In a perfect world, people would have an ideal system to supervise them. Governments all around the world try their best to create management plans for their respective countries. That is why they also come up with projects to help improve the quality of living for their citizens. To fund these projects, the government requires people to pay taxes. It’s safe to assume that every citizen in a given state is a taxpayer. But people’s taxes differ based on their careers. Those who have small businesses, work freelance, and sole proprietors pay something called a self-employment tax to the federal government.

Studying the Self Employment Tax

Anyone who earns an income has to pay taxes. The fact that you are employed is proof that you are capable of paying a small price to the government. If you are working for a company, your taxes are usually deductions from your payroll. If you work for yourself, you need to pay self-employment taxes. The purpose of this tax is to fund Medicare and Social Security. When you speak of self-employment tax, these two factors are the only thing they refer to. But this does not mean that the taxpayer gets an exemption from things like income tax and other requirements.

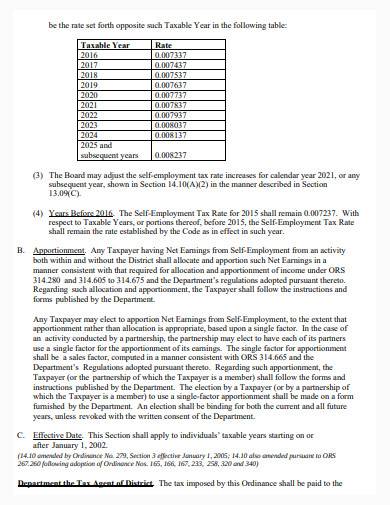

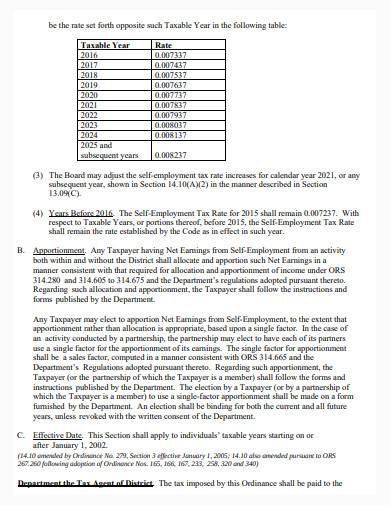

Self Employment Tax Rates

In a company, the employer and employee pay taxes for Medicare and Social Security. As a self-employed individual, you become both the company and the employee. Saying this, you need to pay taxes as both entities. The rate of the self-employment tax is 15.3%. This consists of two main parts: 12.4% for Social Security and 2.9% for Medicare. You must always pay 2.9% for Medicare taxes. The 12.4% Social Security taxes, on the other hand, are up for discussion. The combination of your wages, tips, and net earnings are subject to additional payroll taxes; you must see if Social Security taxes still need paying.

Requirements for Paying Self Employment Tax

To accomplish any task and process, you need to have all the right tools. You can’t win an essay writing contest without a pen that works. The same concept goes for any legal government processes; there are a few requirements you need to compile before you can start filing forms. To pay your self-employment tax, you will need more than just your self-employment tax forms. You need to get your hands on these items and documents.

Social Security Number

Social security is one thing that people rely on. Some will use their pension claims for their retirement plans. To make sure the service gets funding, you need to make your contributions. For the service to identify you as a contributor and taxpayer, you need to have a Social Security number. Social Security is one of the two factors of self-employment taxes, after all.

Individual Taxpayer Identification Number

Identification is essential for any organization. You need some sort of proof that you and the organization share an affiliation. That is why every government requires its taxpayers to get an individual taxpayer identification number. This way, their internal revenue office can track each taxpayer and find out who isn’t paying their taxes.

Estimated Taxes

Since you won’t have the assistance of a company, you may have to file your estimated tax on your own. You can use your estimated tax to pay for your self-employment tax. You can define the estimated tax as a pre-payment of taxes. Your income serves as the only basis for estimated tax and not other factors.

10+ Self-Employment Tax Samples in PDF | DOC

Unless you are earning a low annual income, you would have to worry about taxes being part of your expenses. Paying taxes isn’t cheap, but it is necessary. Your taxes depend on your income statement. If you are a freelancer or small business owner, you need to file self-employment tax forms. But before you can submit them, you need to understand what the tax is. To give you more insight on what self-employment tax is, here are 10+ self-employment tax samples you can check out.

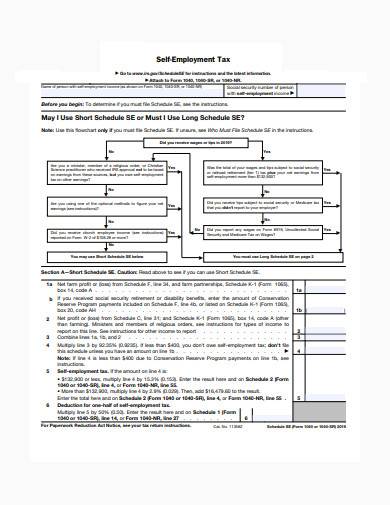

1. Self-Employment Tax Sample

2. Self-employment tax in U.S Template

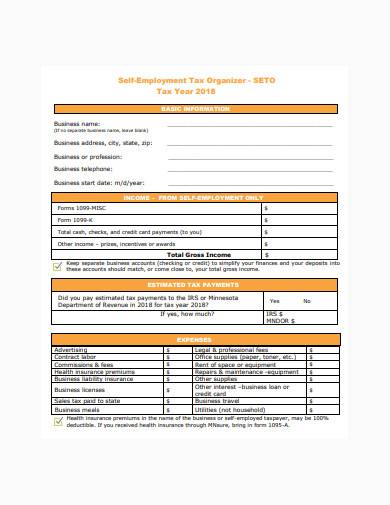

3. Self-Employment Tax Organiser Template

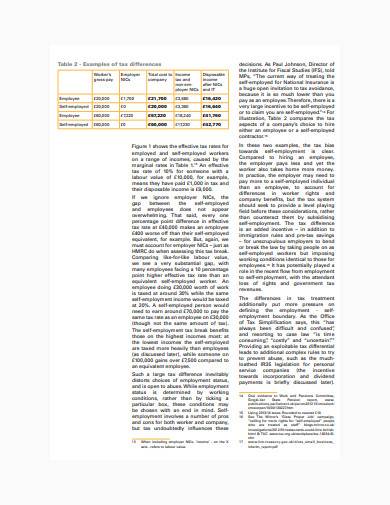

4. The Self-Employment Tax Break Sample

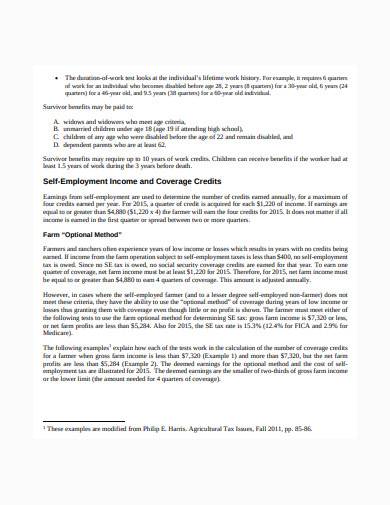

5. Self-Employment Tax Example

6. Self-Employment Tax Template

7. Self-Employment Tax in PDF

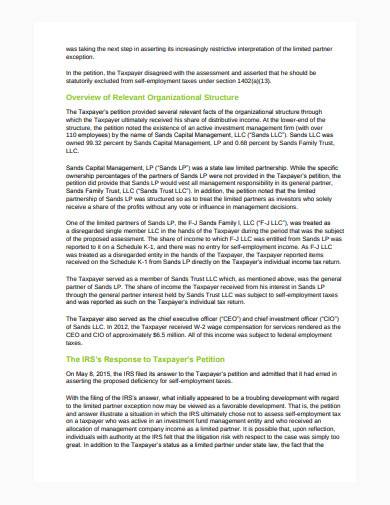

8. Trusts and Self-Employment Tax Sample

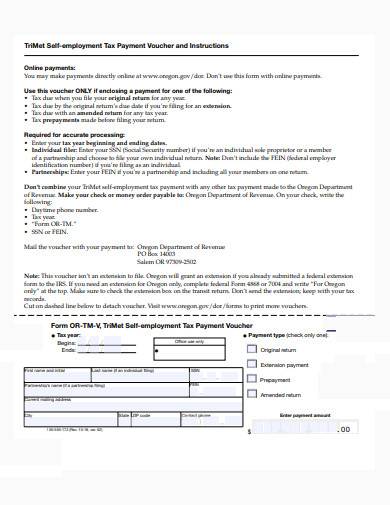

9. Self-employment Tax Payment Voucher Template

10. Formal Self-employment Tax Sample

11. Self-employment Tax in DOC

Paying Your Self Employment Tax

As a self-employed individual, filing and paying your self-employment tax is quite a bother. It adds more work to your already hectic workload. The pleasure of being your own boss gets matched with the hassle of doing everything on your own. That is why you need to understand some tips to make your life easier. Here are some tricks you should familiarize yourself with when paying your self-employment tax.

1. Prepare the Paperwork

Having the right documentation is very important. Instead of acquiring the paperwork when you need them, you should have them ready for anytime you need them. This means you should have a record of the profits you’ve made in the previous years and copies of official forms you might need to submit.

2. Get a Tax Provider Software

Having to record and calculate everything is tough. That is why it would be best if you get yourself a software that does all the work for you. All you need is to type the data in the work sheet, and you are good to go. The only thing you are left to deal with is paying and submitting.

3. Know Your Deductibles

Taxes can be expensive if you think about it. That is why tax deductions and tax returns are a blessing. If you don’t want to spend most of your income on taxes, you need to know your deductibles. This way, your taxes can be so much less of an expense than it already is.

4. Set Up Estimated Quarterly Payments

All taxpayers should schedule their payments regularly. But when you don’t have someone who helps you with your taxes, you need to be mindful of the payment schedule yourself. You need to set up estimated quarterly payments. Setting up reminders will help you avoid missing any payment dates.

5. Ask for Help

Obviously, these tips aren’t helpful if you don’t know the whole payment process. To give an in-depth idea of how the entire thing works, ask for the help of your country’s internal revenue office. They can offer services that will help you with your tax payments.

Taxes are a way for citizens to help the government make the country better. If you are a freelancer, you might need to pay your self-employment tax. It may seem taxing, but if you get it right, you can avoid any trouble.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]