10+ Loan Repayment Agreement Samples

Have you ever been asked for a loan before? Whether you’re getting or giving a loan, you might think it’s somewhat a risky business because of the uncertainty whether or not it you get paid back. How can you ensure that a loan gets repaid? Through a solid agreement! Both the borrower and the lender benefit from having a repayment arrangement in place. If you need some help with this, we’ve got you covered! In this article, we provide you with free and ready-made templates of Loan Repayment Agreements in PDF and DOC formats that you could use for your benefit. Keep on reading to find out more!

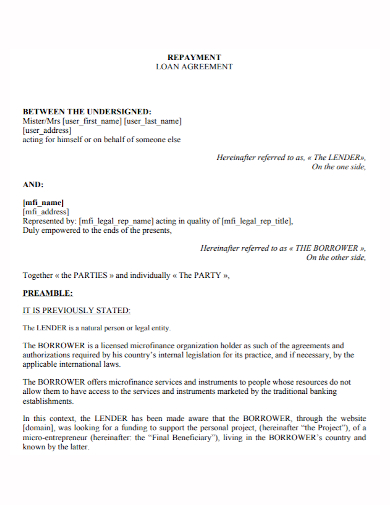

1. Loan Repayment Agreement Template

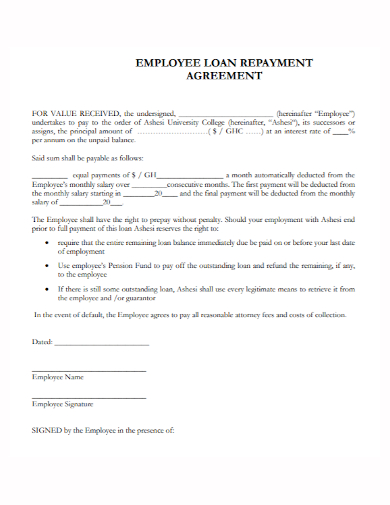

2. Employee Loan Repayment Agreement

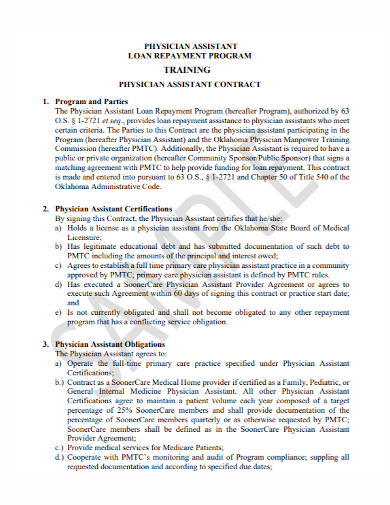

3. Loan Training Repayment Program Agreement

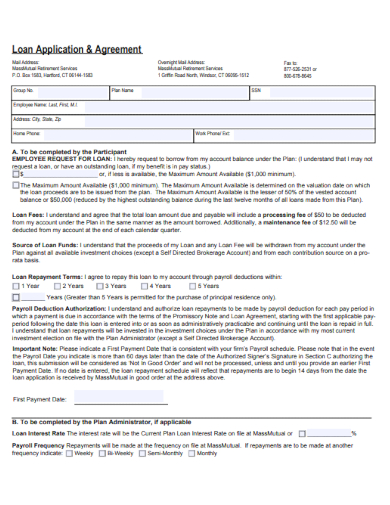

4. Payroll Loan Repayment Agreement

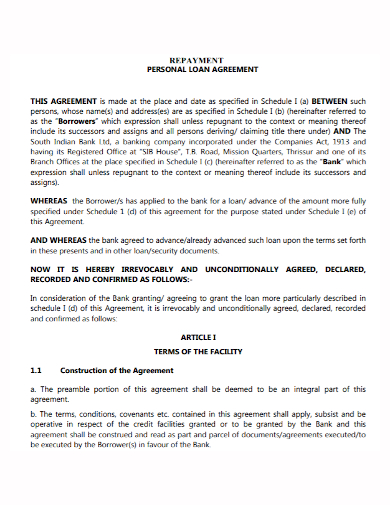

5. Personal Loan Repayment Agreement

6. Loan Repayment Agreement

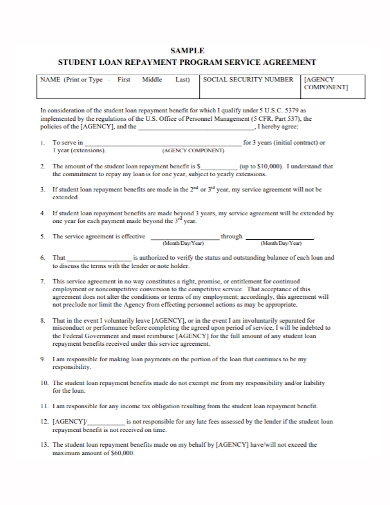

7. Student Loan Repayment Agreement

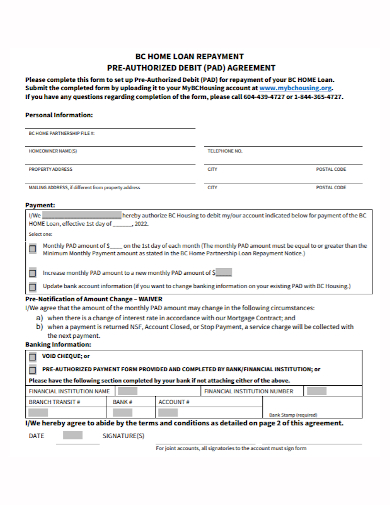

8. Home Loan Repayment Agreement

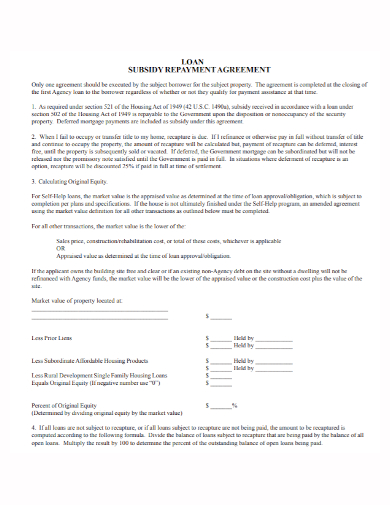

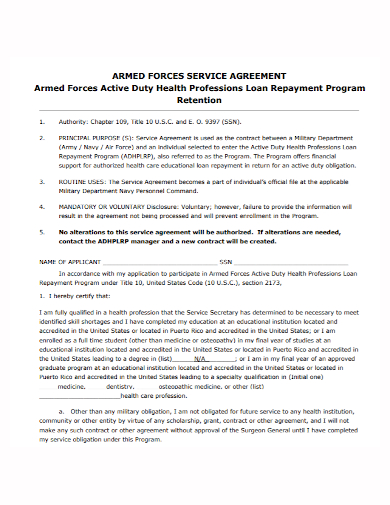

9. Subsidy Loan Repayment Agreement

10. Loan Repayment Program Agreement

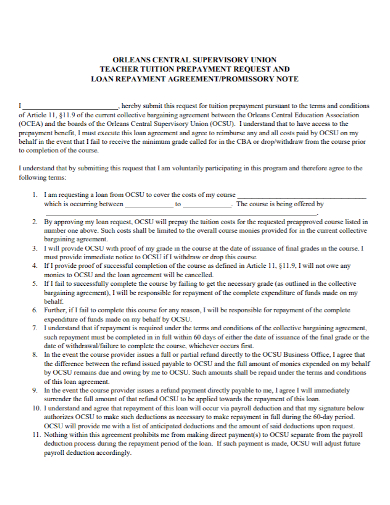

11. Loan Promissory Note Repayment Agreement

What Is a Loan Repayment Agreement?

Borrowing money necessitates the use of loan agreements. A loan agreement lays up the specifics of the transaction, such as the loan amount, interest rate, and repayment schedule. It’s a legal agreement between a borrower and a lender that spells out the conditions of the loan (or other outstanding amount) as well as both parties’ duties. Its purpose is to spell out exactly what both parties are agreeing to in terms of creating a working partnership and what obligations each party agrees to carry out for the period of the loan.

How to Make a Loan Repayment Agreement

It is critical to have a thorough document. Your contract should include as much detail as possible, such as what would happen if payments must be halted, renegotiated, or reduced due to unforeseen circumstances. A Loan Repayment Agreement Template can help provide you with the framework you need to ensure that you have a well-prepared and robust agreement on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. State how much you owe.

A payment plan agreement’s main goal is to pay off the whole debt to the lender. You must specify the purpose of the loan and the total debt amount in the agreement.

2. Defer the payment for a specific amount of time.

When establishing a payment plan agreement, it’s also vital to mention the deadline for paying off the entire amount. Include the start and end dates of the agreement.

3. Make a note of the payment and the mode of payment.

When creating a payment agreement, it’s important to think about the payment method and the frequency of payments. Will the borrower pay the entire amount in one single payment or in installments? If you choose to make regular payments, you must determine how frequently and when the payments will be made. You’ll also need to agree on how you’ll pay – most people want to pay in installments.

4. Don’t forget to include details on the agreement’s other terms.

If you’re writing your own payment plan agreement, include conditions like future revisions, legal costs, indemnity, and an acceleration clause if the borrower is unable to pay.

5. Finally, add the required signatures.

Your payment plan arrangement will not be legally binding until both the borrower and the lender sign it in writing. The signing of the contract serves as legal confirmation that all parties involved have agreed to the conditions of the agreement.

FAQ

What is a payment agreement’s purpose?

A payment plan agreement, also known as an installment agreement, is a written legal contract that permits one party to pay off a greater obligation by making smaller payments over time.

What exactly is a payment method?

Customers pay for a product or service using a payment mechanism. Cash, a gift card, credit cards, prepaid cards, debit cards, and mobile payments may all be accepted at a brick-and-mortar establishment.

Is there a distinction between a loan arrangement and a promissory note?

A promissory note can be used for short-term, minor loans from friends and relatives. On the other hand, loan agreements are utilized for anything from automobiles to mortgages to new company initiatives.

Basically, having an agreement on hand is beneficial because it legally binds a borrower to pay back the money owed. To help you get started, download our easily customizable and comprehensive templates of Loan Repayment Agreements today!

Related Posts

Sample Business Agreement between Two Parties

FREE 9+ Shop Rental Agreement Samples [ Commercial, Lease, Tenancy ]

FREE 10+ Charter Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Mentoring Agreement Samples In MS Word | Apple Pages | PDF

FREE 10+ Partner Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Individual Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Strategic Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Equity Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Producer Agreement Samples in MS Word | Apple Pages | PDF

FREE 10+ Grant Agreement Samples In MS Word | Apple Pages | PDF

FREE 8+ Meeting Agreement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Community Agreement Samples In MS Word | Google Docs | PDF

FREE 8+ Real Estate Option Agreement Samples in MS Word | PDF

FREE 10+ Call Option Agreement Samples In MS Word | PDF

FREE 10+ Advertising Agreement Samples In MS Word | Google Docs | Apple Pages | PDF