The federal government may lend money to individuals, companies, states, and other institutions. That’s a debt you owe. The debt gets overdue if they do not pay it on time. When a debt is past due, the Treasury Offset Program (TOP) assists in debt collection by deducting funds from a federal payment to the debtor. Before transferring the debt to TOP, the agency must send letters to the debtor at the name and address on file for the debt. The letter must inform the debtor of the debt (kind and amount), the agency’s intention to send the debt for offset, and the debtor’s options for resolving the debt.

10+ Debt Offset Agreement Samples

A Notice of Intent to Offset is a letter that informs you of what is about to occur. It indicates that you owe the IRS back taxes or a large sum of money to another government entity. It also indicates that the IRS intends to seize your tax refund. Check the letter to see if your full tax refund or government payments are in jeopardy. The government will usually just take a fraction of your return or payments, but the amount they seek to take will be determined by a number of criteria. Depending on the circumstances, the agency may be able to take your entire tax refund. In other circumstances, you’ll still get a piece of the pie. Make sure the information is correct by double-checking it.

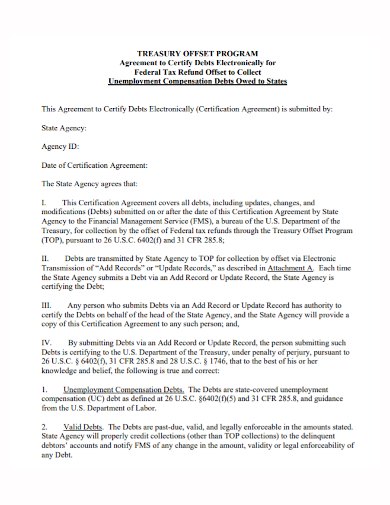

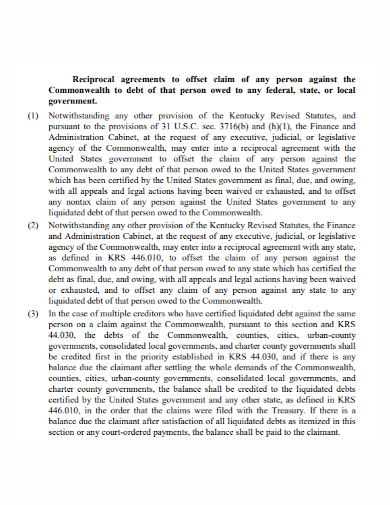

1. Debt Offset Program Agreement

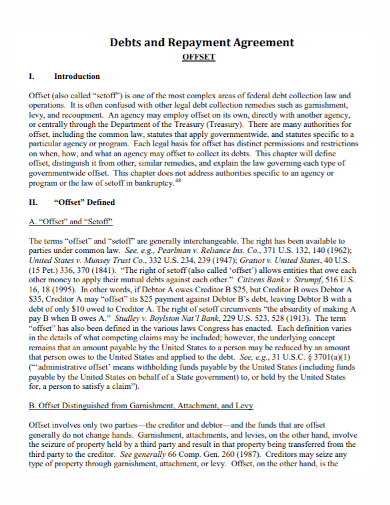

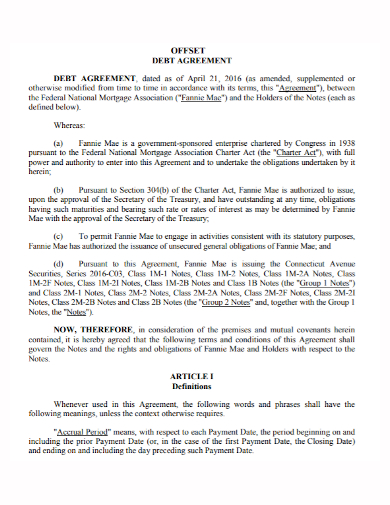

2. Debt Repayment Offset Agreement

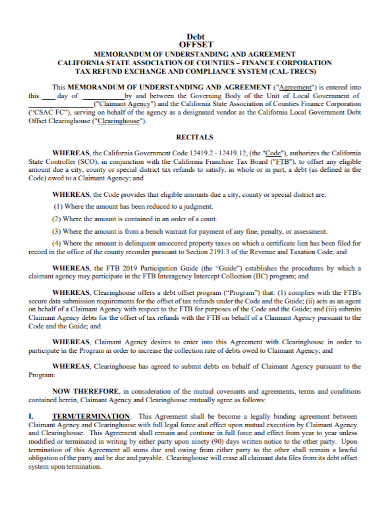

3. Debt Offset Understanding Agreement

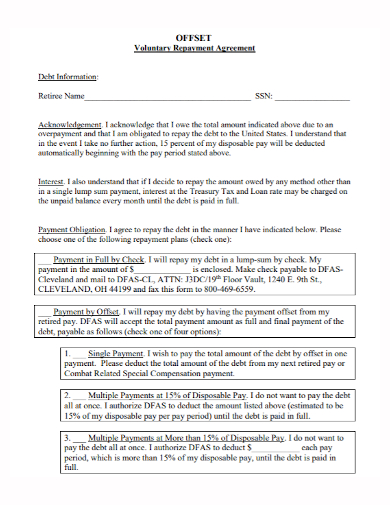

4. Voluntary Debt Offset Agreement

5. Debt Claim Offset Agreement

6. Debt Offset Agreement

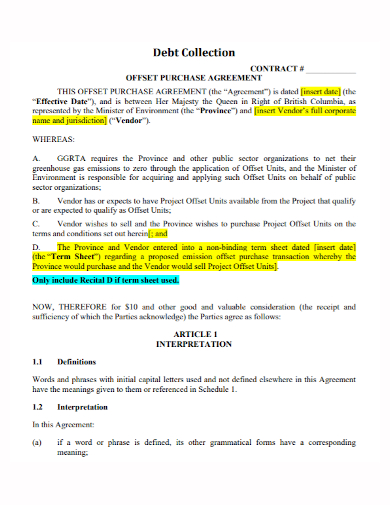

7. Debt Offset Purchase Agreement

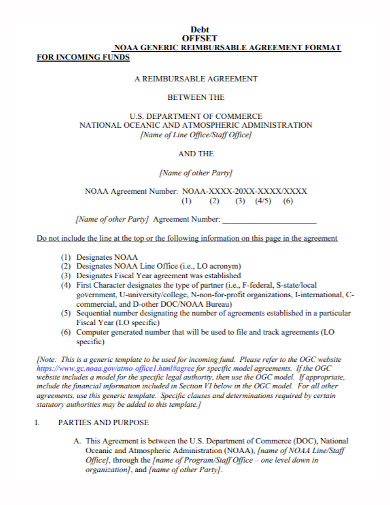

8. Debt Offset Reimbursable Agreement

9. Debt Collection Offset Agreement

10. Clinical Research Debt Offset Agreement

11. Annual Debt Offset Agreement

How Treasury Offset Program Works?

- Sending information about overdue debts to TOP – When a debt is 120 days beyond due, the law requires agencies to send it to TOP. The collection agent must ensure that the debt is legitimate and legally enforceable. The debtor’s taxpayer identification number is included in the information concerning the past-due debt (TIN). This is usually a Social Security Number for an individual (SSN). A Federal Employer Identification Number (FEIN) is typically assigned to a corporation, nonprofit organization, or state agency (FEIN).

- Matching payments and overdue debts – When a government agency is ready to pay someone, a corporation, a state, or another organization, they fill out a payment voucher, which includes the payee’s name and TIN. Payment agencies are the name for these organizations. Most payments are made on behalf of most agencies by the Bureau of the Fiscal Service (of which TOP is a part). Other agencies (such as the United States Postal Service) are in charge of their own payments. The persons who send payments are known as “disbursing officials,” and they utilize the TOP database to compare payees and debtors before issuing a payment. If these two criteria are met, a payment is decreased (offset) to settle an overdue debt: The payee’s name and TIN complement the debtor’s details in the TOP database, and the payment is an offsetable type.

- Sending payments and letter to the payee – If no match is found, the payee receives the entire payment. If there is a match, the offset decreases the payment in whole or in part, to the extent authorized by law, to repay the debt. If money stays in the payment after it has been offset, the payee receives the reduced payment. If the payment is offset, we will send a note stating why the payment is less than expected or that the full payment was used to pay down their past-due debt.

- Giving the debt money to the right agency – TOP transfers the offset amount to the debt collection agency.

FAQs

When does a debtor leave the TOP database?

A debtor remains in the TOP database until the collection agency that sent the debt to TOP instructs TOP to stop collecting it. If the debt has been paid in whole, if the debt is under a bankruptcy stay, or if other factors justify delaying or stopping collection, the agency may notify TOP to cease.

Who administers the Treasury Offset Program?

The Treasury Offset Program (TOP) is managed by the Financial Management Service of the US Department of Treasury (FMS). It enables federal and state governments to recover outstanding debts owing to them by garnishing or balancing your tax refund against your debt.

If you want to see more samples and formats, check out some debt offset agreement samples and templates provided in the article for your reference.

Related Posts

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Car Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Horse Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Option Agreement Samples In MS Word | Google Docs | Apple Pages | PDF