A receipt is a piece of document that is issued after payment for purchased goods or services is made. It contains an itemized list of the purchased goods, including the quantity, price, taxes and fees, and the total payment amount. A receipt is mainly used to serve as proof of purchase, where the seller acknowledges that they received payment for the ordered goods. Aside from shops or stores, charitable organizations also issue receipts after receiving donations from sponsors or donors. This receipt bearing the organization’s name is called a charity donation receipt.

FREE 10+ Charity Donation Receipt Samples & Templates in PDF

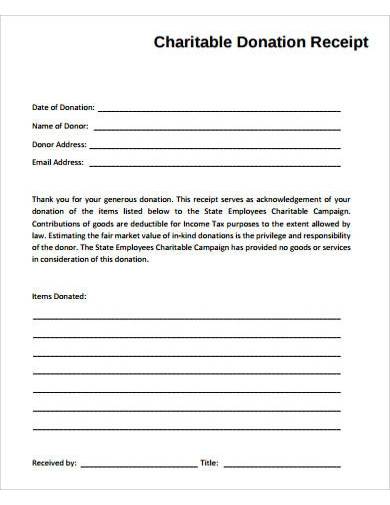

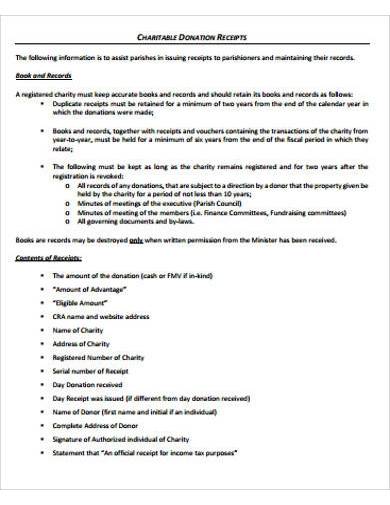

1. Charitable Donation Receipt Template

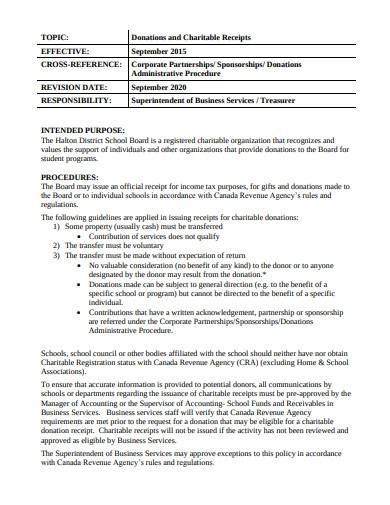

2. Charity School Donation Receipt

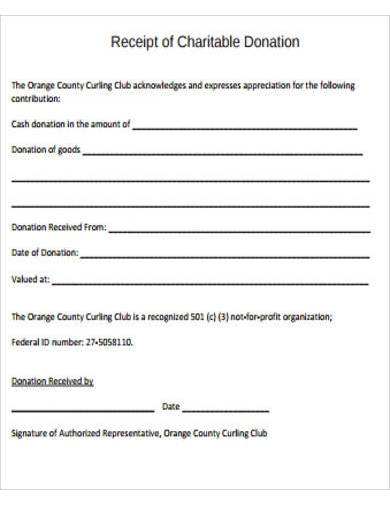

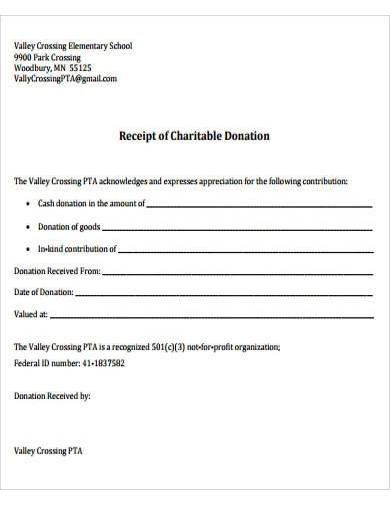

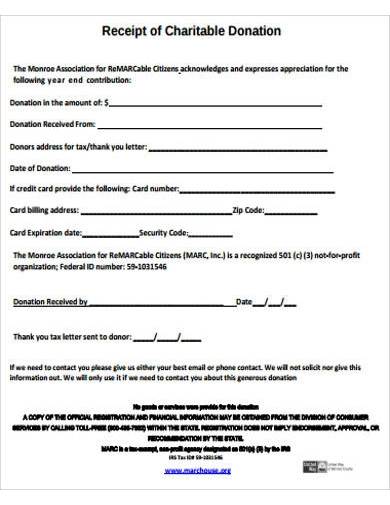

3. Receipt of Charitable Donation

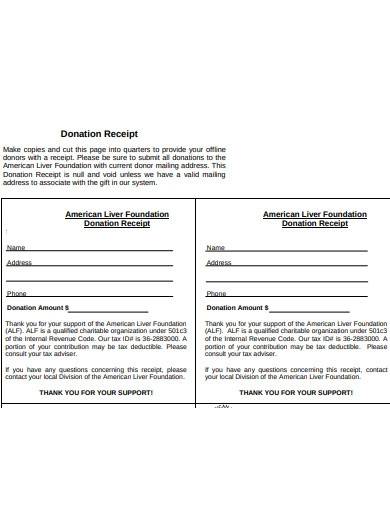

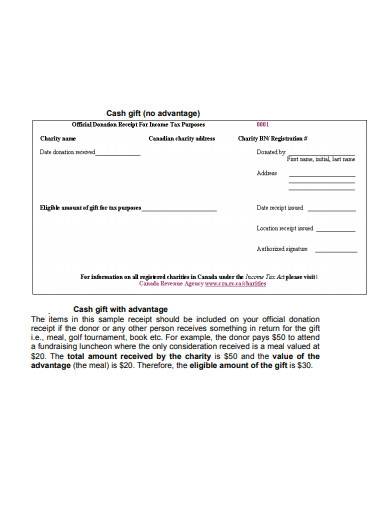

