When an individual or a company operates with limited liability, assets associated with the associated individuals cannot be seized to repay debt obligations owed to the company. Funds invested directly in the company, such as through the purchase of company stock, are considered assets of the company and can be seized if it goes bankrupt.

10+ Limited Liability Agreement Samples

Limited liability refers to a situation in which a business firm’s owners’ (shareholders’) losses are limited to the amount of capital they invested in the company and do not extend to their assets. Acceptance of this principle by businesses and governments was critical to the growth of the large-scale industry because it allowed businesses to raise large sums of money from a wide range of investors who were understandably hesitant to risk their entire fortunes in their investments.

1. Limited Liability Agreement Template

2. Limited Liability Company Agreement

3. Limited Liability Operating Agreement

4. Limited Liability Partnership Agreement

5. Sample Limited Liability Agreement

6. Standard Limited Liability Agreement

7. Limited Liability Property Agreement

8. Agreement for Limited Liability

9. Professional Limited Liability Agreement

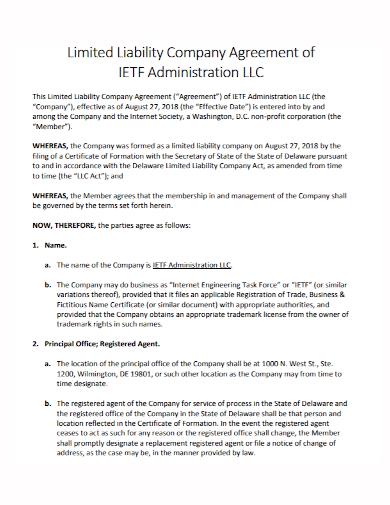

10. Administration Limited Liability Agreement

11. Authority Limited Liability Agreement

Limited Liability Partnerships

The specifics of a limited liability partnership are determined by the jurisdiction in which it is formed. In general, however, as a partner, your assets will be safe from legal action. In essence, your liability is limited in the sense that you will lose assets within the partnership but not assets outside of it (your assets). Any lawsuit will first go after the partnership, though a specific partner may be held liable if they did something wrong.

Overall, an LLP’s flexibility for a specific type of professional makes it a better choice than many other corporate entities. For tax purposes, the LLP is a flow-through entity, which is also an option for LLCs. The partners in flow-through entities receive untaxed profits and must pay their taxes.

Corporations, which are subject to double taxation, are usually preferred over LLCs and LLPs. When a corporation must pay corporate income taxes and then individuals must pay taxes on the company’s income, this is known as double taxation.

Limited Liability in Incorporated Businesses

Because an incorporated company is treated as a separate and independent legal entity, becoming incorporated can provide limited liability to its owners in the context of a private company. Limited liability is especially desirable in industries where massive losses are possible, such as insurance.

In the United States, a limited liability company (LLC) is a business structure in which the owners are not personally liable for the company’s debts or liabilities. Limited liability companies (LLCs) are hybrid businesses that combine the advantages of a corporation with those of a partnership or a sole proprietorship.

While the limited liability feature of an LLC is similar to that of a corporation, flow-through taxation for LLC members is a feature of partnerships. The primary distinction between a partnership and an LLC is that an LLC separates the company’s business assets from the owners’ assets, shielding the owners from the LLC’s debts and liabilities.

FAQs

What is the alternative to limited liability?

Unlimited liability is an alternative to limited liability. All sole traders, as well as some types of business partnerships, have unlimited liability. There is no legal distinction between the business and the owner in a sole-trader business structure. While sole traders can keep all profits after taxes, they are also responsible for any losses incurred by their business and may be forced to repay debts out of pocket.

What is the difference between limited and unlimited liability?

The term “limited liability” refers to a situation in which the amount of money owed in repayments is limited for those responsible for repaying a debt. The term “unlimited liability” refers to a situation in which those who are responsible for repaying a debt have an unlimited obligation to do so. This means that if a business owner’s company runs out of money to pay its debts, he is personally liable for the company’s debts.

Liabilities are the debts that businesses incur in the course of their operations. Borrowing money for new operations or expansions, purchasing supplies and raw materials on credit, or taking out mortgages on property or equipment are all common ways for businesses to accumulate debts in the normal course of business.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF