Accrual accounting is a process in which the performance and status of a business or company are measured by recognizing its economic activities regardless of whether a cash transaction occurs or not. Economic activities are recognized by complimenting revenue to expenses at the period in which a transaction has taken place instead of the time when a payment was made or received. Accrual basis accounting is a method that is most appropriate when evaluating the health or financial status of an organization.

10+ Accrual Basis Accounting Samples

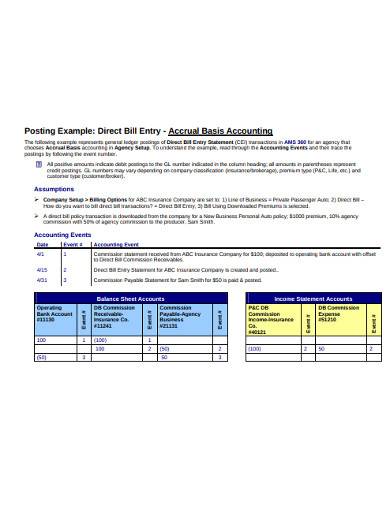

1. Accrual Basis of Accounting Sample

2. Budgeting on Cash Basis and Accounts on Accrual Basis

3. Accrual Basis of Accounting Letter Template

4. Transition to Accrual Basis of Accounting Sample

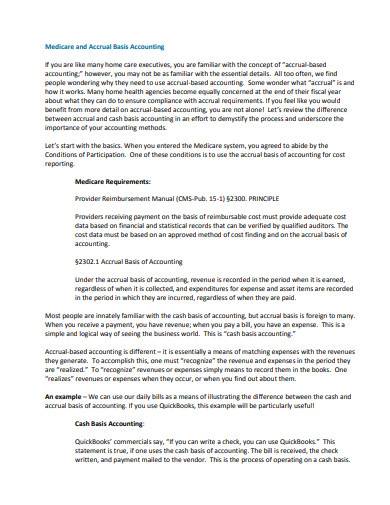

5. Medicare and Accrual Basis Accounting Template

6. Basic Accrual Basis of Accounting Template

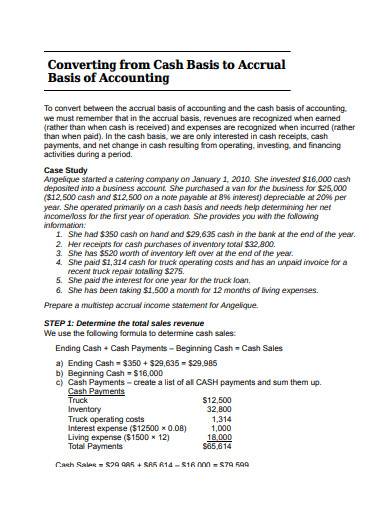

7. Converting from Cash Basis to Accrual Basic of Accounting

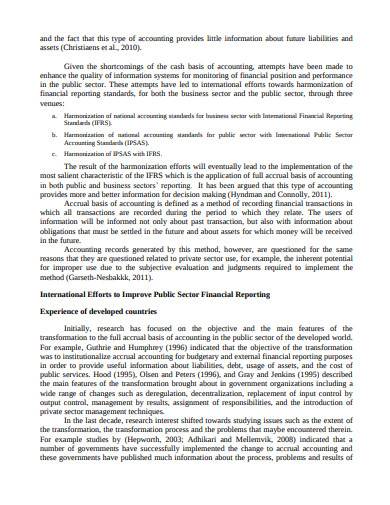

8. Accrual Basis of Accounting in Public Sector Sample

9. Accrual Basis of Accounting Example in PDF

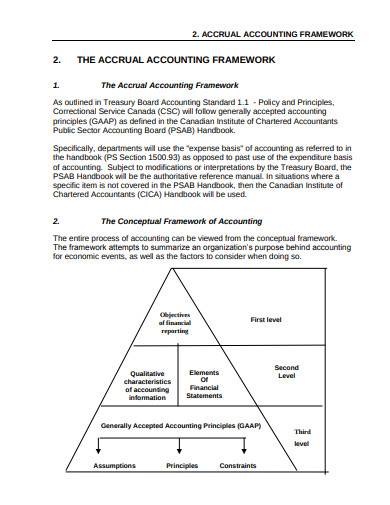

10. Accrual Basis of Accounting Framework

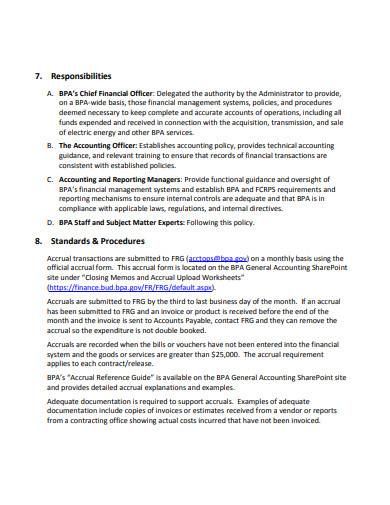

11. Accrual Basis of Accounting in PDF

What is an Accrual Basis Accounting?

Accrual basis accounting is an accounting process that is commonly used by businesses that have a lot of credit transactions or sales of goods and services through credit payment. When a product or service is sold on credit, it is recorded in books based on the generated sales invoice. This process can also affect the business’s balance sheet which contains its receivables and payables even without cash receipts or cash payment receipts.

How to Perform Accrual Basis Accounting

Accrual accounting is considered the standard practice for accounting which is observed by most companies across various industries. In this method of accounting, company revenue will be reported in their income statement once the cash payment has been received. This process is utilized by businesses that want to track their revenue or expenses that have not yet been accounted for. Some examples of accrual accounts include accounts payable, accounts receivable, accrued interest earned or payable, and accrued liabilities.

Step 1: Provide the Total Amount Earned

In your company’s financial statements, start by providing the total amount that the customer owes you. Make a debit on your asset account for the accrued revenue and reverse it with the revenue that the company received by crediting accrued revenue.

Step 2: Make Sure to Monitor Every Payment You Receive

Track and monitor every payment that your company receives from customers and document it in your revenue account as an adjusting entry. Make sure to include the date of the payment, the amount, and the transaction that the amount goes toward.

Step 3: Identify the Rest of the Payment’s Amount

It is also important to make sure that you track the amount of payment that your customer still has to make payment for. Keep them informed and updated on their upcoming payments to help them pay the correct amount.

Step 4: Make Necessary Adjustments

Once you received the payment, make necessary adjustments to your income statement to reflect the correct amount. You can regularly check the income statement to make sure that the records match and the payments are updated.

FAQs

When do companies use accrued revenue?

Companies use accrued revenue for transactions during contract negotiations with a customer, objective-based in which companies provide supply materials or services for a client’s company project, and loans provided by the company to other businesses where they also receive interest income.

What are the categories in accrual accounting?

Accrual accounting has two categories which are the accrued revenues or assets which refers to an income or asset that has yet to be received but a transaction has effectively been made and the accrued expenses which include interest expense accruals, supplier accruals, and wage or salary accruals.

What are the various benefits of accrual basis accounting?

With accrual basis accounting, businesses and companies are provided with a more accurate overview of their current condition and financial health. They can also receive immediate feedback about their expected cash inflows and outflows which makes it easier for businesses to effectively manage their existing resources and management plans for the future.

Accrual basis accounting refers to a financial accounting method that enables companies to document their revenues before they receive the payment for their sold goods or services and document expenses once they are incurred. This method is one of the two commonly used accounting processes and preferred bookkeeping methods so companies can get an accurate financial image of their business operations. Other accounting documents that businesses can use include accounting checklists, accounting services proposals, accounting spreadsheets, and more.

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]