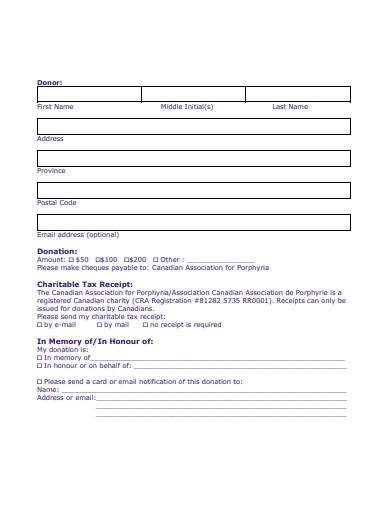

4. Sample Charity Donation Tax Receipt

5. Donation Receipt Template

6. Format of Charitable Donation Receipt

7. Standard Charity Donation Receipt

8. Official Charitable Donation Receipt

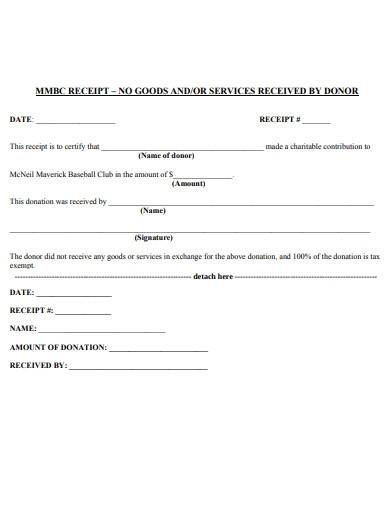

9. Charity Club Donation Receipt

10. Charitable Donation Receipt Sample

11. Charity Donation Receipt Form

What Is a Charity Donation Receipt?

A charity donation receipt is only used by charitable organizations or nonprofit organizations to document or record donations that they receive from donors. Just like a sales receipt, the issuance of a charity donation receipt is an acknowledgment that the organization has received donations from a sponsor or donor. Of course, it is issued only after a donation is made. Although it has a similar purpose with that of sales receipts, it’s appearance and layout varies. The exact amount that a donor donated is specified in the receipt and is written both in words and in figures, similar to how you would write a cheque amount.

Charity donation receipts have other uses aside from a proof of donation. Two copies of the receipt are written each time a donation is made. One copy goes to the donor and the other copy is for the organizations records. Records of the receipt help organizations keep track of their donations and allow them to identify the entities that made the donations. Donations made to charity are tax-deductibles and once the organization reports it to the IRS, the donors will benefit from it.

How to Make a Charity Donation Receipt

Preparing a charity donation receipt is easy. It can be made by hand or with the use of a computer device. Whatever method you use, make sure that the details are acceptable and complete. There’s no need to make a flashy receipt. A simple donation receipt for charity will do. Here are some steps that can help you get started.

1. Follow IRS Guidelines

The IRS or the Internal Revenue Service provide specific guidelines on what a charitable or nonprofit organization must inlcude in the donation receipt so that tax-deductibles can be honored. The guidelines are available on their website, or you can consult a tax attorney to ensure that the details you include are part of the requirements.

2. Choose a Form

The IRS does not require a specific form for charity donation receipts. The organization is free to create a receipt according to their style and preferences, provided that follows the IRS guidelines. You can use different receipt templates that are offered online for free. Choose an editable template so that you can change the details and other contents for your organizationn’s use.

3. Leave Blanks for the Details

Leave blanks or enough space to write the required details. The blanks will serve as guide as to where the donor should write them. It also keep the written details from overlapping giving your receipt a neat appearance. Aside from the required information from the donor, also put in your organization’s name, and the fundraising event or the reason for gathering donations.

4. Add Donation Information

The donation amount, donors name, date and payment type are important donation information that you must include in a charity donation receipt. Not all donations are in cash, some will be in-kind so you need to add specific details of the donated items on the receipt. The amount of the donated items should not be specified unless the donor writes it in the receipt.

5. Add a Disclosure Statement

Check with your state if adding a disclosure is necessary for nonprofit organization receipts. The contents of the disclosure also depend on the state’s preference. You can check out legal websites for a list of requirements for making disclosures according to your state’s laws.

6. Attach a Thank You Letter

Aside from personally thanking the donor during a fundraising event for their donation, attach a thank you letter or thank you note to the receipt. Put it in a simple or cute envelope. Your donor would be happy to receive something thoughtful in return for their donation, even if it is just a small thing.

FAQ’s

What is a donation ID?

Every receipt must have a receipt number or a serial number, which is a combination of numbers and letters. In a donation receipt, it is called a donation ID. Its function is similar to that of a sales receipt, which is to keep an organized record. The Donation ID also makes it easy to find records of the receipt that are kept on file.

What are the advantages of donation receipts for donors and the organization?

One advantage for donors has been mentioned above, which is for deductions on tax returns once reported by the nonprofit organization to the IRS. Another advantage for the donor is that the receipt informs them that their donation has been received, especially if they donated online. For nonprofit organizations, issuing charity donation receipts is an IRS legal requirement. It is also a means to track their donation history and accounting records effectively.

We’re here to help you make a simple and reliable charity donation receipt. That is why we have gathered 11 of the best donation receipt samples and templates. You can download the template of your choice for free! Check them out now!

Related Posts

FREE 10+ Charity Fundraising Letter Samples & Templates in MS ...

FREE 9+ Donation Request Letter Templates in MS Word PDF

FREE 10+ Sample Donation Sheet Templates in Google Docs ...

FREE 10+ Charity Data Protection Policy Samples & Templates in ...

FREE 6+ Sample Donation Request Letter Templates in MS Word ...

FREE 9+ Donation Letter Samples in PDF MS Word

Sample Gift Letters

Sample Pledge Form

FREE 10+ Personal Tax Deduction Samples in PDF MS Word

FREE 9+ Sample Thank You Letter for Donation in MS Word PDF

FREE 9+ Sample Donation Letter Templates in MS Word PDF

FREE 16+ Sample Receipt Forms in MS Word

Silent Auction Bid Sheet Template

FREE 4+ Charity Request Letter Samples & Templates in MS Word ...

FREE 10+ Charity Membership Form Samples & Templates in MS ...