Investor agreements can be tailored to the specific needs and circumstances of the parties involved, and may include provisions related to confidentiality, non-compete agreement, and alternative dispute resolution mechanisms. They are often used in the context of private equity investment proposal and venture capital investment proposal, but can be used in any situation where one party is making a substantial investment in another.

10+ Investor Agreement Samples

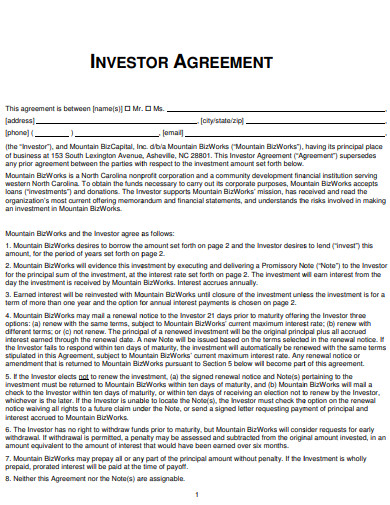

1. Investor Agreement

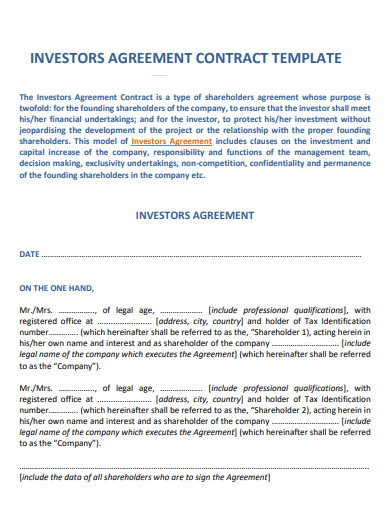

2. Investor Agreement Contract

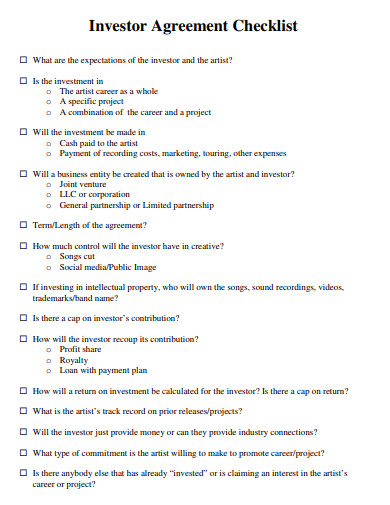

3. Investor Agreement Checklist

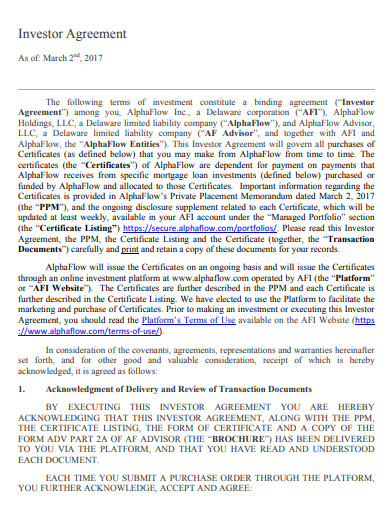

4. Sample Investor Agreement

5. EquityDoor Investor Agreement

6. Investor Member Application and Agreement

7. Investor Rehab Agreement

8. Investor Portfolio Agreement

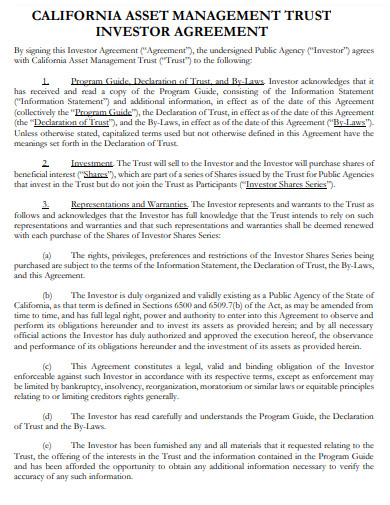

9. Asset Management Investor Agreement

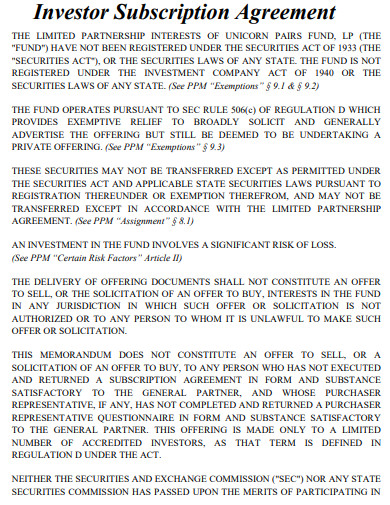

10. Investor Subscription Agreement

11. Investor Agreement Example

What is Investor Agreement?

An investor agreement is a legally binding document that outlines the rights and obligations in investor contract and the company or startup they are investing in. It typically covers a wide range of topics, including the amount of money being invested, the percentage of ownership the investors will have, the expected return on investment, and the responsibilities of each party. The agreement also specifies the circumstances under which investors can exit the investment, and the terms and conditions of such an exit.

How To Make Investor Agreement?

One of the most critical components of an investor agreement is the ownership structure of the company. The agreement specifies the percentage of ownership that each investor will have in the company. This is important because it determines the voting rights of the investors, and the degree of control they will have over the company’s decisions. For instance, if an investor holds a significant percentage of ownership, they may have a greater say in the company’s strategic management plan and decision-making process. Making an investor agreement involves several steps to ensure that it is legally binding, covers all necessary terms and conditions, and meets the specific needs and requirements of the parties involved. Here are some general steps to follow:

Step 1- Identify Parties Involved

Determine who the investors are and who will represent the company or startup. This will include identifying the legal names and addresses of the parties involved. This includes specifying the amount of money being invested, the percentage of ownership the investors will have, the expected return on investment, the distribution of profit and loss budget, and the responsibilities of each party.

Step 2- Include Clause

This helps to safeguard the investments of the investors and ensure that they receive the returns they are entitled to. Define the circumstances under which investors can exit the investment, and the terms and conditions of such an exit.

Step 3- Consult Legal Professionals

It is important to consult with lawyers or legal professionals to ensure that the investor agreement is legally binding and enforceable. Using the information gathered from the above steps, draft the investor agreement. Make sure that the language used is clear and concise.

Step 4- Review Agreement

Review the agreement with all parties involved and revise it as necessary to ensure that it meets the needs of all parties involved. Once all parties are satisfied with the agreement, sign and execute it. Make sure that all parties have copies of the signed contracting agreement.

Who needs an investor agreement?

An investor agreement is typically used in the context of private equity and venture capital investments, but can be used in any situation where one party is making a substantial investment in another. Both investors and the company or startup they are investing in may need an investor agreement.

What should be included in an investor agreement?

An investor agreement should include the amount of money being invested, the percentage of ownership the investors will have, the expected return on investment, the distribution of profits and losses, and the responsibilities of each party. It may also include clauses related to confidentiality, non-compete agreements, and dispute resolution mechanisms.

Can an investor agreement be modified after it is signed?

Yes, an investor agreement can be modified after it is signed if all parties involved agree to the changes. Any modifications should be made in writing and signed by all parties.

In conclusion, an investor agreement is a critical tool for successful investments. It provides a framework for investors and companies to work together, and it specifies the terms and conditions under which the investment will be made. By clearly outlining the rights and obligations of each party, an investor agreement helps to minimize risk assessment and protect the interests of the investors. As such, it is an essential component of any investment arrangement.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF