example

What Is a Business Purchase Agreement?

A business purchase agreement is an official contract entered mutually by both a seller and a buyer to transfer ownership of a business. The agreement stipulates the complete terms of sales, sale items, sale price, and the arbitrary clauses and warranties to protect both the buyer and seller after the sales transaction has been fulfilled. Also see Business Investment Agreements.

Purchase or Sale of a Business Structure

- Stock/Share Sale

Under a stock transaction, the buyer acquires all the stocks from the seller’s company and assumes ownership of all its assets and liabilities. Both parties, in some cases, may also choose to exclude certain assets and liabilities to be sold. - Asset Sale

Generally, buyers prefer asset transactions as they would have greater control over assumed liabilities. Under an asset sale, the buyer acquires some or all assets from a seller’s company but the seller still retains ownership of the corporate entity and remains responsible for its pre-sale liabilities.

It is crucial to seek legal and expert tax advice when determining the most feasible structure for the business purchase and sale transaction. Once a preferred structure has been carefully determined, a purchase and sale agreement may then be drafted. Be sure to follow the correct Business Agreement Format.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF