One key element of a startup equity agreement is the percentage of equity that the individual will receive. This can be expressed as a fixed amount or as a percentage of the company’s total equity. The agreement may also specify a vesting schedule, which outlines the timeline over which the equity will be earned. For example, an equity holder may be required to work for the company for a certain number of years before becoming fully vested in their equity. Another important aspect of a startup equity agreement is the rights and responsibilities of the equity holder. These may include decision-making power, the ability to participate in company meetings and vote on important matters, and any obligations to contribute to the company’s operations.

6+ Startup Equity Agreement Template Samples

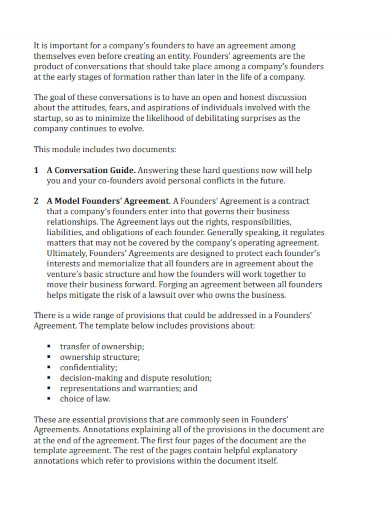

1. Startup Equity Founders’ Agreement

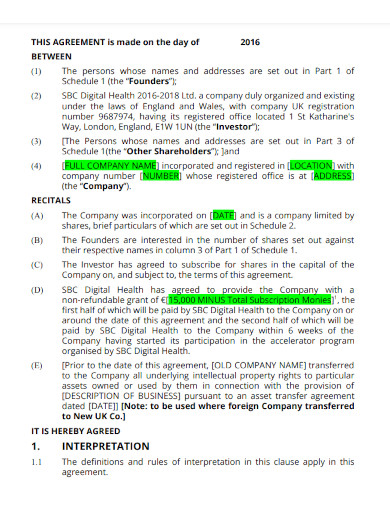

2. Startup Company Equity Agreement

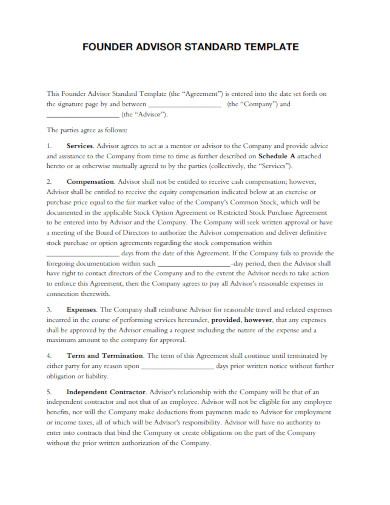

3. Startup Equity Founder Advisor Agreement

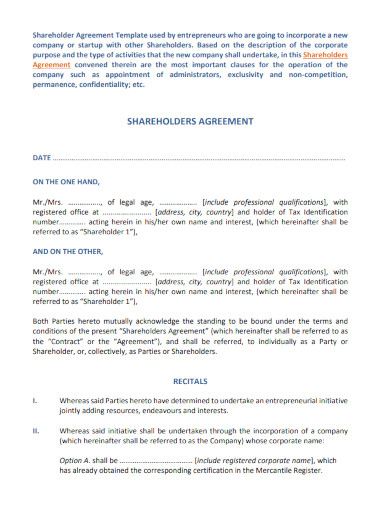

4. Startup Sahreholders Equity Agreement

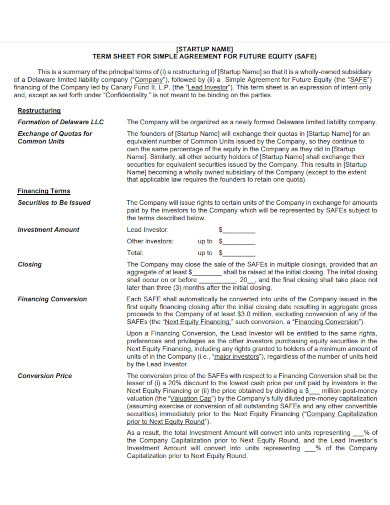

5. Termsheet Startup Equity Agreement

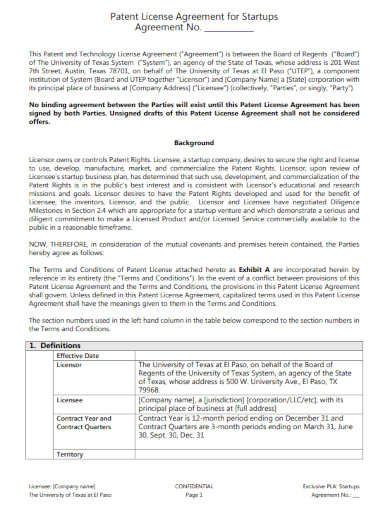

6. Patent License Agreement for Startups

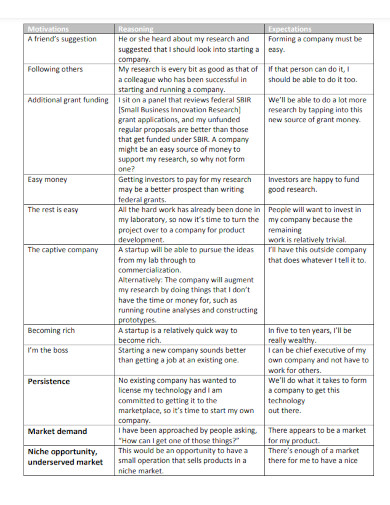

7. Fundamentals of Academic-Based Startup Agreement

What is Startup Equity Agreement?

A startup equity agreement is a legal document that outlines the terms and conditions under which an individual (the “equity holder”) will receive an ownership stake in a startup company. The agreement typically specifies the percentage of equity the individual will receive, as well as any vesting schedule that may apply. It may also outline the rights and responsibilities of the equity holder, including any decision-making power or obligations to contribute to the company’s operations. Startup equity agreements are used to align the interests of the equity holder with those of the company and its other stakeholders, and can be an important tool for attracting and retaining talented employees or advisors.

How To Make a Startup Equity Agreement?

The startup equity agreement may also outline any restrictions on the equity holder’s ability to sell or transfer their equity, as well as any conditions under which their equity may be forfeited or diluted. To make a startup equity agreement, follow these steps:

Step 1- Equity Percentage

