Real estate investors and developers most commonly use real estate option contracts. The flexibilities and advantages they provide make them an excellent buying opportunity while limiting seller benefits. Buyers, assignors, and assignees are usually the receiving parties of option contracts in real estate and sign them alongside the seller.

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions. In addition to flexibility, the purpose of option contracts in real estate includes: attracts high net worth buyers to high-end real estate transactions, lowers the costs of the initial investment, and depreciates the real estate without actual ownership.

6+ Option to Buy Agreement Samples

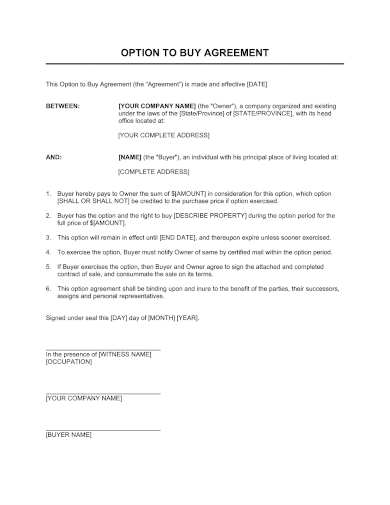

1. Option to Buy Agreement Template

2. Option to Buy Agreement

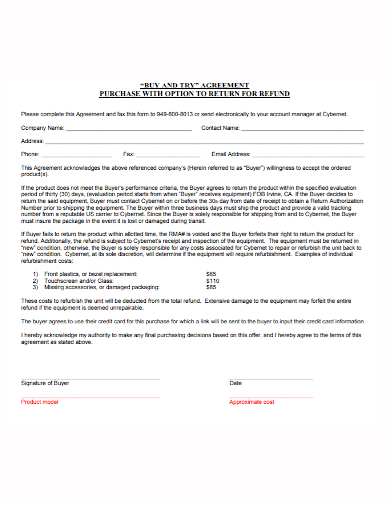

3. Option to Return Buy Agreement

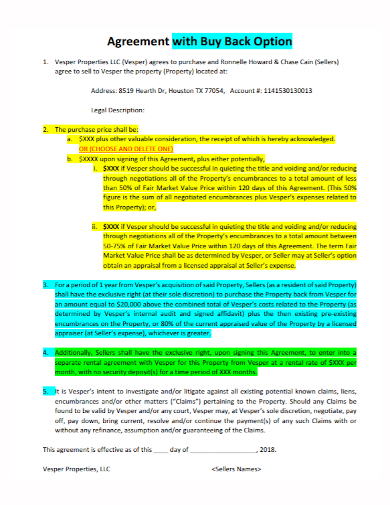

4. Option to Buy Back Agreement

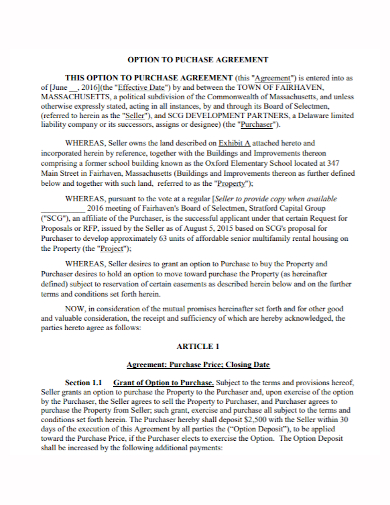

5. Option to Purchase Agreement

6. Option Agreement to Purchase

7. Option Agreement to Purchase Real Property

What Does Option to Buy Means?

An option to buy contract is an agreement between two parties where an investor or tenant pays a fee in exchange for the rights to purchase property at some point in the future. You can have a straight option to buy a contract, which is a unilateral contract that only binds the seller to its terms. Under this type of contract, a landowner or homeowner will keep open the offer for sale in return for a certain fee paid by the buyer, also referred to as the optionee.

What to Include in an Option to Purchase

An option to purchase can appear as a series of clauses in a lease or rental agreement or as a separate document. No matter the format, an option to purchase must: 1) state the option fee, 2) set the duration of the option period, 3) outline the price for which the tenant will purchase the property in the future, and 4) comply with local and state laws.

The Option Fee

In order to be contractually enforceable, the option to purchase must be given in exchange for consideration, or value. While the value of an option contract cannot be nominal, there is no special floor or ceiling; it’s a matter of negotiation between landlord and tenant. Depending on factors such as the price of the home, the option fee can range from several hundreds to several thousands of dollars.

Option fees are typically nonrefundable. In other words, if the tenant decides not to exercise his or her option to purchase the house within the agreed-upon time frame, the tenant forfeits the option money. The option fee is also usually forfeited if the tenant defaults on the lease by failing to make timely and exact rent payments or by breaking a term of the lease (such as housing pets when pets are prohibited). Upon the purchase of the home, the landlord deducts the option fee from the principle of the house and the sale price is therefore deducted by the option fee.

The Duration of the Option Period

An option-to-purchase contract must conspicuously state the duration of the option period. There is no correct or preferred unit of time and option periods can range from months to years. Typically, however, in the residential context, option periods range from one-to-five years.

Depending on the terms of the contract, the tenant may exercise the option to buy the house at any time during the set option period or at a date specified in the option-to-purchase agreement. If the tenant lets the period pass, the option expires and becomes null and void. In that situation, the tenant forfeits the option fee.

Purchase Price of the House

An option to purchase must address the price for which the tenant will buy the rental property in the future. Sometimes, the purchase price is a set price that is determined based on the current appraisal value of the house. This approach does not always make sense, however—the longer the option period, the higher the likelihood of fluctuating home values. So, when longer option periods are contracted for, landlords and tenants usually agree to re-evaluate the purchase price of the home periodically. Alternatively, the landlord and tenant may agree to determine the actual value of the house by appraising the house at the time the option is exercised. Ultimately, as long as both parties are in agreement as to how the value of the house is to be determined, the option contract is enforceable.

Adherence to State and Local Laws

Some state laws specifically protect tenants from entering contracts they do not understand—for example, by requiring option contracts to contain conspicuous wording in specified font size, to inform tenants of the possibility of forfeiting the option fee. To be valid and enforceable, an option to purchase must comply with the nuances of state (and any local) laws that govern the transaction. Check with your state department of real estate to find any applicable laws that may apply to your option to purchase contract.

FAQs

What are the six key elements of an option to buy contract?

- Optionee: Optionee is the party buying a real estate option.

- Optionor: Optionor is the party selling a real estate option.

- Real estate option: When an optionee buys a real estate option, he or she buys an exclusive, unrestricted, and irrevocable right and option to purchase a property at a fixed purchase price within a specified option period.

- Option consideration: the amount of money paid by an optionee to buy a real estate option from an optionor. Please be aware that money needs to exchange hands in order of the option contract to be legally binding.

- Option period: the specific period of time stated in the real estate option agreement in which the option is in effect.

- Exercise of option: The exercising of a real estate option occurs when the optionee notifies the optionor, in writing, that he or she is going to exercise the real estate option and purchase the property under option

What are the types of options?

There are two types of options: call and put. A call gives the buyer the right, to buy the underlying asset at the specified strike price. A put gives the buyer the right, to sell an asset at a specified strike price as in the contract.

The bottom line is that real estate options contracts offer an alternative form of investment, trade, and profit over traditional opportunities. An exchange market for options doesn’t exist, but their provisions may increase the future likelihood of that happening. The most vital aspect of writing an options contract in real estate is that they are enforceable and valid. To help you get started making the contract, download our free sample templates above to use as your guide!

Related Posts

Sample Business Agreement between Two Parties

FREE 10+ Trial Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF