Having at least a basic understanding of how a business continuity works through computing the business profit and sales is essential in running any business, whether it’s a small cafe business or a retail and online store business, or many others. You’ll need to understand how finances are coming in and out of your accounts to achieve your business goals successfully. Hence, a small business balance sheet should be one of the financial statements you need to start learning and creating.

4+ Small Business Balance Sheet Samples

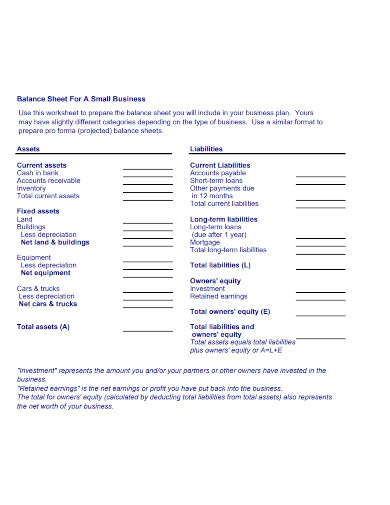

1. Balance Sheet For A Small Business

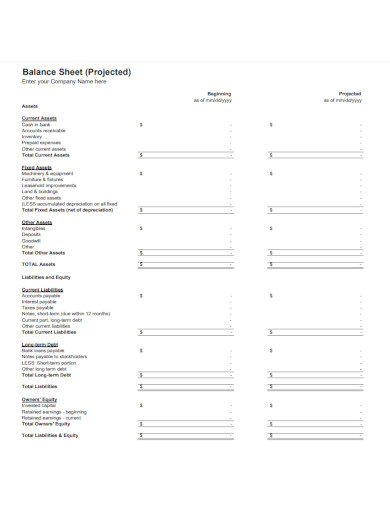

2. Project Business Balance Sheet

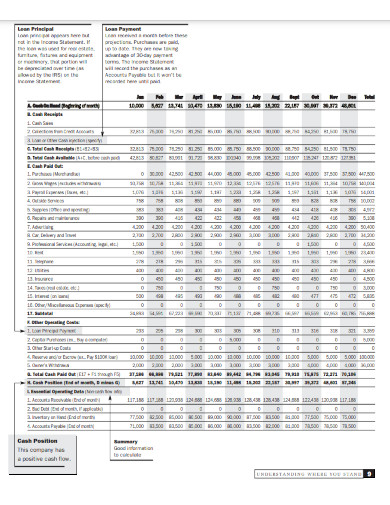

3. Small Business Development Balance Sheet

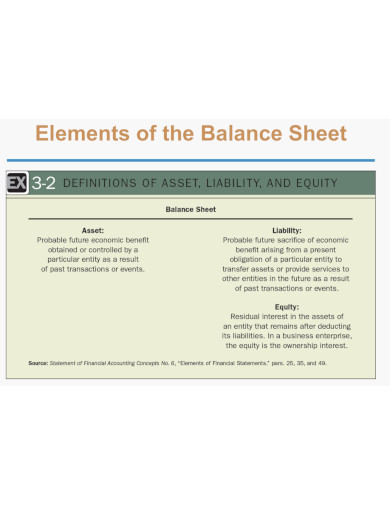

4. Components Business Balance Sheet

5. Balance Sheet Notes Financial Statement

What Is a Small Business Balance Sheet?

A small business balance sheet is a valuable document that showcases your business’s liabilities, assets, and owner’s equity. Reviewing it allows you to acquire a general idea of how to attain your business budget by computing the business inventory and business expenses. Additionally, it gives you a general idea of where your debts lie to gauge your cash flow. Typically, this is prepared at the end of the set periods, like every annual business budget and quarterly financial report.

How to Make a Small Business Balance Sheet

Typically, you ought not to be an accountant or great with a number in constructing a balance sheet for your small business. We understand how important a balance sheet is in depicting your total liabilities, assets, and net worth. So, if you have found yourself in the position of needing to prepare a balance sheet, we’ve got you covered with the right steps for your guidance. Here’s what you need to know:

1. Specify the Reporting Date and Period

A balance sheet depicts a company’s total assets, liabilities, and shareholders’ equity on a specific date, generally referred to as the reporting date. Often, the reporting date will be the final day of the reporting period. Most companies, primarily publicly traded ones, will report every quarter. When this is the case, the reporting date will most usually fall on the final day of the quarter. However, some companies that choose to report on an annual basis will often use December 31 as their reporting date, though they can pick any date. Additionally, it’s not unusual for a balance sheet to take a few weeks to prepare after completing the reporting period.

2. Determine Your Assets

After pinpointing your reporting date and period, you’ll need to calculate your assets. Usually, a balance sheet will list assets in two ways: Individual line items and total assets. Dividing assets into different line items will make it easier for analysts to precisely understand your assets and where they came from; tallying them together will be required for final analysis. Perhaps, assets will often be split into the following line items: current assets and non-current assets. These two needs to be both subtotaled and then totaled together.

3. Recognize Your Liabilities

Again, you will need to identify your liabilities. These should be organized into both line items, and totals as follows: Under the current liabilities are the accounts payable, accrued expenses, deferred revenue, and the current portion of long-term debt. While the non-current liabilities are deferred revenue, long-term lease obligations, and long-term debt. Additionally, these should be subtotaled and then totaled together as with assets.

4. Estimate Shareholders’ Equity

If a single proprietor privately holds a company or organization, shareholders’ equity will generally be straightforward. If it’s publicly held, this calculation may become more complicated depending on the various types of stock issued. Nevertheless, the standard line items found in this balance sheet section include common stock, preferred stock, treasury stock, and retained earnings.

FAQs

Does a business have to have a balance sheet?

Small balance sheets are not necessarily a prerequisite for running your business, but these statements can help them prioritize monetary obligations while showing the financial situation to potential lenders or investors.

What are the three primary things found on a balance sheet?

A balance sheet supplies a remarkable insight into its business dealings, and it usually contains three primary sections, assets, liabilities, and equity.

What are the other things not necessarily needed in a balance sheet?

A balance sheet is fine without the following such as intangible assets, retail value of inventory, depreciation, and many more.

To gain confidence in your business’s financial status, better headstart by creating a comprehensive small business balance sheet to keep you guided. With this, you can acquire the ability to meet customers’ needs and expenditures for business growth.