Instead of using expensive Business planning software, small businesses can use free sample financial plan templates or premium financial plan templates. These Financial Plan Templates can be printed and used for commercial purposes. Financial plan templates are usually based on Microsoft Excel, but they can be made using Microsoft Word as well.

Instead of using expensive Business planning software, small businesses can use free sample financial plan templates or premium financial plan templates. These Financial Plan Templates can be printed and used for commercial purposes. Financial plan templates are usually based on Microsoft Excel, but they can be made using Microsoft Word as well.

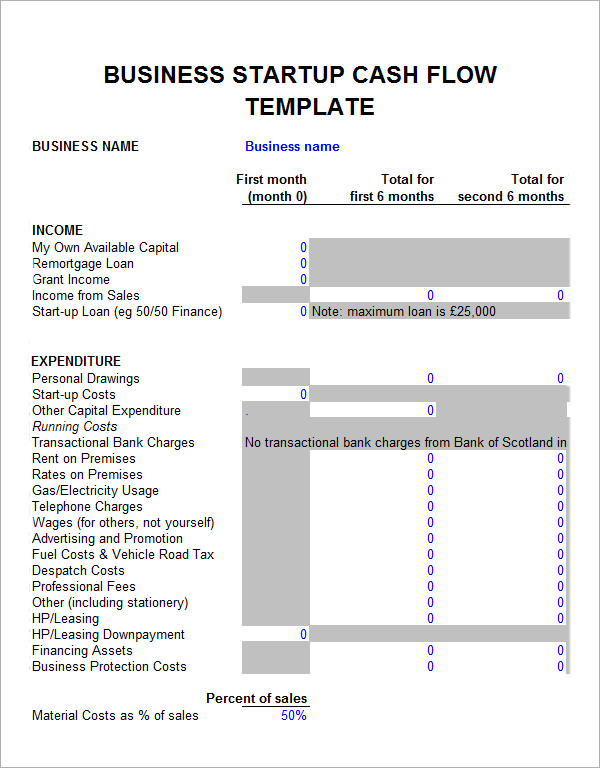

Financial Plan Template

Restaurant Financial Plan Template

Financial Advisor Business Plan Template

Printable Financial Plan Template in Word

Organizations use a financial plan to determine how they will meet their strategic goals. A financial plan is crafted immediately after the vision statement and the firm’s objectives have been established.Financial plan definition and creating a financial plan is available here You may like Financial Business Plan Templates.

Simple Sales Plan

Strategic Sales Plan

Simple Fundraising Plan Template

Financial Plan Template

This financial plan template shows the cover sheet of any financial plan or financial report. It shows that the cover sheet of a financial report must be intricately designed so as to look to formal, presentable and relatable. This template has the background of currency and calculators which is very relatable with the subject matter of finance.

The contents of the cover page, as shown by the image are the name and number of the specific financial plan, its version number and date of effect, name of the person preparing the plan and the name(s) of the person(s) to whom this plan is to be presented.

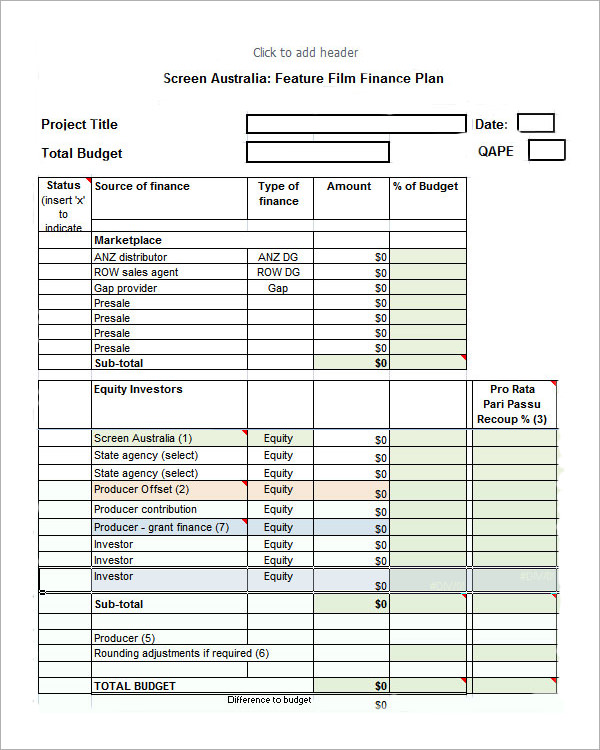

Finance Plan Sample

This is a sample template of Screen Australia’s feature film finance plan. It includes the title of the project, its total budget, date, QAPE, sources and types of finance, along with the amount, also the % of the budget it occupies. It also shows the amounts procured from the equity investors, with the sub total and the total budget.

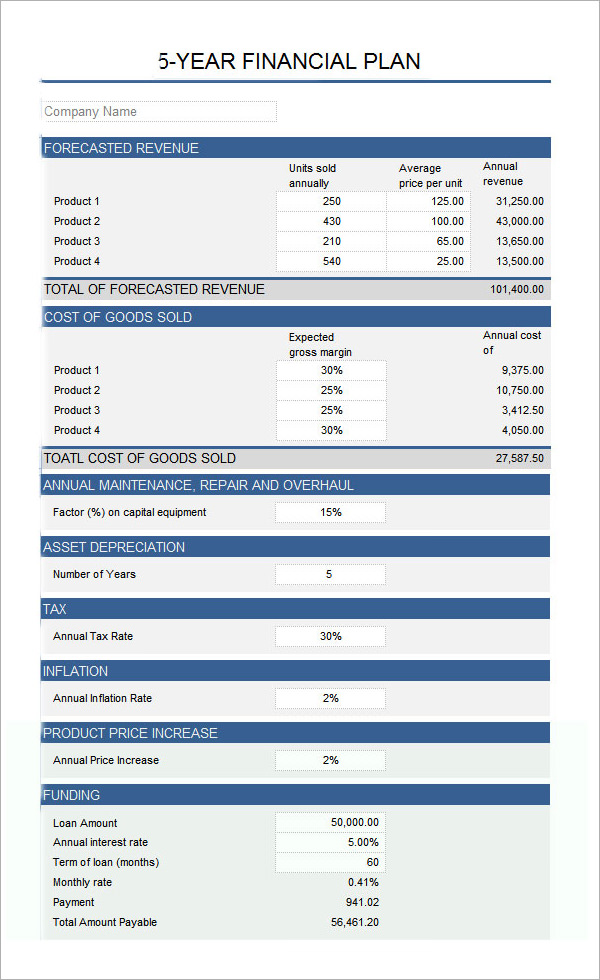

Financial Plan Example

This financial plan template serves as an example to show the details of a financial plan that is, its format, contents, etc. It shows the number of units of the 4 different products sold and the average price per unit, the product of the 2 is the annual revenue which is then totalled.

On the other hand we have the Cost of Goods Sold which is reached by deducting the gross margin from revenue. Apart from these, there are slots allotted for depreciation, maintenance, tax, inflation etc.

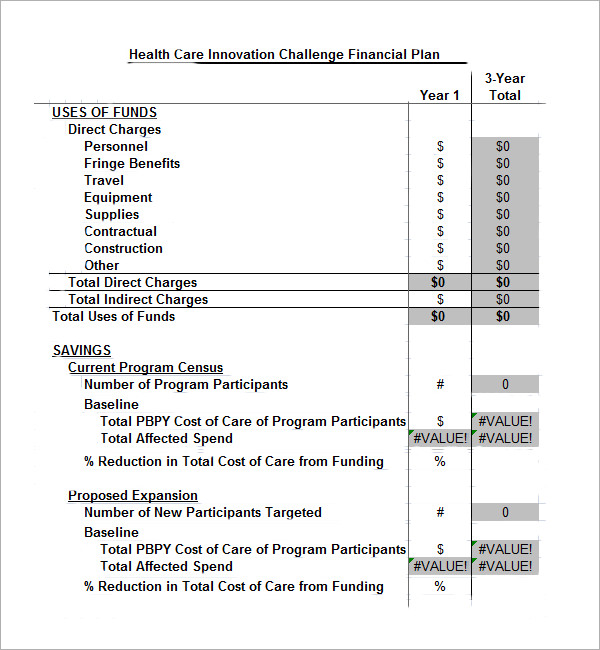

Personal Financial Plan

This personal financial plan template shows the financial plan of an individual. How he uses and allocates his funds, segregating the charges into direct and indirect charges. It also sheds light on the savings and proposed expansion of the plan.

Financial Plan Outline

Business Financial Plan

What is a Financial Plan Template?

A financial plan is generally referred to as an evaluation of any individual’s present income and future state of finance. It makes use of all the variables which are known at present to predict the company’s future financial position that is future income, future value of assets, and withdrawal plans if any. This is done by way of budgets, more often than not. Budgets are used to organise finances and spending so to maintain a certain level of savings. Financial Plans are referred to as investment plans as well, except in case of personal finance. You can also see Business Plan Templates.

What Are The Benefits of Financial Plan Templates?

- Smarter management of funds.

- Understanding future needs.

- Advance arrangement of finance.

- Assurance to investors

- Strong financial control

- Lower taxes

- Savings

Tips To Prepare Sound Financial Plans?

- Setting goals which can be measured.

- Understanding the effects of various financial decisions.

- Periodic revaluation of the financial position

- Early planning

- Keeping realistic expectations

Purpose of Financial Plan Template

Many small businesses are not able to sustain their operations because of improper financial planning. With the help of a good financial plan template, they can plan funding and other aspects. A financial plan template helps one:

- Determine the costs of setting up shop

- Predict Profit and Loss

- Predict cash flow

- Predict balance sheet

- Review break-even point

Benefits of Financial Plan Template

- It is necessary for the success of the organization.

- It formalizes the business plan.

- It confirms that the set objectives can be achieved financially.

- It aids the CEO in setting financial targets for the firm.

- It helps the staff get rewarded for meeting financial objectives

If you have any DMCA issues on this post, please contact us!

Related Posts

Sample Research Reports

Salutatorian Speech Samples

Sample Key Log Templates

Sample User Manual Templates

Sample Chart of Accounts Templates

Sample Graduation Speech

Rental Ledger Templates

Sample Delivery Note Templates

Sample Discursive Writing Templates

Sample Handover Reports

Sample Pitching Chart

Research Paper Examples

Research Paper Samples

Sample Payment Vouchers Templates

Sample Report Writing Format Templates