Determine the percentage of equity that the individual will receive: This should be based on the value that the individual will bring to the company, as well as any negotiation between the parties. You can also identify any vesting schedule that will apply: This should outline the timeline over which the equity will be earned, and may include provisions for accelerated vesting in certain circumstances.

Step 2- Rights and Responsibilities

Outline the rights and obligations of the equity holder in the following areas: This may include the ability to make decisions, the capacity to participate in company meetings and vote on significant issues, and any responsibility to contribute to the functioning of the organization.

Step 3- Determine Restrictions

Specify any restrictions on the equity holder’s ability to sell or transfer their equity: This may include provisions for right of first refusal, repurchase rights, or other restrictions. Include any provisions for forfeiture or dilution of equity: For example, the agreement may specify that the equity will be forfeited if the individual leaves the company before becoming fully vested, or that the equity will be diluted if the company issues new shares.

Step 4- Review The Agreement

Have the agreement reviewed by an attorney: It is important to have a legal professional review the agreement to ensure that it is fair and complies with relevant laws and regulations. Additionally, you can have the agreement signed by both parties: Once the agreement has been reviewed and both parties are satisfied with the terms, it should be signed by both the equity holder and a representative of the company.

What should be included in a startup equity agreement?

A startup equity agreement should include the percentage of equity that the individual will receive, any vesting schedule that will apply, the rights and responsibilities of the equity holder, and any restrictions on the ability to sell or transfer equity.

Who should have a startup equity agreement?

Startup equity agreements are typically used to establish the terms of an equity relationship between a startup company and an individual, such as an employee or advisor.

How do I create a startup equity agreement?

To create a startup equity agreement, follow the steps provided.

Overall, a startup equity agreement is a crucial tool for establishing the terms of an equity relationship between a startup company and an individual. It helps to ensure that both parties have a clear understanding of their roles and responsibilities, and helps to protect the interests of all stakeholders involved.

Related Posts

FREE 10+ Trial Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF